Aston Martin (LSE:AML) shares have rallied 108% over the past six months. That’s incredible, although the starting point is the Liz Truss-engendered stock market collapse.

The Gaydon-headquartered firm made headlines in March after results surprised to the upside, and as Fernando Alonso’s F1 performance in Bahrain wowed investors.

The share price has rolled back since then. But that’s only the tip of the iceberg. It’s a stock that had experienced a huge amount of volatility in recent years.

What’s going on at Aston?

The March results were billed as something of a turning point. The car maker made a £495m loss before tax for 2022, but registered a narrow operating profit of £6.6m in Q4.

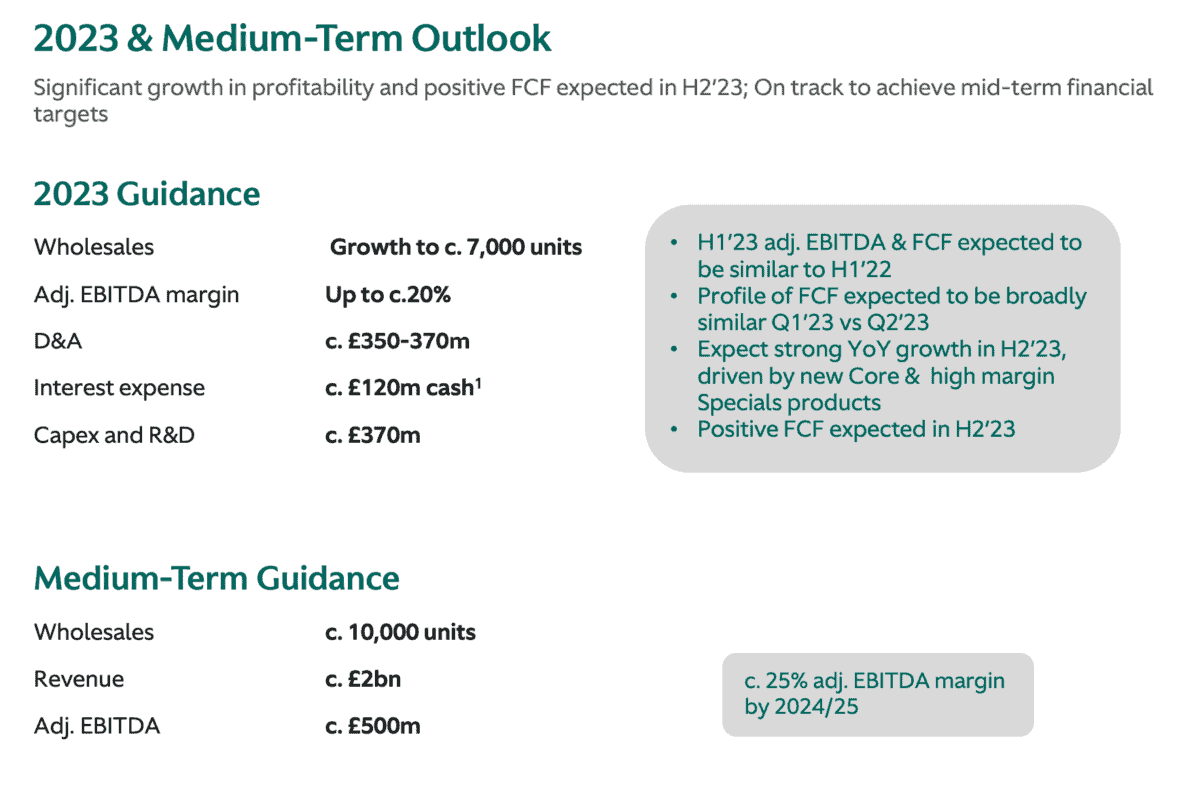

That’s what investors had been waiting for. It’s a sign that executive chairman Lawrence Stroll’s focus on high margin vehicles may be starting to bear fruit. Stroll has set ambitious goals for 2024/25, including £2bn in revenues and £500m in adjusted EBITDA.

Originally that involved shifting 10,000 cars a year, but in the March results, finance chief Doug Lafferty said he was “very confident” that the firm would hit the 2024/25 financial objectives with sales of just 8,000 cars a year.

What’s next?

The big question for many investors is, what’s next?

Well, the company seems very confident of hitting its objectives, and maybe it’s time to start believing.

Some 6,412 vehicles were sold in 2022 and higher margin vehicles, including the DBX SUV, are an increasingly large part of this. The 2023 forecast is for growth to around 7,000 units sold at wholesale.

As we can see from the above infographic, the company still holds its medium-term guidance for 10,000 vehicles at wholesale.

So, does that mean Aston will outperform on its financial targets? After all, Lafferty claims they only need to sell 8,000 vehicles to hit £2bn in revenue and £500m in EBITDA — we’re talking about a 25% difference between 8,000 vehicles and 10,000 vehicles.

For the sake of argument, if EBITDA were to increase in line with vehicles sold — which it wouldn’t — we’d be looking at £625m in EBITDA.

One thing that’s worth highlighting is the company’s sizeable interest repayments — £120m in 2023. That’s going to weigh on the balance sheet for some years.

Doubling my money?

I think it’s entirely possible to see Aston Martin trading at double the current 225p — 450p is still less than where it was two years ago.

Given the impact of debt, and the required R&D spend, I’m not entirely sure what cash flow will look like in the coming years.

But it’s worth highlighting that peer Ferrari trades at 50 times earnings. If we were to apply the same logic to Aston, it’d need to register profits of £30m to justify its current £1.5bn market cap, and £60m for £3bn — the latter would mean doubling my money.

So, do I think I can double my money with Aston? Very much so. But I’m hoping to see a steady progression from here on — that’s the key.

In the meantime, I’m buying more stock and I’m off to Baku to cheer on Fernando and Lance.