On Thursday, Royal Dutch Shell (LSE: RDSB) released its Q4 and FY2017 results. Thanks to a rebound in the oil price, profitability and cash flow were significantly higher than in FY2016.

Importantly, for income investors, the oil major held its dividend steady. It declared a fourth-quarter dividend of 47 cents, taking the full-year payout to $1.88. It has now paid that amount for four consecutive years. At the current share price, the yield is a nice 5.4%.

However, looking ahead to FY2018, the consensus dividend estimate is actually lower than that. Currently, analysts have pencilled in a payout of $1.83 for the year. That implies a dividend cut is on the cards. Could Shell cut its dividend this year?

While nothing is ever certain in financial markets, barring another catastrophic collapse in the oil price, I believe a cut is highly unlikely. Here are three reasons why.

Oil price rebound

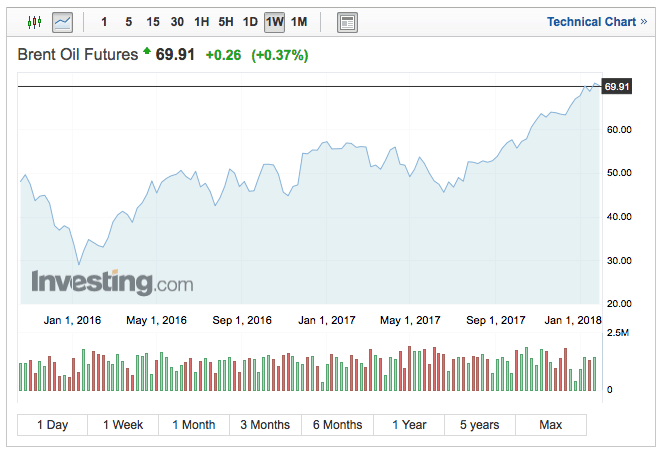

Shell’s profitability is largely related to the price of oil. When the oil price collapsed to under $30 per barrel in early 2016, the outlook was extremely challenging for Shell and other oil companies.

However, over the last two years, the price has staged a significant comeback. Take a look at the chart below.

Source: investing.com

With the price of Brent oil now back at $70 per barrel, the outlook for companies like Shell is a lot healthier.

Cash flow is up

A higher oil price translates to higher revenues, cashflows and profits. This is reflected in the recent FY2017 results. Cashflow from operations rose 73% to $35.7bn in FY2017 while free cashflow increased to $27.6bn, up from -$10.3bn in FY2016. This is good news for shareholders.

Given that the FY2017 dividend cost the company around $15.6bn, we can see that it was easily covered by free cashflow. This leads me to believe that the chances of a dividend cut this year are unlikely.

Track record

It’s also worth keeping Shell’s track record in mind. The oil major hasn’t cut its dividend since WWII – a phenomenal achievement.

Companies with strong dividend track records generally take great pride in their dividend history. I have no doubt Shell has immense pride in its own history. It won’t want to ruin that track record now.

If Shell did cut its payout, it would upset quite a few investors. I’m not just talking about private investors like you and me here, but also some of the world’s largest investors, including powerful sovereign funds and mammoth pension funds. Many of these own and depend on Shell due to its high yield, and a dividend cut, and the implications of that would not sit well with such investors. The company most likely understands this, and is set to do everything in its power to uphold its impressive track record going forward.

Of course, if the oil price does take another dramatic tumble, we will have to reassess the outlook for the payout. Yet for now, Shell’s FY2018 dividend looks safe to me.