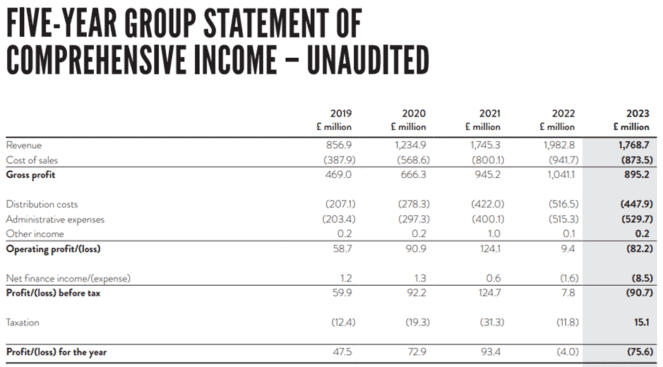

The boohoo (LSE:BOO) share price has fallen 82% since March 2019. Over the past year, it’s down 35%.

And after a tough few years, during which the company has struggled with rising costs and intense competition, shareholders will be hoping for no more bad news. However, there are moves afoot to crack down on one of the heaviest polluting industries on the planet.

The ‘polluter pays’ principle

According to Greenpeace, the fast fashion industry accounts for 8%-10% of global CO2 emissions.

To combat this, on 14 March, the lower house of the French parliament voted to impose a surcharge of €5 — £4.28 at current exchange rates — per item of clothing sold by the industry.

The draft legislation proposes increasing this to €10 (£8.56),by 2030. However, the levy can’t exceed more than half of an item’s retail price.

If ratified by the upper house, the charge will come into effect in 2025.

It’s unclear how the tax might apply to boohoo. Reports suggest that it’s the ultra-fast fashion retailers, like Shein, that are the intended target of the new law. And it’s not known how much of boohoo’s revenue is generated in France, although it says it has a “strong presence” there.

But cash-strapped governments are always looking for ways to minimise CO2 and generate additional revenue. And it wouldn’t surprise me if the UK considered implementing similar measures at some point. In FY23, boohoo generated over 60% of its revenue here.

If a similar policy was introduced in Britain, I think it would have adverse consequences for the online fashion retailer’s share price, and the wider industry.

What are the implications?

According to its annual report and accounts for the year ended 28 February 2023 (FY23), the company’s average order value was £53.32 and comprised 2.82 products. That means an average selling price (ASP) of £18.91 per item.

An additional tax of £4.28 – equal to 22.6% of the ASP — could lead to a significant drop in sales.

That’s because, according to Statista, consumers in the fast fashion industry were found to be the most price-conscious in 16 out of 18 countries surveyed.

And the possibility of an additional sales tax couldn’t have come at a worse time for the company.

Over the worst?

That said, although it’s a little early to talk of the company having turned the corner, there are some green shoots of recovery in sight.

The company has seen a small improvement in its margin as it focuses on improving profitability. Its adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) margin is expected to be 4%-4.5% when its FY24 results are reported. The board aims to grow this over the “medium term” to 6%-8%.

The company has identified £125m of annualised costs savings. It’s also reduced its stock levels and its debt is under control. However, the impact of these initiatives might not be seen until FY25.

For FY24, the directors are expecting adjusted EBITDA to be £58m-£70m (FY23: £63.3m).

There’s a lot of uncertainty surrounding the company, and the industry in general. So investing in boohoo at the present time is a little too risky for me. But I’ll be watching from the sidelines with interest.