Generating a reliable second income is a common long-term goal for UK investors. The goal of complementing our working income with another tax-free income is incredibly compelling.

One popular route is to use a Stocks and Shares ISA to produce a tax-free income stream that supplements employment earnings or, over time, replaces part of them altogether.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

It might be daunting, but it’s very possible

To put a clear figure on the challenge, £900 a month equates to £10,800 a year. If an investor targets a 5% annual withdrawal rate from an ISA portfolio, the maths is straightforward. Dividing £10,800 by 5% implies a required portfolio value of roughly £216,000.

At first glance, that number can feel intimidating. However, focusing solely on the end figure risks missing the more important point: very few investors reach it in one leap.

ISAs are built for gradual, consistent wealth accumulation. Contributions are made monthly or annually, dividends are reinvested, and compounding does much of the heavy lifting over time.

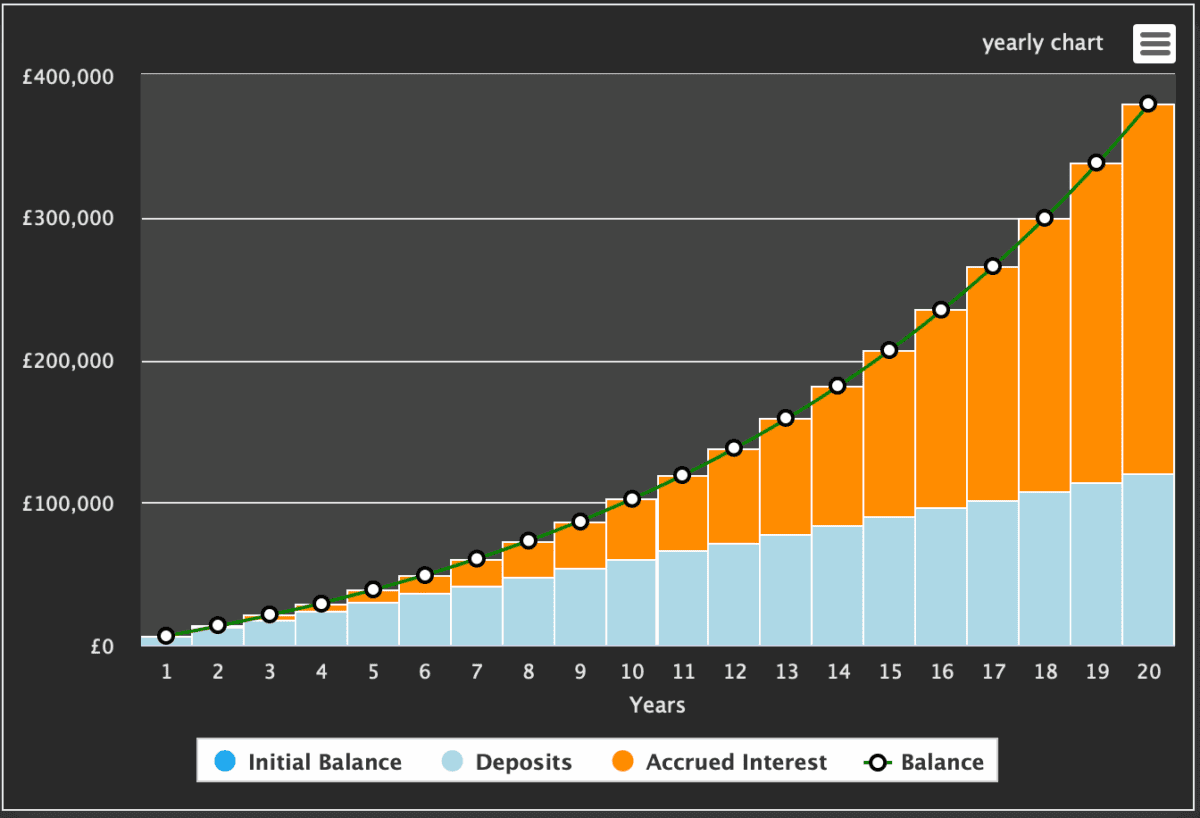

What’s more, compounding is snowball effect. Looking at the graph below we can see how the pace of growth appears to increase as time goes on.

Here’s how £500 per month could compound into £210,000 in 15 years, and surge to £400,000 within 20 years. This assumes a 10% annualised growth rate — marginally above the average annual ISA return over the last decade.

Importantly, time and consistency matter more than starting size. Regular investing, even in modest amounts, can compound meaningfully over a decade or more.

This is particularly the case within the tax-efficient wrapper of an ISA. What begins as a distant target can, with discipline and patience, become a realistic and sustainable second income stream.

Where to invest?

When building a portfolio from scratch, I believe the carefully chosen stocks are the best way to go. One small-cap stock I like is Arbuthnot Banking (LSE:ARBB).

Arbuthnot presents a compelling case for income and growth-seeking investors, trading at a steep discount with significant appreciation potential. The stock is currently priced at a modest 0.52 price-to-book ratio, and analysts forecast a price target of 1,500p, implying it’s 69% undervalued.

The income narrative is equally strong. Dividends have grown steadily from 42p in 2022 to an estimated 53.5p, pushing the forward yield above 6%. This payout appears secure, supported by a healthy 2.1 coverage ratio and a conservative loan-to-deposit ratio of 57.6%, which provides a superior liquidity buffer compared to larger peers like Lloyds (96%).

The primary risk is the liquidity. Due to its smaller size, Arbuthnot has a wide buy-sell spread. Investors face an immediate “fall rate” of 3%-4% upon purchase as they navigate this pricing gap.

However, with a projected long-term earnings growth rate of 15.2%, the fundamentals may justify this initial cost. I certainly think it’s worth considering.