There are fresh reports that Chinese fast-fashion juggernaut Shein is considering a blockbuster initial public offering (IPO) on the London Stock Exchange. If this global growth stock does list in the UK, it would be the largest ever on these shores.

What do we know about Shein? And what would it mean for its smaller UK rival boohoo (LSE: BOO)?

An e-commerce giant

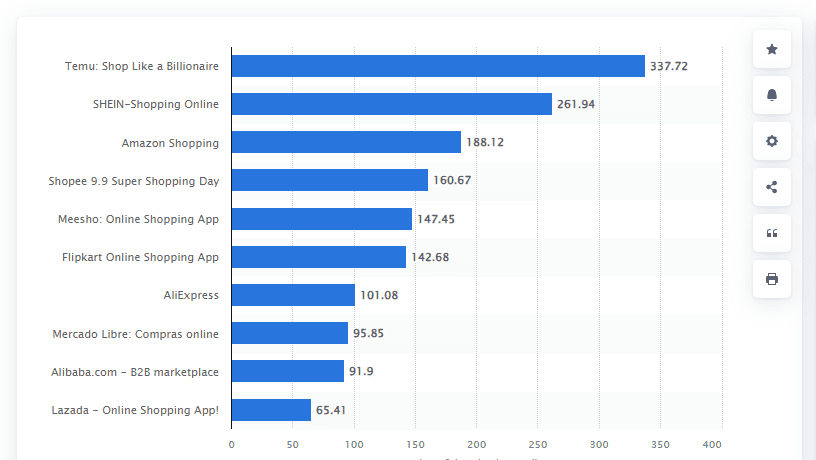

Shein ranked as the second most-downloaded shopping app worldwide in 2023, according to Statista.

It had over 261m downloads — more than Amazon! — and is now the world’s largest digital-only fashion retailer.

Leading shopping apps worldwide in 2023, by number of downloads (in millions)

I’ve read that management think revenue could top $58.5bn in 2025. If so, that would be massive growth from the $30bn or so it was expected to have generated in 2023.

At first glance, this would make the rumoured $70bn-$90bn (£55bn-£71bn) IPO valuation seem plausible. I see no reliable figures on any company profits, however.

Would I invest?

I’d certainly be interested to look at the IPO prospectus. However, I do have reservations because Shein has been accused of forced labour in its supply chain.

Also, artists have accused it of stealing designs and there are even reports that some of its clothes are made with potentially hazardous materials.

Shein denies these allegations. But I worry that many institutional investors might still be put off.

That said, the company is reportedly trying to replicate Amazon Marketplace by letting third-party retailers sell products on its platform. As well as fuelling growth, this diversification could help reduce risks associated with its own supply chain.

Will it happen?

Though founded in China, Shein has never actually sold products there and is headquartered in Singapore.

It was preparing to go public in New York this year. However, it’s now exploring alternatives like London because of regulatory hurdles in the US due to some of the allegations highlighted above.

Apparently UK chancellor Jeremy Hunt has met with Shein’s CEO to talk about the potential float. That’s not surprising. Just $1bn was raised on the London Stock Exchange last year, the lowest sum since 2009.

The UK market is clearly desperate for new listings. Personally, though, I have my doubts this one will happen. I’ll believe it when I see that LON:SHE ticker symbol (or whatever it might be).

What about boohoo?

I do wonder what boohoo makes of all this. After all, Shein has been gobbling up market share and putting pressure on it with unbeatably low prices.

In boohoo’s H1, covering the six months to the end of August, sales fell 17% year on year to £729m. The company slid to an adjusted loss before tax and net debt rose to £35m.

Worryingly, active customers declined to 17m from 19.2m the year before.

More positively, the company has opened a new US warehouse while cutting costs. So it may not all be doom and gloom.

My fear, though, is that the fast fashion market is a race to the bottom. And that Shein, with its potentially huge post-IPO war chest, will keep heaping huge pressure on boohoo’s growth and margins.

As such, I have no intention of investing, despite the 90% share price fall in three years.