Rolls-Royce stock has delivered truly eye-popping growth over the past few years. And after starting 2026 strongly, the FTSE 100 engine maker is close to £13 per share.

This takes the three-year return above 1,100%. This is the sort of gain people might associate with a high-flying US tech share rather than a FTSE 100 blue chip. Incredible stuff!

Looking ahead, however, City analysts reckon this under-the-radar UK stock could deliver much higher returns by 2027.

Fast-growing fintech

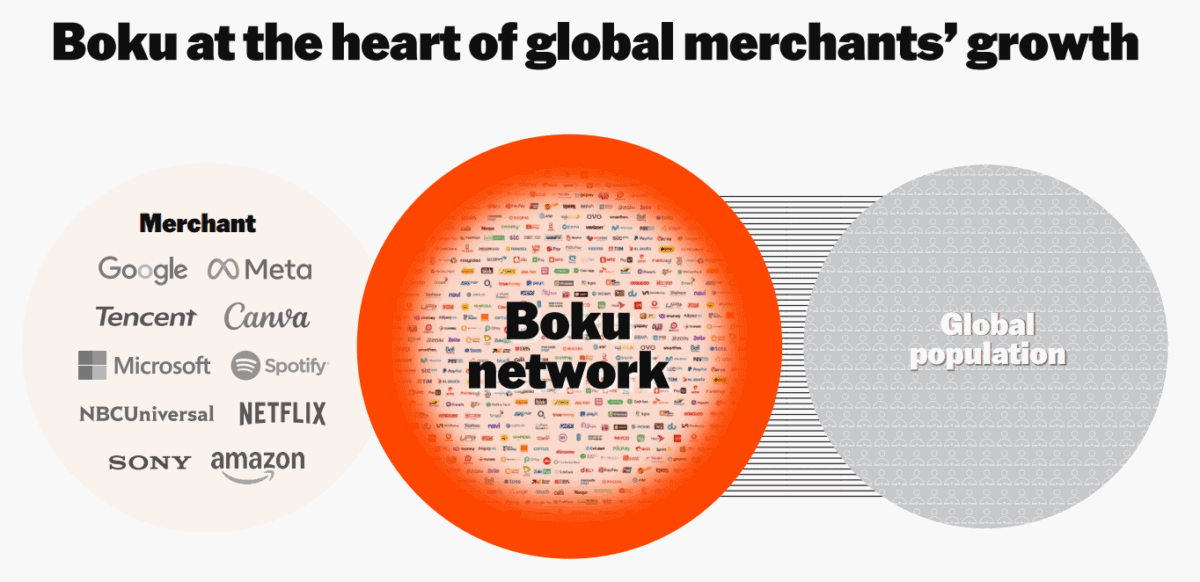

The share I’m referring to is Boku (LSE:BOKU), an AIM-listed fintech firm with a £668m market cap. It connects merchants to 200+ local payment methods (LPMs) and wallets, helping people in 60 countries pay for goods and services with their mobile phones.

Boku says its mission is to “simplify global expansion for our merchants by providing seamless access to the world’s most popular payment methods”. It works with Netflix, Spotify, Amazon, Google, and many more.

Revenue has grown rapidly, from $56.4m in 2020 to an expected $152m this year. However, an attractive thing here is that Boku is now firmly profitable, with net profit expected to grow 25% this year to more than $34m.

In particular, Boku is seeing strong growth in bundles, which is where digital services like Netflix or Spotify are packaged with mobile or broadband plans.

The long-term opportunity is significant because in regions like Southeast Asia, digital wallet use is exploding far faster than credit card adoption. Almost 60% of the company’s revenue comes from Asia Pacific, though it’s also been cleared to access Brazil’s most popular instant payment system (Pix).

As such, Boku has committed to compound annual revenue growth of 20%+ over the medium term, alongside margin expansion. And it’s opened an innovation hub in Singapore dedicated to solving merchants’ cross-border money movement headaches.

The company is also currently piloting stablecoin payment rails, which demonstrates how forward-thinking it is.

With increasing volumes across our network, we are prioritising operational efficiency and building a platform with the capacity to scale significantly.

Boku CEO Stuart Neal

Share buybacks and valuation

The share price is up 68% since the start of 2024. However, the board believes Boku’s shares remain undervalued, and a share buyback programme is ongoing.

Based on current forecasts, the stock is trading at 27 times forward earnings. For a fast-growing fintech with potentially many years of growth left in the tank, I don’t think that’s particularly expensive.

Indeed, it may even prove to be very cheap. Brokers agree, with all six covering Boku rating it a Buy.

Moreover, the average price target is 330p, which is 47% above the current level of 223p.

Hidden gem stock?

Naturally, Boku faces stiff competition from other fintechs eyeing up the lucrative LPM market. In Latin America, it’s up against Uruguay’s Dlocal, which is much larger (with a $4.2bn market cap).

I used to own Boku shares in 2018/19. Since I sold them, the company dropped off my radar. However, it’s come a long way from phone bills and is expanding impressively into local payments, especially in Asia.

I already have a lot of fintech exposure in my portfolio, so I’m not going to re-invest. But others might want to consider taking a small stake in this fast-growing fintech sooner rather than later.