If you’re under 40, there are plenty of smart financial moves you can make. For example, saving for retirement, investing your money, and using tax-efficient accounts to protect your gains from the tax authorities are all very smart ideas.

However, if I had to list the smartest move you can make while you’re still under 40, I’d say it’s opening (and saving into) a Lifetime ISA for retirement. Here, I’ll explain why this particular ISA – which is only open to those aged between 18 and 40 – is so powerful.

An extra £100,000+ in retirement

The first major advantage of the Lifetime ISA is that it comes with 25% bonuses from the government on contributions of up to £4,000 per year, to age 50. So, if you put in the full £4k while you’re eligible, you’ll pocket £1k for free. This is a phenomenal deal that could really turbocharge your wealth over time.

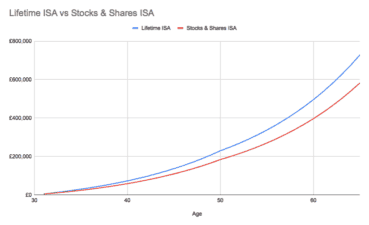

Consider this hypothetical example. Let’s say you put £4,000 into a Lifetime ISA every year between the age of 30 and 50 and your friend puts £4,000 into a Stocks & Shares ISA every year between 30 and 50. You both invest your money in the same diversified portfolio of stocks that generates a return of 8% per year (these gains will be tax-free in both accounts), and you both leave the money in your respective ISAs until you turn 65.

By the time you both turn 65, your friend’s Stocks & Shares ISA will be worth around £583,000 – which is certainly a healthy amount of savings. However, due to the extra £1,000 you picked up every year from the government between the age of 30 and 50, your Lifetime ISA will be worth a huge £729,000.

That’s a difference of nearly £150,000! Are you starting to see the power of this ISA?

Access your money tax-free

Yet it gets better. The other huge advantage of the Lifetime ISA is that once you turn 60, you can access your money completely tax-free. Don’t underestimate this benefit – it could save you tens of thousands of pounds in tax.

For example, let’s say you’ve just turned 60 and you have £500,000 saved in a workplace pension or Self-Invested Personal Pension (SIPP). You can access this money, but unfortunately, you can only take 25% of it tax-free (£125,000 in this case). Any further withdrawals will be added to your income and taxed at your normal rate.

So, if you wanted to withdraw £25,000 per year for retirement income purposes, you’d most likely be looking at several thousand pounds in tax per year. However, if that £500,000 was saved in a Lifetime ISA, you could take the whole lot tax-free. There would be zero tax payable on lump-sum withdrawals or income withdrawals. Over time, the tax saving could be substantial.

All things considered, the Lifetime ISA is a very powerful investment vehicle. Not only can it potentially boost your wealth significantly, but it can also save you a fortune in tax. If you’re under 40 and eligible to open an account, I think you’d be mad not to.