The FTSE 100 and FTSE 250 are happy hunting grounds for investors seeking to build long-term passive income.

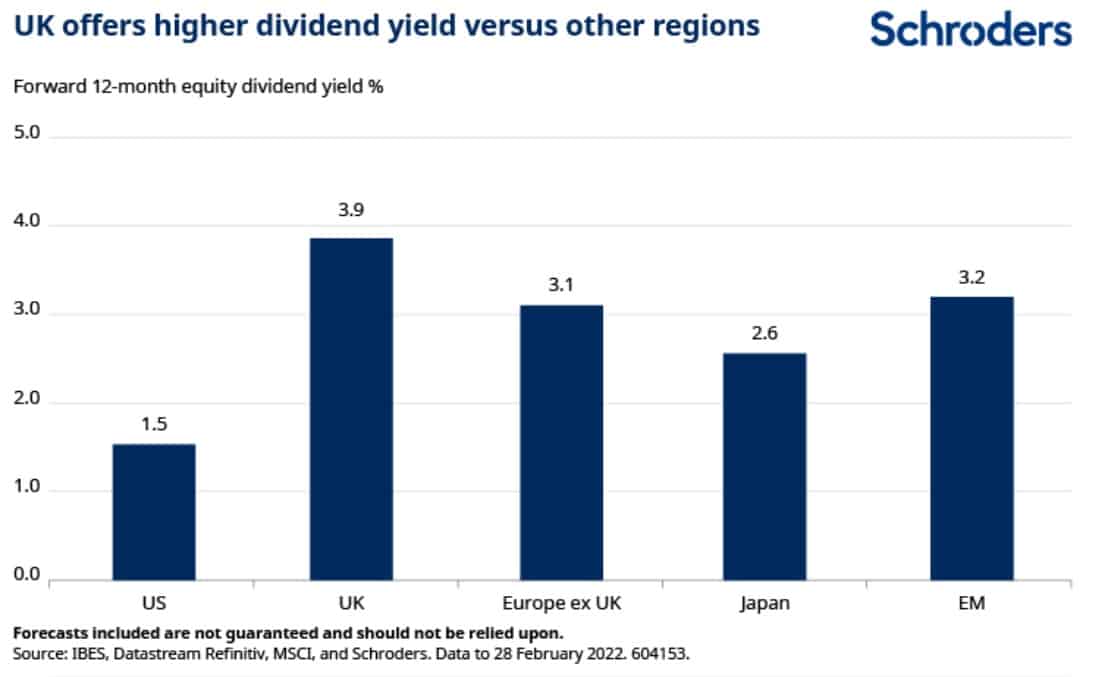

The London Stock Exchange is packed with large companies that operate in stable, mature industries. This makes the UK a particularly great place to go shopping for dividend stocks, as the chart from Schroders below shows.

Life-changing passive income

The London Stock Market’s large contingent of top dividend stocks has long made it a lucrative place to invest. Between 2011 and 2021, the average annual return for Stocks and Shares ISA investors clocked in at 9.64%, according to wealth manager Moneyfarm.

This sort of long-term return is not to be sniffed at. It certainly beats the meek returns that saving in a cash account produces. But I think that with some careful research I can find stocks that could deliver an even better return than this.

Let’s say I tailor my investment strategy to make an average annual return of 12% a year. If I were to invest £200 a month and successfully hit this target, I would have made a nest egg just shy of £580,000.

This sort of sum could help me retire with a comfortable level of regular income. If I were to apply the popular 4% withdrawal rule and draw this amount down each year I’d have an annual passive income of £23,168.

Beating the market

Of course, nothing is guaranteed when it comes to stock investing. Markets can go up but they can also go down.

But, over time, they have proven to be a highly-effective way for investors to make money. There’s a reason why they’ve been popular for centuries.

And with a careful approach to share investing people have made enormous returns far above the market average. The emergence of the Stock and Shares ISA millionaire in the past decade is evidence of how, with such a careful approach, it’s possible for investors to make life-changing sums.

3 top dividend stocks

I have sought to turbocharge my returns from buying UK dividend stocks. Rio Tinto is a big-yielding mining share I’ve bought in 2022. And I’m considering adding Glencore and its 9.4% dividend yield to my portfolio too.

Like Rio Tinto, I think this FTSE 100 business could thrive in the next decade as a new commodities supercycle kicks off. Profits from its coal division could slump as the fight against climate change intensifies. But I expect this to be more than offset by growing demand for the copper, iron ore, cobalt and other industrial metals it produces and markets.

Recruitment company Pagegroup — which yields a market-beating 9.5% — is another stock I’d looking at to boost my passive income. Earnings here could disappoint as the global economy teeters towards recession. However, over the long term, I believe international expansion will help it deliver solid shareholder returns.

These are just two of many top dividend stocks on my radar right now. Through a combination of dividend income and capital appreciation I think buying UK shares is a great way for me to build long-term wealth.