The Glencore (LSE: GLEN) share price was up 8% in early trading today (9 January) after reports that Rio Tinto (LSE: RIO) is in early-stage merger talks with the FTSE 100 miner. This comes on the heels of the proposed Anglo American–Teck Resources merger, signalling that consolidation is back on the agenda in the metals sector.

For Glencore, the focus is less on headlines though and more on what the deal could mean for copper – and how the company’s coal exposure factors into the discussion.

Merger details

Early details are limited, and both companies stress that nothing is agreed yet. Rio Tinto is clearly looking to expand its copper portfolio, while Glencore brings not just metals but a major trading division.

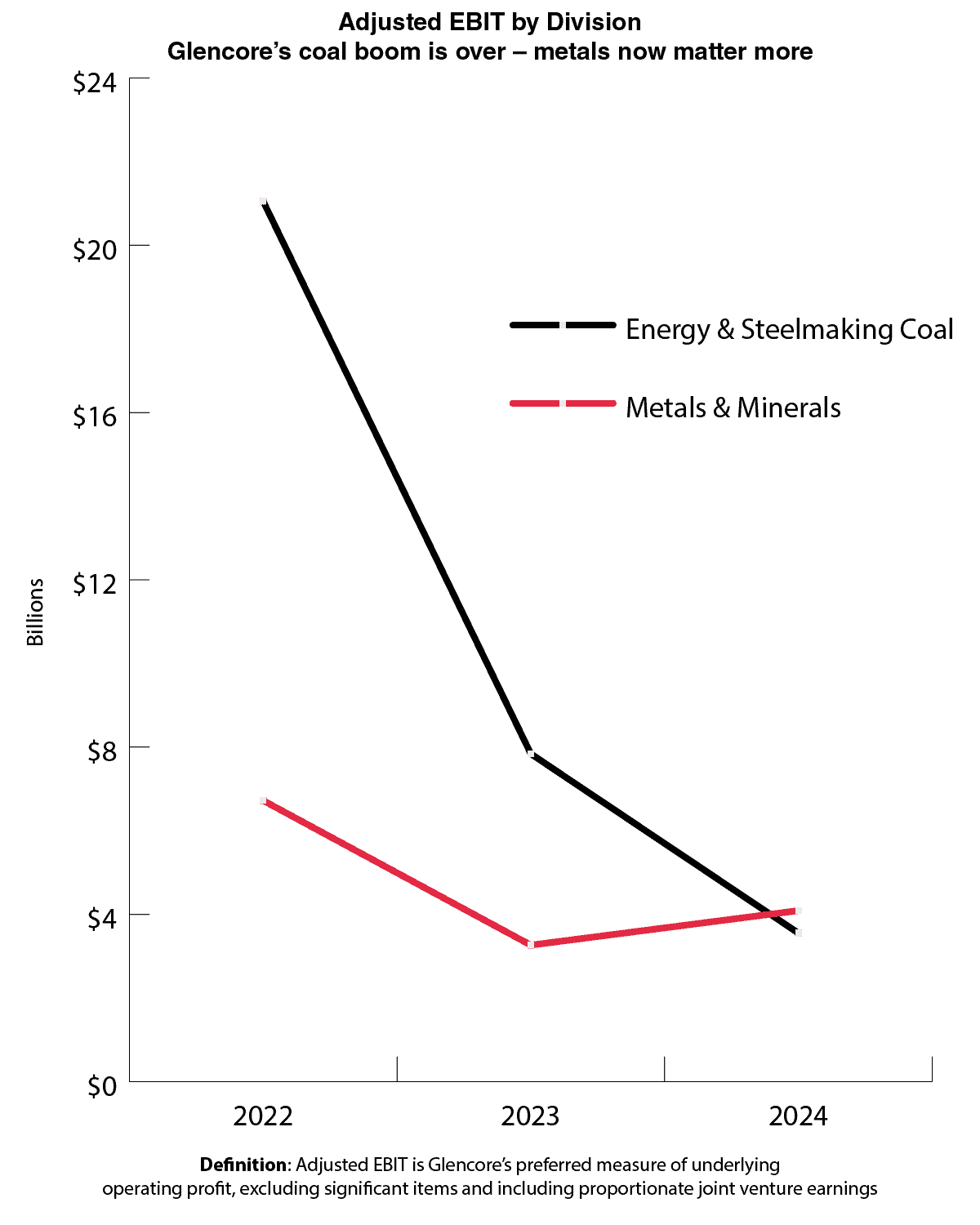

Coal is the obvious sticking point. Rio has exited coal entirely, whereas Glencore’s operations in Australia and beyond still account for around half of total revenue. Yet in practice, coal is far less central to Glencore’s cash flows than many assume.

The chart below shows the miner’s adjusted earnings (EBIT) across its two divisions: while coal earnings have collapsed since the post-Covid spike, metals and minerals have remained remarkably resilient. That shift gives Glencore flexibility in any deal and reduces the risk that coal alone could derail a transaction.

Chart generated by author

Copper is the story

If you strip away the headlines, this is fundamentally a copper story. Glencore is positioned to be one of the world’s largest producers, targeting around 850,000 tonnes this year and potentially reaching 1.6m tonnes by 2035.

Supply is constrained: Chile’s output is flat, new discoveries are rare, and permitting can take 15 years.

Meanwhile, demand is climbing, driven by electrification, renewable energy, AI data centres, and industrial growth. Even modest price stability combined with steady volumes can meaningfully boost earnings.

Rio Tinto, by contrast, has been light on copper, relying heavily on iron ore. Accessing Glencore’s copper assets would give it a far more credible position in a market where a 30% supply shortfall is projected by 2035. For shareholders, that’s the angle that really matters: copper is now central to the energy transition, and both companies are looking to the long term.

Glencore’s trading business is the ace in the pack. Many rivals have tried to copy it, none have succeeded. In a world of increasing supply constraints and volatile prices, this division is effectively priceless.

Risks

Any merger of this scale would be behemoth-level, with enormous regulatory hurdles across multiple jurisdictions. Integrating two very different corporate cultures – one trading-heavy, the other conventional mining – is far from trivial.

Coal, while smaller than before, could still pose ESG, political, or financing complications. And the sheer size of the combined company would make it highly exposed to commodity cycles, geopolitical tensions, and operational disruption.

Bottom line

The Glencore-Rio Tinto story isn’t about immediate share price spikes. It’s about copper optionality, disciplined production, and strategic positioning in a market likely to remain undersupplied for years.

For investors comfortable with Glencore’s volatility, today’s merger headlines add context but don’t change the fundamentals. Copper remains the driver – the part of the story most likely to shape earnings, growth, and long-term market relevance.