What can you get for £7 nowadays? An overpriced coffee, a cheap streaming subscription, a short train journey. With the right investment strategy, it could also provide a substantial cash boost in retirement with dividend shares.

Sound far fetched? It really isn’t, as I’ll now demonstrate.

Targeting a £33.7k income

Thanks to the mathematical miracle of compounding — where returns are reinvested to grow over time — and the long-term power of the stock market, even a modest sum like this can create life-changing wealth in later life.

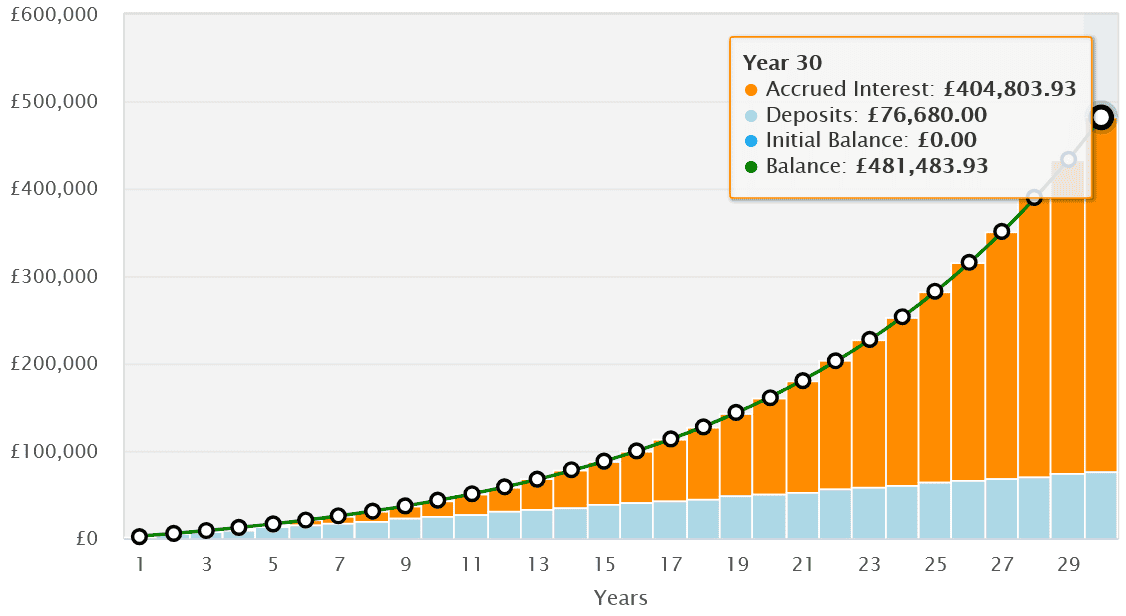

£7 a day works out to £2,555 over a year, or roughly £213 a month. If put in the stock market and delivering a 10% average annual return, an investor could turn that into a whopping £481,484 over 30 years.

But how could that be turned into a large retirement income? One method could be by buying dividend shares. It’s a strategy that can provide scope for further portfolio growth alongside a beautiful passive income.

Let’s say our investor puts their £481,484 into dividend-paying stocks with an average 7% yield. At this rate, they would receive a tasty £33,700 second income to supplement the State Pension.

Tips to build wealth

That’s a pretty impressive passive income, I’m sure you’d agree. And it’s one that investors would likely need to pull several smart tricks to achieve.

For example, they’d likely need to eliminate capital gains and dividend taxes to boost compounding — as well as income tax on withdrawals — by investing in a Stocks and Shares ISA.

They’d also need to come up with a sound investing strategy, like thinking long-term and ignoring temporary market volatility; taking time to find durable, quality stocks; and building a diversified portfolio of shares.

The final point is critical, as it provides a smooth return and eliminates concentration risk by spreading out an investor’s cash. This can help an investor enjoy a handsome return even if one or two companies underperform.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Balancing risk and reward

Want to know how this can be achieved quickly and cheaply? Investment trusts and exchange-traded funds (ETFs) are the answer. These investment vehicles can hold hundreds of stocks along with other asset classes like cash, bonds, and precious metals.

Take the iShares Core MSCI World Index (LSE:IWDG). This ETF holds shares in 1,317 different companies, spanning various parts of the globe and taking in around a dozen different industries.

To give you a flavour, some of its notable holdings include chipmaker Nvidia, retailer Amazon, drinks maker Coca-Cola, and bank HSBC.

Like any shares-based fund, it can fall when broader stock markets decline. However, it’s still (in my opinion) a great way to balance risk and reward. Investors here have enjoyed an average annual return of 11.7% since the fund’s creation in 2017.

Purchasing individual shares is higher risk but can yield greater returns. But the gains on many ETFs are far from shoddy, as this iShares product’s performance shows.

The 11.7% return it’s provided beats the broader stock market’s 8% to 10% long-term average. And if that continues, someone investing £7 a month here could realise an even-better dividend income than the £33,700 described here. It’s just one great option to consider to build wealth with shares.