There are few better investors to follow globally than Warren Buffett. And despite his age, he’s continuing to teach investors through his annual letter to his company, Berkshire Hathaway’s, shareholders.

In these letters, Buffett shares his timeless wisdom, distilling decades of investment experience into valuable insights. His teachings emphasise the importance of long-term investing, the significance of economic moats, and the power of compounding.

Buffett’s emphasis on businesses with enduring competitive advantages and his aversion to market timing resonate with both novice and seasoned investors.

Beyond strategy, his emphasis on ethical business practices and shareholder-friendly corporate governance sets a standard for responsible investing.

As investors navigate an ever-changing market, Buffett’s letters serve as a beacon of wisdom, offering enduring principles that withstand the test of time.

What can I learn?

If I were a novice investor, starting out in 2024, there are several ways I could put his teachings to use in an effort to turn £8,000 into riches.

First, I’d focus on understanding the businesses I invest in, just as Buffett advocates. Conducting thorough research and selecting companies with strong fundamentals, enduring competitive advantages, and reliable management is crucial.

This allows me to make informed data-driven investment decisions. Buffett has traditionally invested in companies that are undervalued. And this requires me to compare metrics like the price/earnings-to-growth ratio (PEG) or the discounted cash flow model.

Patience would be my ally, thus aligning with Buffett’s long-term investment philosophy. Instead of succumbing to short-term market fluctuations, I;d adopt a buy-and-hold approach, allowing my investments to grow over time.

Moreover, I’d want to ensure that I had a diversified portfolio. Spreading my investments across different sectors and industries helps mitigate risk and ensures I’m not overly exposed to the fortunes of a single company or sector.

Lastly, I’d look to harness the power of compounding. By reinvesting dividends and letting my investments grow over the years, I could potentially benefit from the compounding effect, allowing my initial £8,000 to accumulate wealth steadily.

After all, Buffett said: “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Compounding and time

Taking a broader perspective, the importance of time and compounding can’t be understated. Buffett has been a phenomenally successful investor, achieving an annualised return around 20%. However, even a return that’s half that could can turn my £8,000 into riches.

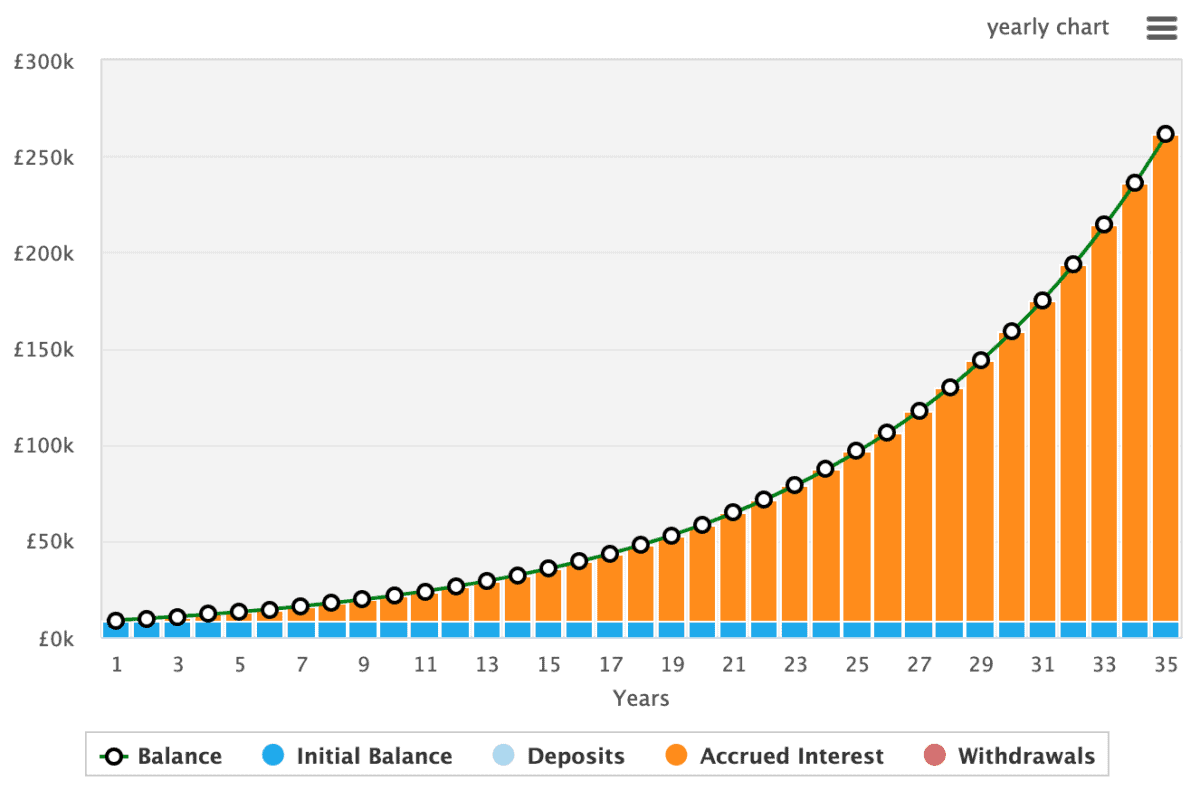

The below graph shows how my £8,000 can grow into £261,109 over 35 years, assuming an achievable 10% annualised return. If I were shrewd, and contributed, say, £100 a month to the portfolio, it would grow even faster.

Of course, I need to be wary. If I invest poorly, I could lose money, and that’s why it’s vital that I use resources, be they online or offline, to help me make sensible investment decisions.