Tesco (LSE: TSCO) shares have had a decent March. As I write (28 March), they’re up 7%. And while over five years they’re basically flat, that doesn’t include the dividends that have been providing shareholders a second income.

Here, I’ll look at how much I’d need to invest in this FTSE 100 stalwart to aim for a grand a year in dividends.

Staying on top

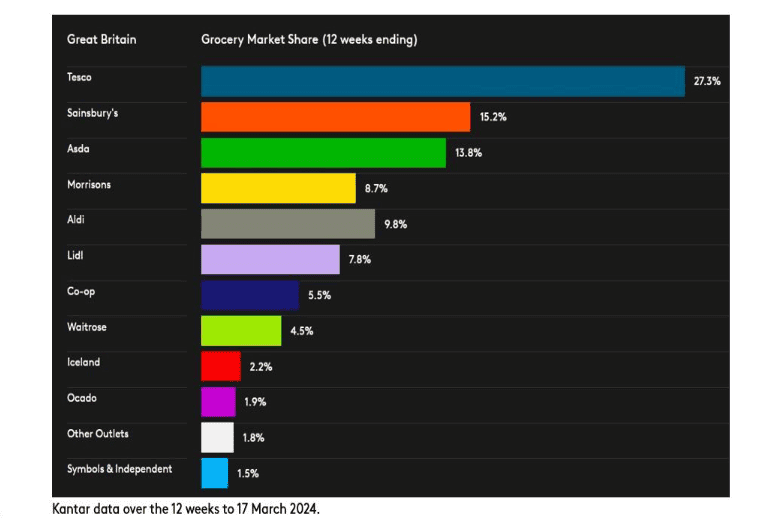

According to recent data from market researcher Kantar, Tesco is having a solid 2024. In the 12 weeks to March 17, year-on-year sales climbed by 5.8%.

The big winner, however, is Ocado, which has been luring in customers with a voucher offer. The online grocer is this month’s fastest growing retailer.

However, as we saw at Christmas with the German discounters, Ocado’s growth hasn’t been coming at Tesco’s expense. The supermarket giant’s market share nudged up to 27.3%, a 0.4% increase. It’s still the top dog.

Easing inflation

Meanwhile, food price inflation in the four weeks to March 17 eased to 4.5%, the lowest rise since the start of the Ukraine war. The data says prices for butter, milk, and toilet roll are falling fast.

This doesn’t mean shoppers aren’t still struggling, but it’s nevertheless good news for Tesco. When customers aren’t penny-pinching, they tend to buy more non-food items that have higher profit margins.

Of course, we’re not out of the inflationary woods yet. Take cocoa prices, for example. They recently hit $10,000 (£7,899) a tonne, an all-time high.

Poor harvests in West Africa are to blame, and this doesn’t bode well for my wallet with my daughter’s Easter eggs yet to be bought.

Clubcard magic

I’d say the main risk here is competition. Aldi and Lidl continue to snap away at Tesco’s heels, and there are new models emerging like HelloFresh‘s meal-kit business.

Ominously, Amazon also continues to sniff around the UK grocery scene. Others may enter the fray.

However, as time goes on, it becomes increasingly apparent to me just how much of a competitive advantage the Clubcard loyalty scheme gives Tesco.

I mean, I feel pangs of guilt if I leave a store and haven’t tapped my Clubcard after buying just bread and milk. And I always try to use their petrol stations for the fuel points. That card is a powerful thing.

Pair this with the well-oiled delivery service, powerful brand, and successful Aldi price-matching campaign, and Tesco’s competitive position appears rock-solid to me.

Passive income

The company’s earnings per share (EPS) is forecast to be 23.9p in FY 2025 (starting at the end of February).

Based on today’s share price of 299p, that puts the stock on a cheap forward price-to-earnings (P/E) ratio of 12.5.

The forecast dividend is 13p per share. This means the forward yield is 4.35%.

More specifically for our purposes, it means I’d need to spend £23,000 acquiring 7,692 shares to aim for that £1,000 a year in passive income.

Would I do that myself today? Probably not. Though I do think Tesco could contribute nicely to a diversified income portfolio, especially as no dividends are guaranteed.

The issue for me is that HSBC stock is offering a forward yield of 7.8% (nearly double that of Tesco’s). And I just can’t peel my eyes away from it.