The Roblox (NYSE:RBLX) share price is up around 100% at $89.70 from its March 2021 direct listing price of $45. The company has a market cap of $51bn now, a significant increase on the $29.5m value arrived at in the private funding round in January 2021.

Operationally Roblox has reported revenues of $387m for the first quarter of 2021, a 140% year-on-year increase. Average daily active users of the Roblox platform increased 79% year-on-year to 42.1m. However, operating losses swelled to $135m in the first quarter of 2021, from $73m a year previously.

So, the Roblox share price and the company itself have been growing robustly. Of course, the pandemic helped in that it meant more people spending more time on digital leisure activities. Although that effect will dissipate, Roblox has ambitious plans for continuing to grow into the future.

What is Roblox?

Roblox is not a game; it’s a place where people (mainly under 13 years old) go to play games made by other developers. The developers create the games using Roblox’s tools. To play games, users have to download the Roblox app for desktop, mobile, or console. To create games, users have to download Roblox Studio. Roblox and Roblox Studio are free to download and use.

Roblox Studio looks a little like the Unity development platform. Both allow games to be developed with and without coding. However, Unity’s platform is a fully-fledged game engine with fewer restrictions and a higher ceiling for developing games that can be deployed to any platform.

It could be said that Roblox is to game content what YouTube is to video content. It gives games creators a space to showcase and earn money from their work.

Robux

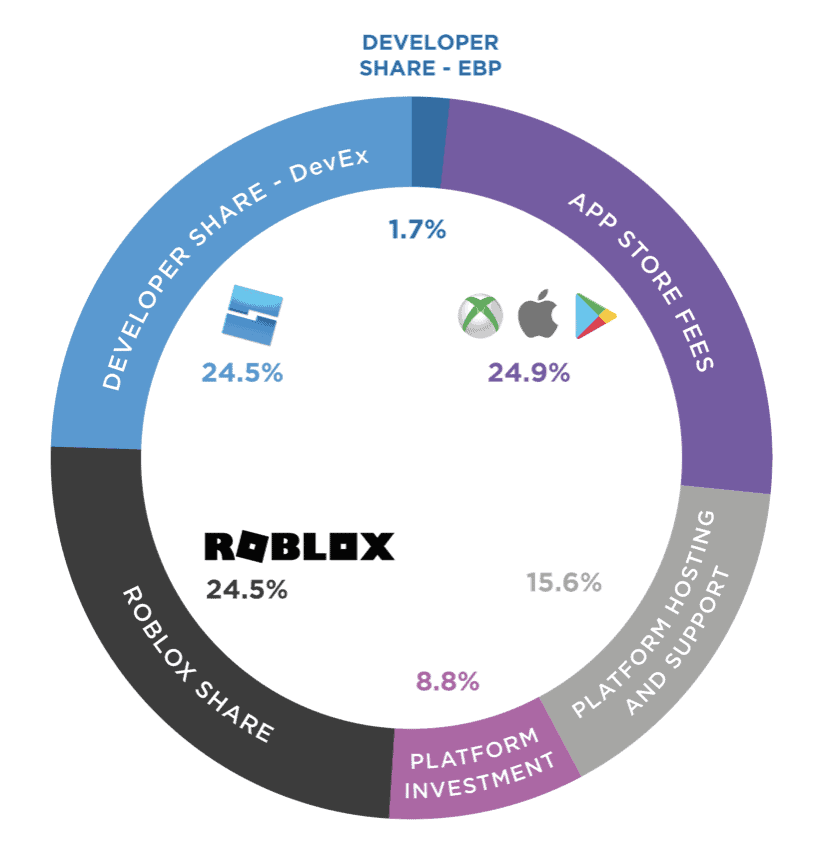

Roblox users buy Robux, the platform currency, with real-world currency. Robux are used to access advanced features and customisations for the platform and games. Roblox splits the real revenue earned by selling Robux three ways. Around a quarter goes to app stores that users used to download and operate the Roblox platform. Another quarter goes to games developers. That leaves around half for Roblox.

Source: Roblox presentation

The rest of Roblox’s revenue comes from advertising, licensing, and royalties. For example, Roblox-branded items are licensed for sale through third parties, and various media companies advertise on Roblox.

Roblox share price

I think comparing the Roblox platform to YouTube is reasonable. Needham & Company, a research firm, valued YouTube at roughly $300bn as a standalone entity based on revenue multiples. Roblox’s current market cap is $51bn. If Roblox can eventually rival YouTube in terms of revenue and scale, I would expect the Roblox share price to move higher.

Roblox wants to grow into a place where users can play games and learn and hold parties with their virtual friends. Artists are already hosting launch parties on Roblox. That could support a move to YouTube-like valuations. On the other hand, the Roblox platform’s audience is much younger than YouTube, and it does not have the breadth of content yet. That would argue for Roblox not achieving YouTube-like valuations. With the entire US tech sector looking pricy, I think the Roblux share price could go either way, and at the moment, I am watching from the sidelines.