UK-based oil and gas company Zephyr Energy (LSE: ZPHR) has attracted a lot of positive attention in recent years. And with its share price down 27% year-to-date, this penny stock looks like a potential bargain to me at less than 5p. But is it really?

Ups and downs

Penny stocks are among the riskier investments I could make in the stock market. I’ve been looking recently at Zephyr Energy, a British firm that drills for oil and gas in the Rocky Mountains in the US. The company has only a £72m valuation, which means its share price can be volatile.

This was plain to see from what happened a couple of years ago. Between June 2020 and August 2021, shares in the firm jumped from 0.43p to 6.3p for a return of 1,300% on an investment. I’d never expect one of the FTSE 100 giants to give me a 13 times return on my money in less than a year.

On the other hand, if I’d bought in at 3.75p in June 2018, I’d have been licking my wounds after a heavy 88% loss when the price dropped to that 0.43p mark.

While these ups and downs mean that I’d never invest too much in penny stocks, I’m always on the lookout for a small stake if I can see good value.

A company that’s growing

Zephyr Energy’s latest earnings report shows a company that’s growing fast. Revenue of $42.9m for full-year 2022 didn’t just beat the guidance of $35m-$40m, but was a seven-fold increase on 2021 revenues of $6m.

And most importantly, the year-on-year revenue growth of over 600% was linked to production growth of over 500%. So I’m not looking at a temporary boost due to increased oil prices.

The AIM-listed company is geared towards further growth too, which would be a positive sign should I decide to open a position in the stock myself.

That growth will be spearheaded by six new wells that should be open by June and a predicted number of barrels of oil (or equivalent) that are predicted to reach 1,550-1,750 per day in 2023. That figure is up from 1,490 in 2022.

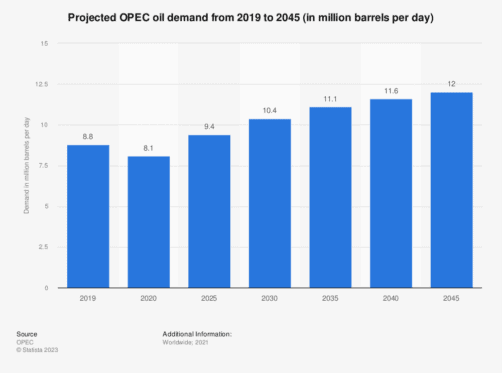

Looking longer term, this graph from Statista shows that oil demand from OPEC countries – oil making up 86% of Zephyr Energy’s output – is predicted to rise significantly in the decades ahead.

The long-term risk here is worldwide demand for oil lessening as fossil fuels are phased out. I wouldn’t want to be holding this type of stock if that happens sooner than expected.

Am I buying?

On the whole, increases in revenue and good news on the horizon make Zephyr Energy a penny stock I’ll consider buying soon. The long-term risks with the oil and gas industry do mean I’m not sure I’d place it firmly into bargain territory, however.