Generating £2,243 a month in passive income is a worthy objective.

This figure equates to £26,916 annually, but the size of the ISA required depends largely on the size and sustainability of the yield.

At a 4% annual income rate – a common benchmark for a diversified portfolio of dividend shares, bonds and income funds – an ISA of around £673,000 would be required.

At a higher 5% yield, the required pot falls to roughly £538,000.

Pushing yields to 6% would reduce this further to about £449,000, though higher yields usually come with greater risk and less reliable income.

These figures assume income’s taken without eroding capital and that dividends or interest are relatively stable. Inflation also matters, as £2,243 a month today will not have the same purchasing power in 10 or 20 years.

In practice, many investors aim for a balance between income generation and modest capital growth to help preserve long-term spending power within an ISA.

How to get there?

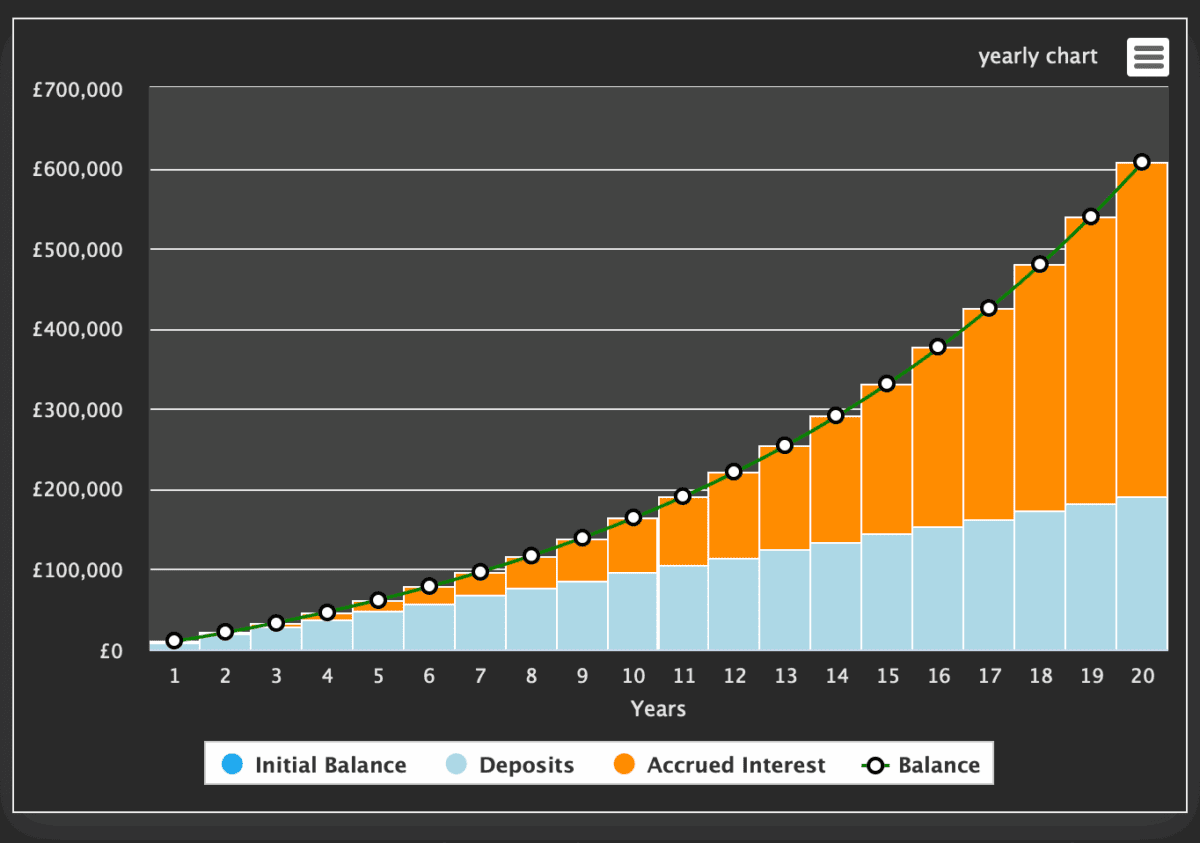

Building a portfolio of this size might sound daunting, but it’s very achievable. For context, if an investor put £800 in a month and achieved 10% growth per annum (just above the long-term return for the average UK Stocks and Shares ISA), the portfolio would be worth £607k after 20 years.

The above chart shows us something very important. It’s that our portfolio compounds over time. This is essentially earning interest on our interest from the previous years. In this example, the investor would have put down £192k over the period. The real gains, more than £415k, comes from interest earned on interest.

Of course, this is just the theory. The hard part is choosing the right investments.

Where to invest?

Most of us Fools believe the best investment strategy is to build a portfolio of a dozen or two well-researched stocks, held for the long term and supported by a clear understanding of each company’s competitive position, growth drivers and risks.

The core part of any investment however, is the valuation. That’s always my starting point. It makes a huge difference.

One stock that stands out for me is TBC Bank (LSE:TBCG). TBC Group is a Georgian bank with a fast-growing subsidiary in Uzbekistan, giving it exposure to two of the most dynamic economies in the region. While it’s often viewed primarily as an income play, I think that undersells the growth opportunity on offer.

Revenue is forecast to grow at an average rate of 17.7% over the next two years, making it the 17th fastest-growing stock on the FTSE All-Share. Earnings are expected to rise by 7.3% in 2025, 14% in 2026, and 14.3% in 2027. Despite this, the shares trade at just 4.9 times forward earnings on a rolling 12-month basis, implying a PEG ratio of around 0.45.

Investors are also paid to wait, with a forward dividend yield of roughly 6.2%, well covered by earnings. While profitability metrics trail those of peer Lion Finance, they remain far superior to most UK banks.

It’s little surprise then, that all four covering analysts rate the shares a Strong Buy, with an average price target 35% above today’s level.

All investments have risks. It’s worth recognising that neither Georgia nor Uzbekistan are stable liberal democracies investors traditionally crave. Political uncertainty and international interference are also factors.

Nonetheless, I feel it’s a stock UK investors should strongly consider.