Chancellor Jeremy Hunt announced a new ‘British ISA’ in last week’s Spring Budget.

He’s proposing to give investors an additional £5,000 allowance on top of the current £20,000 ISA allowance to invest specifically in the UK market.

I’ll make a few observations on the proposal. And then look at some of the opportunities the market’s offering investors right now.

Patriotic gimmickry

The Chancellor presented the new ISA as part of a package of measures to support British businesses.

In reality, though, unless we’re buying new shares issued by a company in a fundraising (such as a rights issue or placing) our money isn’t flowing into the business. We’re not providing it with any capital to help it grow – by, say, developing new products or expanding into new countries.

For the most part, our £5,000 will go into the pockets of fellow investors who happen to be selling their shares.

As such, the British ISA smacks to me of patriotic gimmickry in an election year. It would have been a lot easier for everyone if the Chancellor had simply increased the existing £20,000 ISA allowance to £25,000.

Waiting game

Another thing to note is that this new ISA hasn’t actually been launched yet. And won’t be any time soon.

There’s a consultation period until 6 June. The government will then need to review the responses and formulate the rules governing which investments will be eligible. And after that, providers will need time to build the new product.

It’s unlikely to be launched before April next year – if it’s launched at all. Ultimately, the Conservatives may not commit to the idea. Or Labour – if they get into power – may ditch it.

Eligibility

At the moment, what would constitute an eligible investment for the British ISA is also an open question.

It looks like all London-listed stocks could be eligible. This would include not only individual operating businesses, but also UK-listed investment companies, such as the venerable City of London Investment Trust.

This trust has served UK investors well for many decades. It has an unrivalled record of having increased its dividend for 57 consecutive years.

Still, there’s some uncertainty about whether it (and others like it) will be eligible. There’s less doubt about the individual stocks in its portfolio.

Footsie companies

To look at what the UK market has to offer in the way of big FTSE 100 names, City of London’s roll of top 10 holdings isn’t a bad place to start.

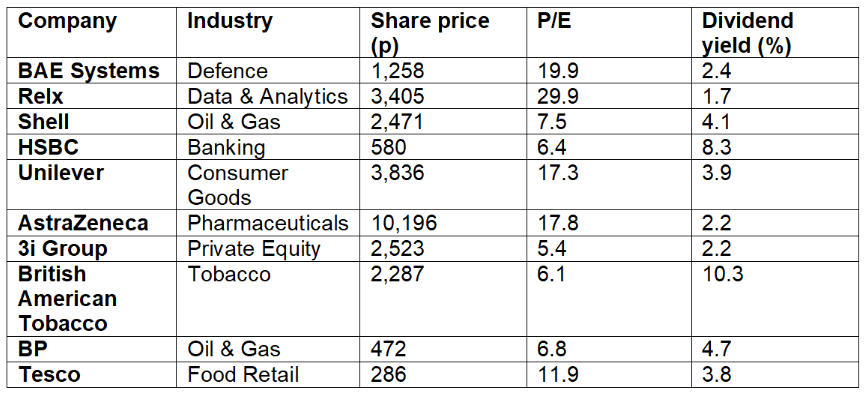

The table below lists them. And I’ve added columns illustrating the industries they operate in, their current share prices, and my calculations of their valuations on a couple of measures: price-to-earnings (P/E) and dividend yield.

Myriad options

A couple of things in the table strike me immediately.

First, aside from the two companies in the same sector (Shell and BP), the holdings represent a diverse range of industries. And second, there’s a wide variation in their valuations.

At one end we’ve got Relx with a P/E of almost 30 and a yield of just 1.7%. At the other, British American Tobacco with a mid-single-digit P/E and yield of over 10%.

At the end of the day

Value investors and high income seekers will naturally be drawn to stocks with low P/Es and big yields. Conversely, growth investors are always likely to gravitate towards stocks with high P/Es and little or no yield.

Both approaches are capable of delivering healthy returns on investment. And of course, both are capable of disappointing.

In this context, I’d stress that P/Es and dividend yields aren’t the be all and end all of successful investing. Also, that the companies I’ve mentioned are just 10 of literally hundreds listed on the London Stock Exchange.

The proposed new £5,000 British ISA may be a bit gimmicky, and if it does launch it’ll be more restrictive than the existing £20,000 ISA. But at the end of the day, any increase in the amount investors can shield from the taxman surely can’t be a bad thing!