In my opinion, JD Sports Fashion (LSE:JD) is up there with the strongest FTSE 100 shares.

When I reviewed the financials, I was immediately taken aback by the great margins and revenue growth.

So, I decided to delve deeper and look at what caused the recent decline. I also wanted to get to know the company’s operations better and look at making an investment decision.

What caused the price decline?

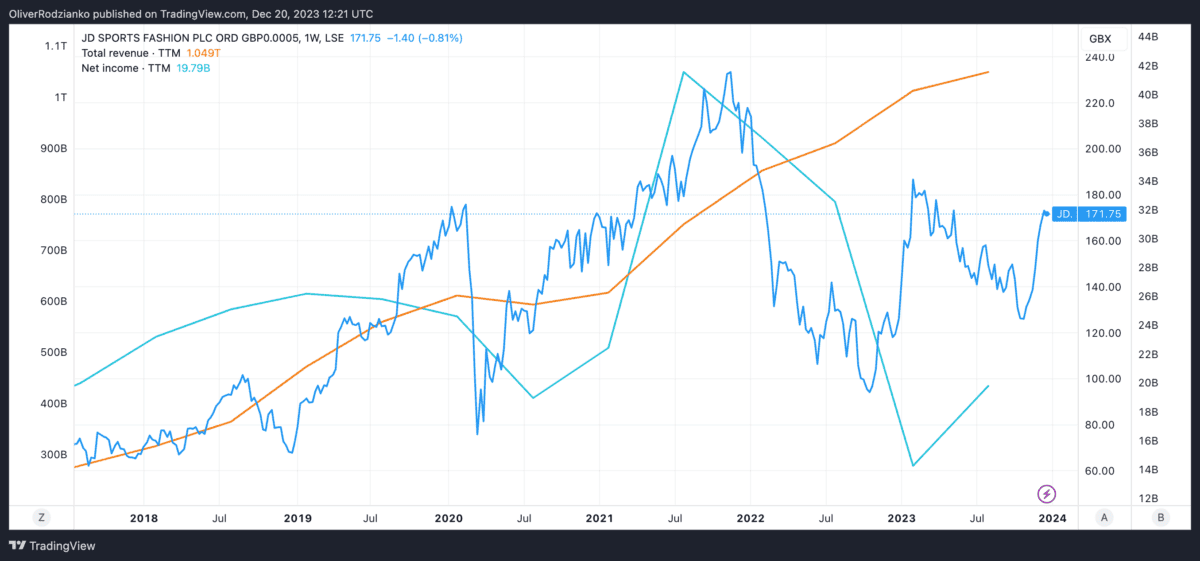

The shares started falling in 2021, declining nearly 60% between 19 November 2021 and 14 October 2022.

The price has risen almost 80% since the bottom. That speaks volumes to me about the quality investors must be recognising in the company.

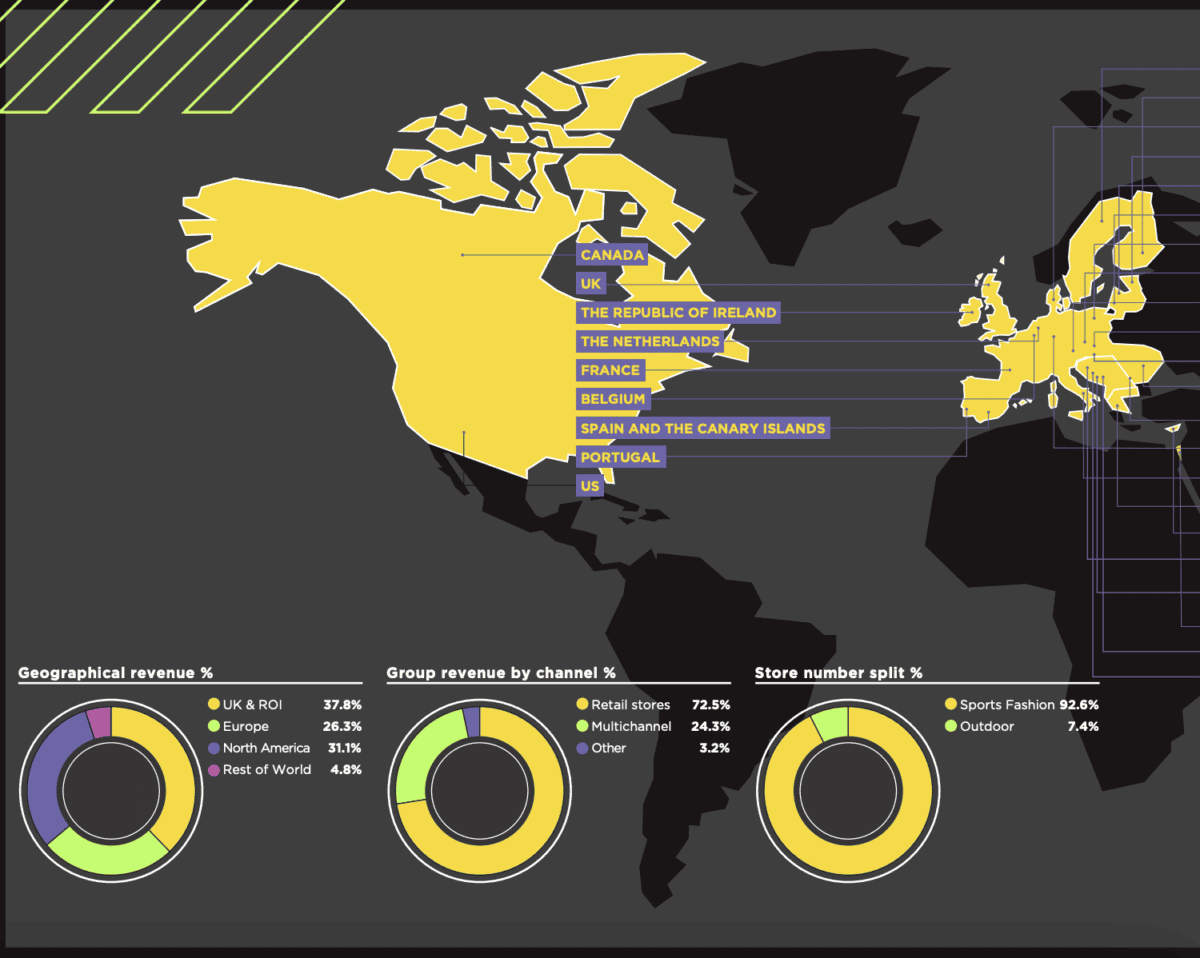

I think the prime reason for the price decline was the difficult economic environment, not only in the UK but abroad, too. This is particularly true as the organisation has a global presence:

High interest rates and inflation likely drove away customers and investors. These economic conditions also would have increased the costs of operations.

In the UK, the cost-of-living crisis has also been challenging for JD Sports Fashion as the general public has tightened spending on items not deemed vital, like new designer sports clothing.

However, the company managed to maintain revenue increases despite these challenges. It reported £8.6bn of revenue in 2022 and £10.1bn in 2023.

The real issue around 2021 was a reduction in net income, a signifier of poor profitability for the company. This is usually due to increased product and service costs, internal management, and operational expenditures.

Where could it go from here?

JD Sports Fashion have made some strong collaborations and acquisitions recently. It purchased DTLR Villa and Shoe Palace and took an 80% stake in Cosmos Sport, all streetwear retailers. It also partnered with Excel Esports, embracing e-gaming audiences. I think these operations could positively impact the share price.

For me, one of the most significant risks to consider when making an investment right now is the price-to-earnings ratio, which is 44. However, based on future earnings estimates, that comes down to just 11. That could signal an opportunity for me. What most people are worried is overvalued now could, in fact, shift when future earnings hit home. Of course, future earnings estimates might fall short, which could negatively impact the shares.

Another area I’m watching carefully is a significant level of debt from the pandemic, which has increased since then from £2bn in 2020 to £2.5bn in 2023.

But, the company has a solid operating margin of nearly 9%, which has expanded over time.

And, with a 10-year average annual revenue growth rate of almost 26%, I have to admit this is a high-growth enterprise selling at a very low price. For that reason, I think the shares are set to climb in 2024.

To buy or not to buy?

I’m slow when it comes to buying new companies. JD Sports Fashion has been on my radar for a while, but it’s too soon for me to make a judgement call.

I’ll likely go through my portfolio soon and sell off some of the shares I don’t think are worth owning anymore.

Then, I could easily see myself buying shares in this excellent sports fashion conglomerate.