The stable nature of medicine demand makes pharmaceutical companies popular with investors during uncertain times. But FTSE 100-listed GSK‘s (LSE:GSK) share price has dropped 4% since 1 January as share pickers have invested elsewhere.

The healthcare giant has its problems. But at a current price of £13.78 per share it does, on paper at least, offer great value when compared to other UK blue-chip shares.

GSK trades on a forward price-to-earnings (P/E) ratio of 9.3 times, below the FTSE average of 14 times. Furthermore, its 4% dividend yield beats the index’s 3.7% average.

It’s worth remembering that the FTSE index is hugely diverse, though. So comparing the company with other major players in its industry rather than just its index is a useful exercise.

How does GSK’s share price stack up on this front?

P/E ratio

A good starting point is to consider how the company is priced in relation to predicted future earnings. This can be calculated using the P/E ratio for the current financial year.

On this front GSK makes a strong impression. Its multiple is less than half that of FTSE 100 rival AstraZeneca‘s 18.6 times.

The UK business also looks cheap compared to its international peers. Pfizer trades on a P/E ratio of 11.2 times for 2023, while Merck & Co and Eli Lilly carry enormous multiples of 35.4 times and 56.2 times, respectively.

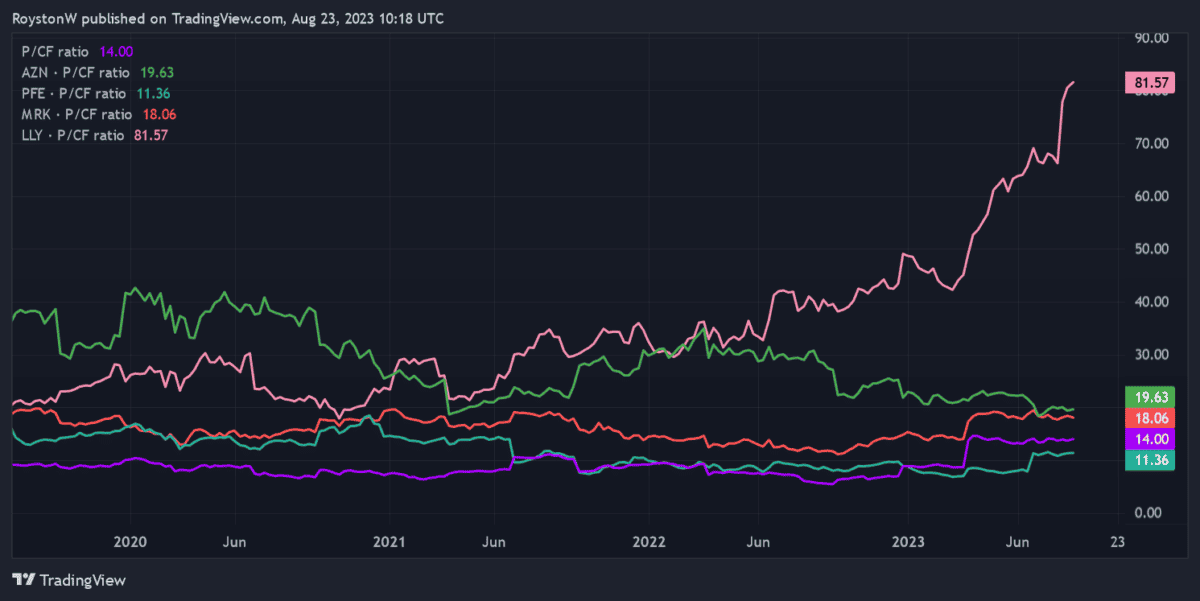

P/CF ratio

The value of GSK’s shares isn’t as clear cut on a price-to-cash flow (P/CF) basis isn’t as clear cut, though, as the chart above shows. This is a useful metric to use for businesses that require vast amounts of capital like pharmaceuticals firms.

Aside from Eli Lilly, which trades on a monster reading above 80, it sits fairly close to its sector peers. That said, it is only beaten by Pfizer on this metric.

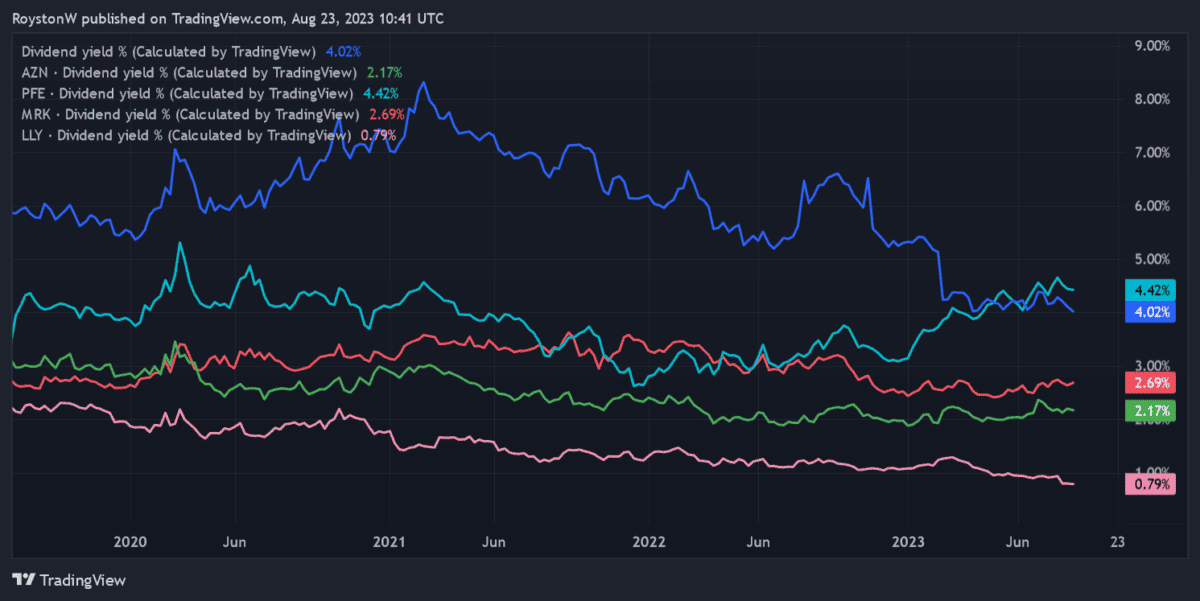

Dividend yield

Drugs developers aren’t famed for paying especially large dividends. This is on account of their colossal research and development costs. Last year GSK announced it would spend £1bn over the next decade to produce vaccines and treatments for malaria, tuberculosis, HIV, neglected tropical diseases, and antimicrobial resistance alone.

Yet the business still offers that large 4% dividend yield, as I mentioned. And as the chart shows, this is far above what its industry peers (bar Pfizer) currently offer.

Why I’d buy today

Concerns over the size of the firm’s pipeline is the main reason GSK trades more cheaply than its rivals. However, I feel this problem could be baked into the current price of its shares, and especially when considering the stock’s P/E ratio.

It’s my belief that its share price could rise strongly over the long term. Revenues from products launched since 2017 have been impressive, while margins are improving, leading to upgrades to sales and profit forecasts.

GSK has a great track record of creating industry-leading treatments. Indeed, its money-spinning Shingrix shingles vaccine has just shown 100% efficacy during trials in China. And as global demand for medicines marches higher, I expect the FTSE business to generate excellent shareholder returns.