With the annual contribution deadline for a Stocks and Shares ISA falling in the coming week, I have been thinking about my own ISA strategy.

I have a shopping list of companies I would like to buy stakes in when I have spare cash in my Stocks and Shares ISA.

The company currently at the top of that list is Legal & General (LSE: LGEN).

Demand likely strong

Not all investors realise that Legal & General is not the company it used to be.

The name and logo are still familiar to millions from decades advertising general insurance for consumers. I see that strong brand awareness as an advantage.

But Legal & General’s business has shifted increasingly onto financial products related to lifetime financial planning, such as pensions and investment management.

That market is huge and I expect it to be fairly resilient over the long term.

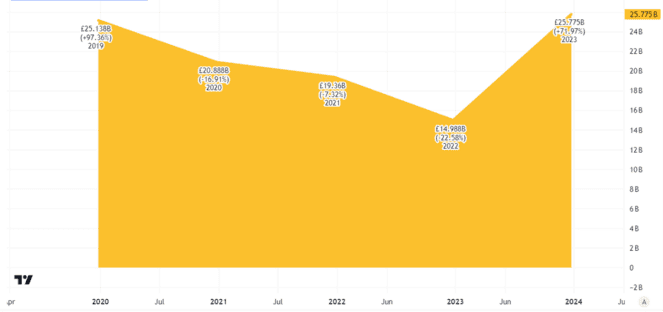

But while Legal & General’s revenues are large, they have not shown growth in recent years.

A large market like this one attracts competitors. That can put pressure on pricing. And that could be a long-term risk to profit margins.

Strong cash flows and dividends

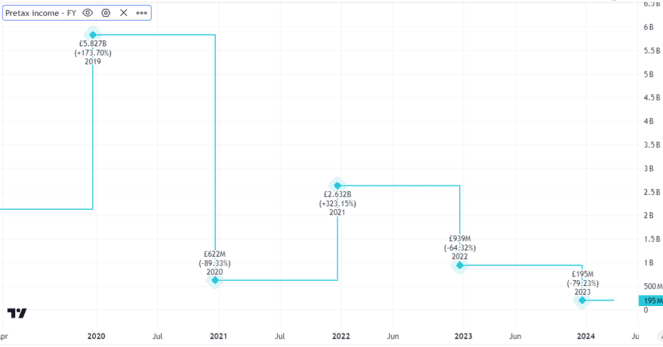

Still, Legal & General has been consistently profitable over the past few years.

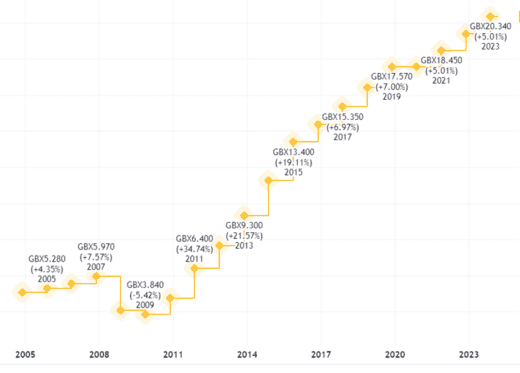

That is good news from a shareholder’s perspective. The FTSE 100 firm has been a strong dividend payer. Looking back over the past couple of decades, there have only been two periods when the dividend per share did not rise annually.

One was during the pandemic, when it was held flat. The other was following the 2008 financial crisis, when the dividend was cut.

It did then regain its old level — and more — within a few years. But a financial crisis hurting investment returns and earnings is always a risk, including for the dividend.

Source: TradingView

At the moment, the yield is 8%. That is around double the FTSE 100 average, which helps explain why Legal & General is top of the shopping list for my Stocks and Shares ISA.

Attractive valuation

What about valuation though? After all, investing is not just about buying the right shares, but also trying to buy them at an attractive price.

The price-to-earnings ratio of 35 looks expensive. However, last year saw a big drop in earnings. That accounting figure however, reflects the sort of movements in investment valuations I identified above as an ongoing risk. I expect stronger earnings in at least some future years.

Operating profit of £1.7bn compares favourably to a market capitalisation of around £15bn, as far as I am concerned.

Billions of pounds of dividends

Between 2020 and this year, the company expects to have paid well over £5bn (and perhaps almost £6bn) in dividends — and still have accumulated net surplus cash of £0.8bn.

That underlines the lucrative, cash generative nature of the firm’s business model.

Tucking Legal & General into my Stocks and Shares ISA now, while the yield is 8%, could hopefully let me earn some of that dividend gusher if it keeps flowing in years to come!