The BP (LSE:BP) share price was 486p at the start of the year. Now it’s around 200p, almost 60% lower. The Covid-19 crisis caused oil demand to slump, and some oil-producing nations also increased their supply. This led to lower oil prices. Oil & gas producing giant BP saw its revenues slump. Losses mounted as assets were written down due to a bleak outlook for oil prices. BP had to slash its dividend and issue debt to raise cash.

The anticipation and then reality of a dividend cut explains most of BP’s share price slump. In response to the pandemic and the broader outlook for oil, it’s planning big eco-focused changes. These changes make the company riskier, explaining the rest of the share price slide. I think the BP share price is attractive at 200p because the potential rewards outweigh the risks. However, I don’t think the kind of investor it traditionally attracted would agree with me.

High yield, high risk

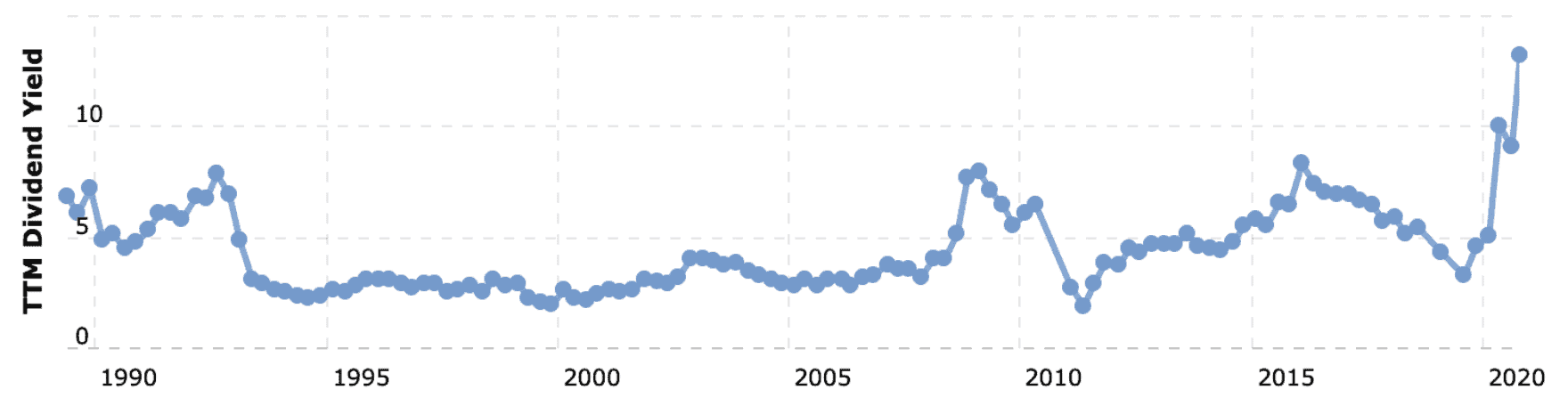

Income investors used to flock to oil majors. Oil prices, and therefore BP’s fortunes have always been cyclical. But, investors seemed to feel that the good years offset the bad enough to make the dividend reliable. Looking at the chart below, aside from the blip in the early 90s, the dividend yield on BP shares was below 5% for almost two decades as it steadily increased its dividend. That suggests the dividend was seen as reliable. Think of dividend yields like interest rates on loans: the more reliable borrower gets a lower interest rate.

Source: macrotrends.net

As the Great Recession of 2007/09 unfolded, BP’s dividend yield increased, reflecting increased risk. Eventually, it cut its dividend, and the yield fell. But despite starting to increase the dividend payment again and then maintaining it all the way into 2020, the yield rose, and stayed high, only dipping below 5% briefly in late 2019. Then the Covid-19 crisis happened, and here we are.

BP has cut its dividend to 5.25 cents per share per quarter for the foreseeable future. That’s about 16p per year, or around half of what was on offer last year, but the dividend yield is around 8%. That’s high for BP, but it reflects the riskier nature of the company and its dividends. According to its own forecasts, peak oil may have already come and gone, and a renewable future looks almost certain. It has recognised this and plans to be a very different company by 2030.

Who should pay the price for BP shares?

BP has committed to a 40% reduction in oil and gas production by 2030. Investment in low carbon energy should increase from $0.5bn to $5bn annually in a decade. More renewable energy capacity, greater bioenergy production, and 10% market share for hydrogen fuel are things BP wants for its future, which includes being net-zero for emissions by 2050.

The payoffs are big if it can manage the transition. BP would swap volatile oil returns for a steady 8%-10% one on renewables projects, and markets would price its shares more favourably if it goes green. But there are significant risks involved in pivoting away from oil as you invest in what is still a young renewables industry. But I think investors who have a 10-year or so horizon, and can take the risk of missing dividend payments might find that 8% yield appealing.