There’s no doubt that Nvidia‘s (NASDAQ:NVDA) financial results over the past year have been something special. Profits have soared as chip demand for the artificial intelligence (AI) revolution has boomed. But as an investor, I feel that its impressive trading is now baked into its elevated share price.

At $122.60 per share, Nvidia trades on a huge price-to-earnings (P/E) ratio of 45.5 times for 2024.

Tech stocks usually command large premiums because of their significant growth potential. However, the chipmaker looks massively expensive compared to almost all its sector rivals.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

Fellow tech giants and AI stocks Microsoft and Alphabet, for instance, trade on forward P/E ratios of 37.5 times and 24 times, respectively.

This heady valuation leaves little room for scope for bad news. A global economic slowdown, product development issues, or problems with meeting orders are a few risks that — if they became reality — could cause Nvidia’s share price to sink.

Early days

There’s another problem that I have with buying Nvidia shares at current prices.

The microchip maker has been one of the AI pacesetters so far. But at this early stage of the race, it’s difficult to tell who will be the eventual winners from this new tech frontier.

Each of ‘The Magnificent Seven’ shares — which includes Nvidia, Microsoft and Meta, alongside Amazon, Apple, Alphabet, and Tesla — are all spending vast sums in generative AI and machine learning. We may look back and baulk at Nvidia’s massive valuation a few years from now.

Better AI stocks?

One way to get around this could be to buy AI-related stocks rather than the technology companies themselves. This approach will give me the chance to hedge my bets as well as avoid the vast premiums these growth companies attract.

With this in mind, here are some I think could be great ways to profit from the AI revolution.

Power surge

A substantial amount of computational power is required for AI applications, especially those involving deep learning and large-scale data processing. This in turn is leading to rapid expansion of data centres that hold the necessary hardware, and with it a sharp rise in electricity demand.

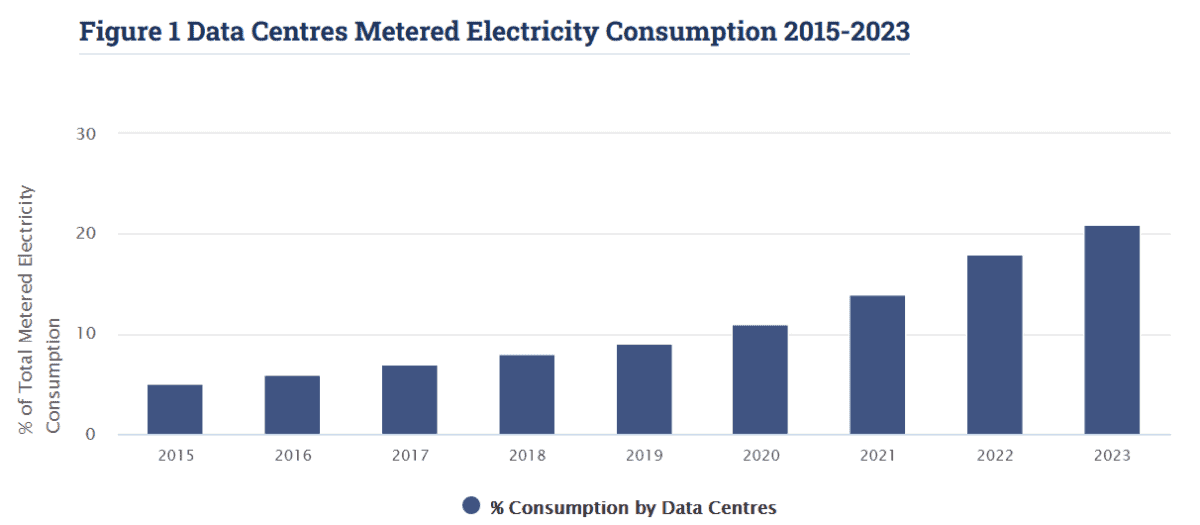

Energy usage data from Ireland this week underlines just how much juice it takes to run these hubs. Electricity consumption by the country’s data centres soared by a fifth between 2022 and 2023. The sector now accounts for 21% of all Ireland’s power, more than all of urban households in the country combined.

With AI rapidly growing, countries are in severe danger of missing their net zero policies. The result could be a ramping up of renewable energy creation across the globe.

Greencoat Renewables is one such business that could benefit from Ireland’s power drain. It owns and operates mainly onshore and offshore wind farms across Europe, the majority of which are located on the Emerald Isle.

Other strong renewable energy stocks include The Renewable Infrastructure Group — a share I own in my own portfolio — and FTSE 100 wind energy giant SSE. There are in fact dozens of such stocks for investors to choose from today.

Unfavourable weather periods can play havoc with energy generation and profits at companies like these. But like Nvidia, they also carry considerable growth potential as the battle against climate change intensifies.