Known across the land, Tesco (LSE: TSCO) needs little (if any) introduction. But while a lot of people consider the supermarket company as a place to pick up their groceries, not every thinks about buying a stake of the business. As far as I can see, however, there are quite a lot of things to like about Tesco shares.

Large, resilient market

One is the market in which it operates. Trends may come and go, but no matter what happens, people need to eat.

So although some grocers may fall in or out of fashion over time or as the economy changes, the market for groceries and household goods is huge. It is likely to remain that way for the foreseeable future.

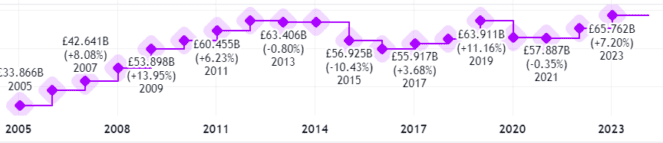

Just look at the large revenues Tesco has generated in recent years. It is making sales of over a billion pounds each week on average.

Source: TradingView

Strong market position

Not only does it operate in a market with high ongoing demand, but Tesco has a commanding position in that market.

In the UK, it has the largest share of the grocery market by far. That can help it achieve economies of scale, improving profitability.

By withdrawing from a number of overseas markets over the past decade, Tesco has increased the role of its key UK business in its overall performance. That can help it to focus where it performs strongly.

But there are risks involved too.

Concentrating heavily in one market ties a company’s fortunes more closely to that market. So something like a regulatory inquiry into UK grocery pricing could have a big effect, for example.

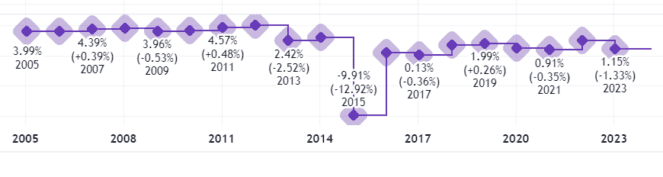

Growing competition could eat into profit margins. That is a real risk for the valuation of the shares. Although selling groceries is a business with large revenues, margins can be low. Tough competition in the UK grocery markets over the past couple of decades has pushed net profit margins dramatically down. This chart shows what has happened at Tesco.

Source: TradingView

Those are some razor-thin margins lately!

Attractive valuation

Tesco shares are up 12% over the past year. On a five-year timeframe though, allowing for a share consolidation associated with the sale of its Asian business, the Tesco share price is down 2%.

That puts the FTSE 100 stock on a price-to-earnings (P/E) ratio of 15.

Not only is that lower than it has been at some points in recent years, I also think it is reasonable. Tesco is a strong business and a P/E ratio in the mid teens looks like a fair price for that.

Not buying for now

For now though, while I see various reasons to like the shares, I have no plans to add any to my portfolio.

Why not? Although the business is strong, I do not like what has happened to profit margins in UK grocery retailing at all.

With ongoing intense competition from price-focused rivals like Lidl and B&M, I see the risk of ongoing pressure on margins.