The FTSE 100 rose by around 20% in 2025, its best year since 2009. Much of the heavy lifting came from strong performances by precious metals producers, banks and other financial stocks. With the index having hit the 10,000 mark for a while – and dividend yields falling – investors might reasonably wonder whether the best opportunities have already passed. However, I still see bargains, even among stocks that have rallied hard recently.

Volatile stock

After hitting a three-year low in April, Glencore (LSE: GLEN) has enjoyed a powerful rebound, more than doubling from its lows. Yet despite that rally, the shares rose only 14% over 2025, leaving the miner well behind many of the index’s biggest winners.

One reason for that cautious pricing is the lingering focus on volatility. Glencore’s earnings have swung sharply with commodity prices for years, and the market appears to assume that will continue.

But that framing misses an important structural point: the company’s earnings and cash flows have built-in operating leverage. In other words, the business can benefit disproportionately from even modest stabilisation in commodity markets – and we may already be seeing that take shape.

Copper prices

Take copper, for example. The red metal has enjoyed a strong run, climbing roughly 40% over the past year. That rally is being supported on both the demand and supply side.

Demand is coming from multiple sources, including electrification, renewable energy, industrial activity and the AI data-centre build-out.

Meanwhile, supply remains constrained. Major producing nations such as Chile have seen flat output, while ore grades continue to decline over time.

Layer on top of that uncertainty around tariff policy, countries stockpiling metals and the threat of export bans, and a potent mix is forming beneath the surface.

But here’s the key point: copper prices don’t need to go parabolic for the miner’s cash flows to improve meaningfully. Price stability, combined with steady volumes and disciplined cost control, can be enough to shift the earnings outlook from contraction to expansion.

Market mispricing

Crucially, that’s not how the market appears to be pricing Glencore today. Many investors continue to assume that prolonged weakness in coal will swamp any metals upside, leaving earnings range-bound or worse. As a result, expectations remain muted, even as share prices recover.

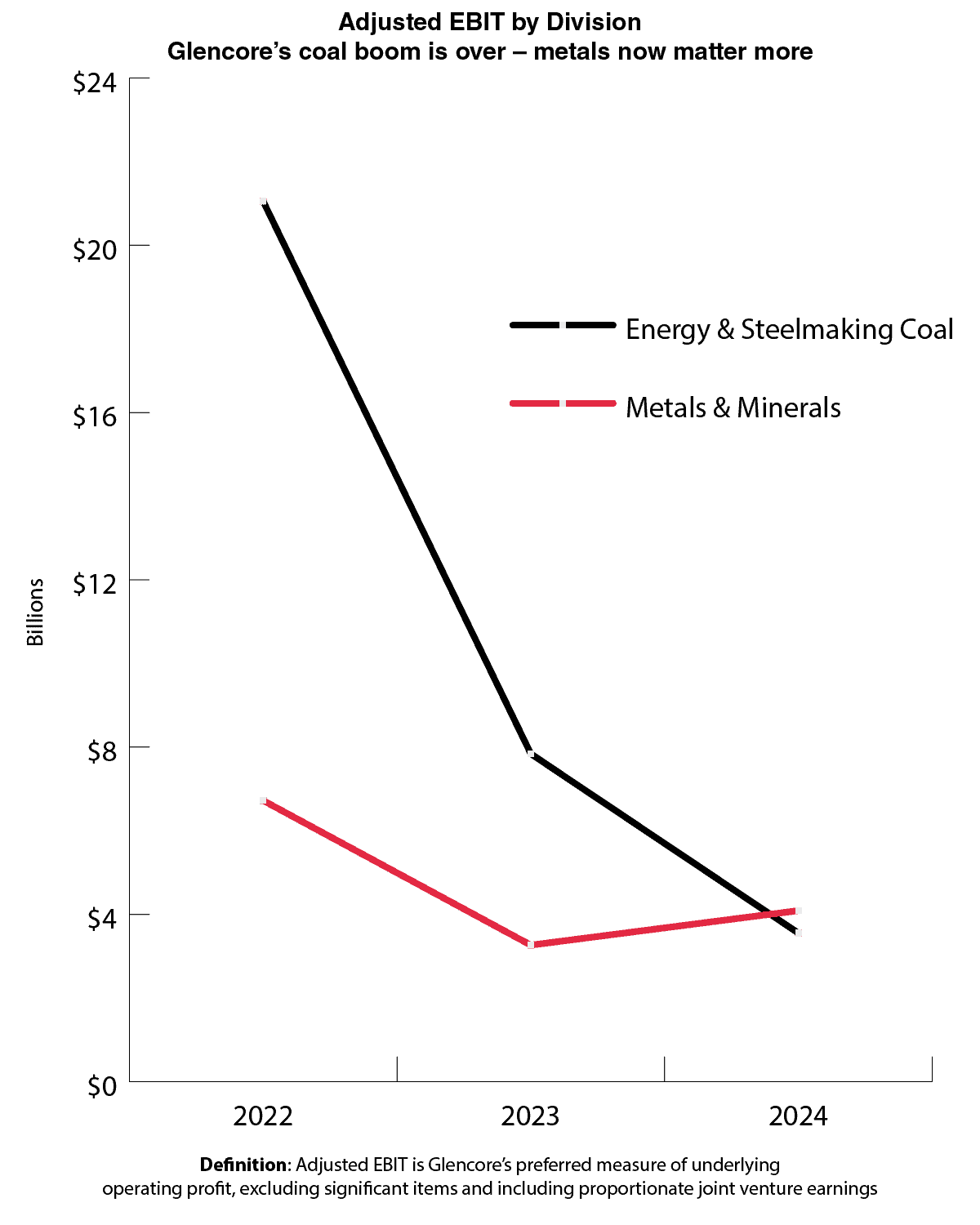

However, an adjusted EBIT chart – which strips out one-off accounting items – tells a different story. It shows that, despite weak metals prices in 2023 and 2024, the Metals and Minerals division has remained remarkably resilient. By contrast, Energy and Steelmaking coal earnings have collapsed, now contributing less to overall profits than the metals business.

Chart generated by author

This suggests the market may be underestimating the company’s true operational strength.

Key risks

Operational risks remain, from weather-related disruptions to rising costs as mines go deeper and labour tightens.

The miner’s global footprint also exposes it to geopolitical and regulatory uncertainty, including shifting tariff regimes and government intervention in key producing regions. These factors could affect production and cash flows, even if metals demand remains robust.

Bottom line

Glencore remains a stock I continue to watch closely in my own portfolio. Its resilient metals earnings and operational flexibility mean that even modest stabilisation could improve cash flows. For investors looking for exposure to long-term commodity trends, it’s worth considering – particularly as the FTSE 100 sits near 10,000.