The BAE Systems (LSE:BA.) share price is up 36% over one year and 91.7% over two years. It’s among the most successful stocks on the FTSE 100 in this respect, rallying on the back of increasing global tensions and war in Ukraine and Israel/Gaza.

The extent of the rally is interesting, because, for a while now, there’s been clearer value opportunities on the index. But the markets aren’t always rational, and positive sentiment is a valuable and scarce commodity.

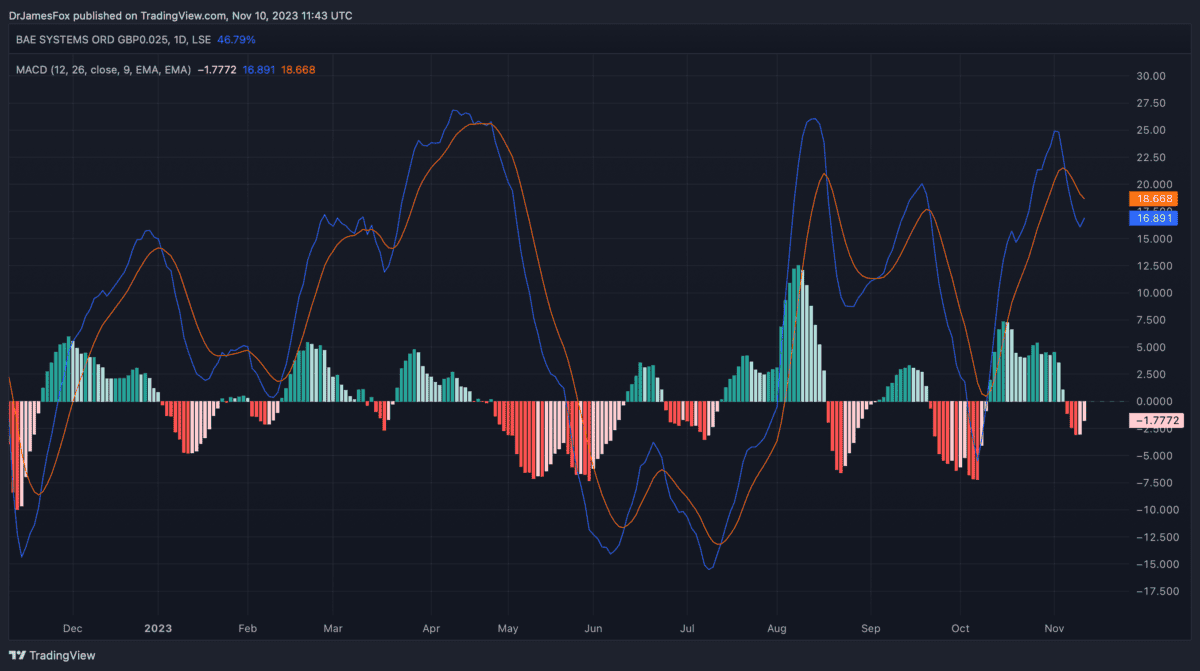

The below chart shows the broad positive sentiment towards the stock over the past 12 months. This sentiment was also reinforced on Friday (10 November) as BAE Systems was among only five stocks to push upwards in the morning’s trading.

Target price

The share price has been pushing up, but it’s getting close to its average target share price. At the time of writing, the actual share price is £11.11 while the average target price established by brokerages is £11.51.

In turn, this suggests that the fair value for the stock — at least according to the analysts that follow it — is just 3.6% higher than the price at this moment in time. Companies that investors suggest are ‘good value’ don’t tend to trade this close to the target price. By comparison, Barclays is trading 36% below its average target price.

Of course, there’s another way of looking at it. Brokerages don’t upgrade their forecasts all that often — maybe every few months at most. As such, there can be something of a lag, and that’s more apparent when a company’s prospects are improving.

For example, the Israel-Hamas conflict has been something of a catalyst for the BAE share price. However, many brokerages won’t have updated their assessments of the defence manufacturer since the war started. So, that needs to be factored in.

Valuation

UK stocks often trade at a discount to their US peers. This is one of the reasons we’re seeing companies increasingly look to the States for an initial listing rather than the UK.

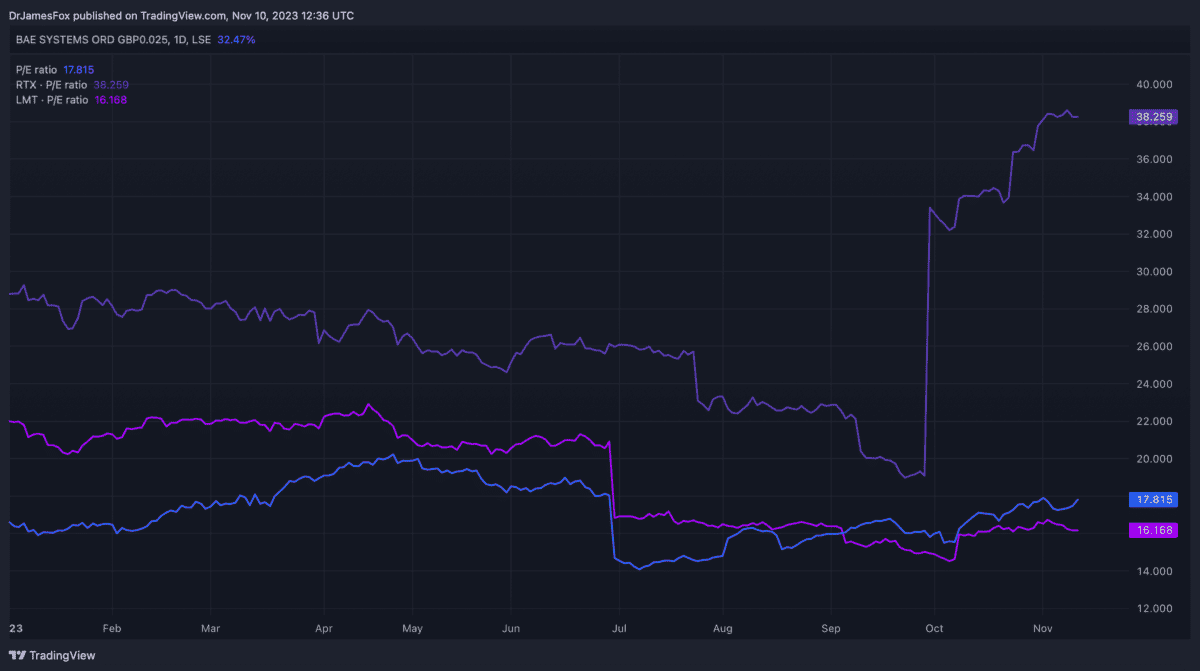

However, as we can see below, BAE actually trades at a premium — just — to defence and aerospace giant Lockheed Martin but at a discount to RTX Corp — formerly known as Raytheon.

Of course, the price-to-earnings (P/E) valuation is just one metric. When we look at others, the three companies appear to trade broadly in line with each other.

| BAE | Lockheed Martin | RTX | |

| P/E non-GAAP | 16.5 | 16.3 | 16.7 |

| PEG Forward (non-GAAP) | 1.2 | 1.8 | 1.6 |

| P/S | 1.4 | 1.7 | 1.8 |

| EV-to-EBITDA Forward | 11.3 | 12.5 | 12 |

| Price-to-Cash Flow | 8.3 | 14.7 | 15.1 |

One of the most illuminating metrics here is the PEG forward. Essentially this is the P/E divided by expected annualised growth rate of five years. BAE’s non-GAAP P/E of 16.5 is divided by a forecast annualised growth rate — which here appears to be about 13.5% — and that gives us a 1.2 PEG ratio.

Clearly, using the data above, analysts believe that BAE will grow much faster than its US peers in the coming years.

Geopolitics has a huge influence on these company’s share prices. A new detente probably wouldn’t be good for the share price. However, the data suggests BAE could still represent good value.