Shares of Ashtead Group (LSE: AHT) plunged on 20 November after the equipment rental giant delivered a profit warning. As I write, the FTSE 100 stock is 10% lower than it was just three trading days ago.

Ashtead is one of my largest Footsie holdings. Is this sell-off just a great opportunity for me to scoop up more shares 10% cheaper? Or are things now bleaker? Let’s dig in.

What happened

The company, which rents out everything from traffic cones to cranes, said it expects record results for the second quarter, which ended on 31 October. And it anticipates record H1 group rental revenue of $2.58bn, representing 13% growth year on year.

From this, adjusted pre-tax profit is expected to grow 5% to approximately $1.31bn.

This growth was driven by “robust end markets, ongoing structural drivers and a record operating performance“.

But that’s where the good news ended. The company then noted that slowing revenue late in the second quarter had continued into the current quarter.

It attributed this slowdown to lower levels of US emergency response activity, with a significantly quieter hurricane season and fewer naturally occurring events like wildfires.

Additionally, its TV and studios equipment rental business in Canada was impacted by the recent Hollywood strikes.

Revised guidance

Consequently, it lowered its full-year guidance and now expects group rental growth of 11%-13%, compared to prior guidance of 13%-16%.

This will result in EBITDA being 2%-3% below current market expectations.

In addition, it now expects lower full-year adjusted pre-tax profit due to a depreciation charge of approximately $2.12bn and a net interest cost of around $540m.

Bargain shares?

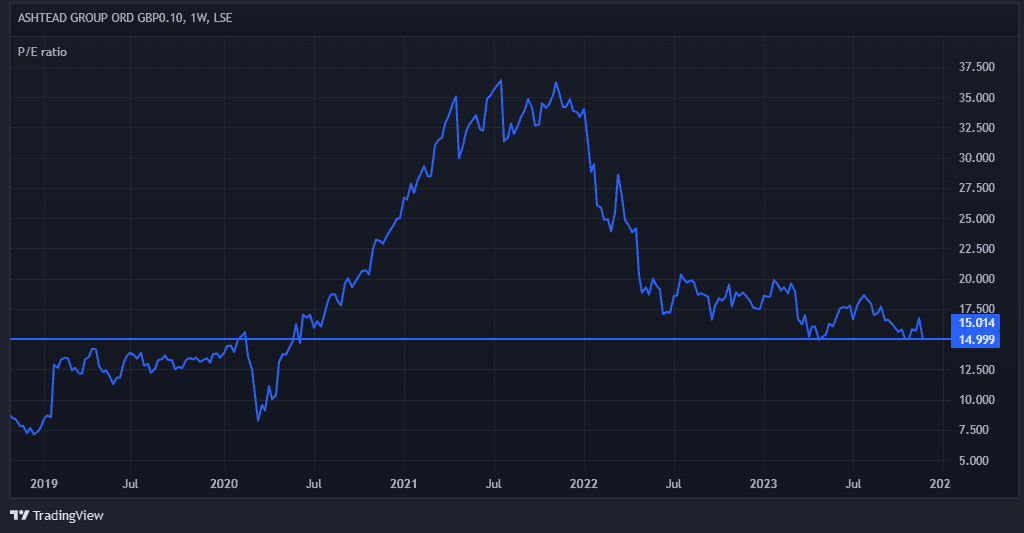

The stock is now trading on a price-to-earnings (P/E) ratio of about 15. That’s the cheapest the valuation has been for a while.

On a forward-looking basis, the P/E ratio drops to 13.7. That’s not much more than the FTSE 100 average.

However, Ashtead has grown both its revenue and operating profit at a compound annual growth rate (CAGR) of 14% over the last five years. The dividend has grown even more briskly, at a CAGR of 17.6%.

Those are not average figures, suggesting that the stock is attractively priced.

That said, we can’t ignore the fact that some experts are still predicting a recession in the US (Ashtead’s largest market by far) next year.

Economic slowdowns obviously aren’t great for construction, which makes up around 40% of its business. So this is a risk.

An intact growth story

Still, management remains bullish and called these recent headwinds “one-off events” impacting the current financial year.

Looking forward, the increasing number of huge construction projects in the US should underpin strong growth at the company over the next five to 10 years.

These projects will see massive federal funds directed towards transportation, energy, and climate infrastructure, including electric vehicle battery and semiconductor plants.

Indeed, the Infrastructure Bill and the Inflation Reduction Act combined should provide about $1.5trn in direct infrastructure spending.

As the second-largest equipment rental firm in North America, this presents a massive opportunity for Ashtead.

Putting all this together, I see the dip as a buying opportunity for long-term investors. And it’s one I intend to take once my Black Friday spending commitments are out of the way.