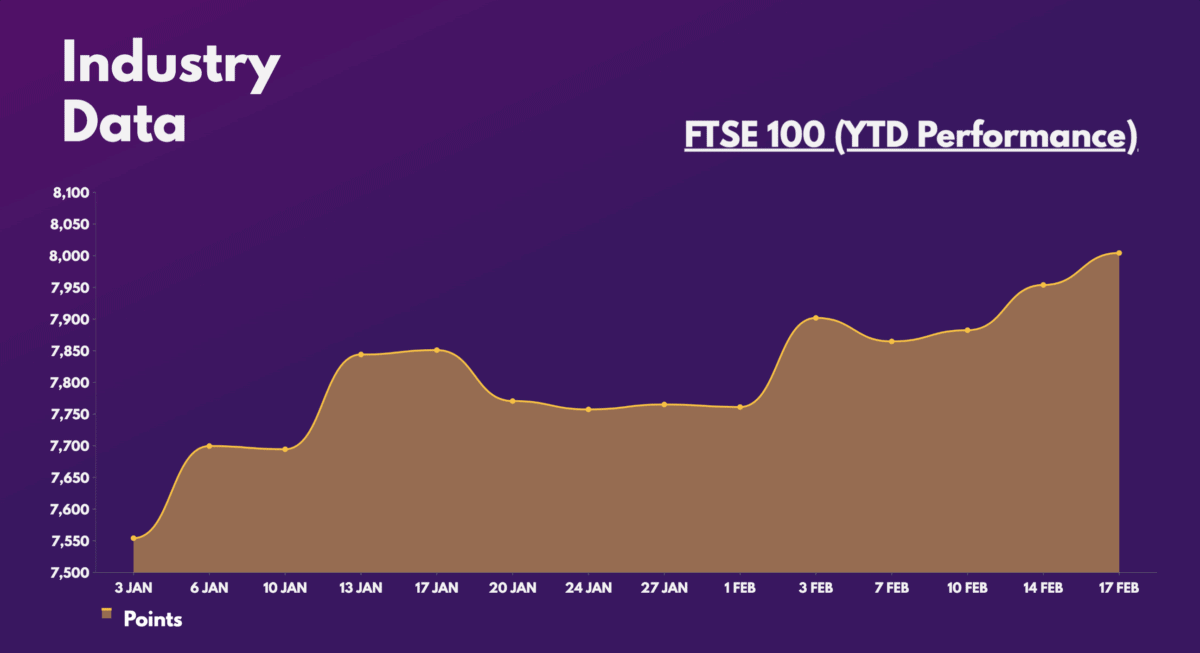

As Warren Buffett once said, “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price”. Even though the FTSE 100 recently hit an all-time high, it’s still filled with wonderful companies at cheap prices, and some UK shares may be bargains.

Starting on the front foot

For all the talk about Britain’s flagship index being underwhelming, it’s been the exact opposite over the past year. The index is up almost 25% since December 2020 and has performed admirably. Investors have flocked to consumer staples, financials, and commodities — sectors where the index has heavy weightage — during difficult times.

| Sector | % of FTSE 100 |

|---|---|

| Consumer staples | 17.9% |

| Financials | 17.8% |

| Materials | 13.4% |

| Industrials | 12.2% |

| Healthcare | 11.7% |

| Energy | 9.5% |

| Consumer discretionary | 6.9% |

| Communications | 4.3% |

| Real estate | 1.4% |

| Technology | 1.4% |

And bad times make solid companies shine. Over the past decade, the FTSE 100’s lack of exposure to tech and growth names saw investors flock to US stocks for better prospects, thus painting a pessimistic picture of UK equities. However, this has also resulted in a meaningful opportunity to capitalise on undervalued stocks.

Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.

Sir John Templeton

All in on blue chips

The British economy could very well still plunge into a recession soon. But this shouldn’t affect the headline index too much. That’s because only a quarter of its revenues are sourced locally, with the bulk of them coming from emerging markets and the US. As such, this presents a very lucrative opportunity to invest in FTSE 100 shares.

China’s emergence from its pandemic slump could help to oil the wheels as well. This is especially the case with commodity stocks such as miners and oil explorers. And with interest rates expected to remain elevated throughout 2023, financials and consumer staples should perform well.

Most lucratively, UK shares are currently trading at relatively cheap valuation multiples. With an average price-to-earnings (P/E) ratio of 14, and a forward P/E of 11, the main index’s multiples are still historically very low. What’s more, Footsie’s dividend yield averages approximately 4%, which is pretty attractive. And with shareholder returns expected to increase over the coming years, there’s no better time to buy than today.

Shares with a strong footing

That being said, not all FTSE 100 shares are made equal or boast bargains. In fact, some are teetering on being overpriced, given the UK’s remarkable rally since October. Nonetheless, I have a three favourites worth mentioning.

The first is IAG. The airline group continues to ride the tailwinds of a strong travel industry and is on route to getting back to full-year profitability. And with load factors still lagging pre-pandemic levels, there’s still plenty of upside potential for the travel stock.

The second is housebuilder, Taylor Wimpey (LSE:TW) as the developer’s shares slowly rebound from bottom. The housing market may not return to its highs any time soon, but the FTSE 100 stalwart’s robust financials and mega dividend yield (7.5%) present a lucrative investment opportunity for long-term growth while earning passive income.

Finally, Lloyds (LSE:LLOY) is a great stock to take advantage of the current rate-hiking cycle. The bank is forecasted to continue generating high levels of income from its high interest-bearing assets. This could result in shareholders receiving bigger dividends while earnings continue to grow.