BP shares (LSE: BP.) have had a roller-coaster 2025. The February strategy reset saw a pivot away from renewables, followed by a sharp April sell-off after US tariffs hit. Since bottoming at a three-year low, the stock has been creeping higher. The big question: can a new CEO help boost this holding in my ISA portfolio in 2026?

Strong profits

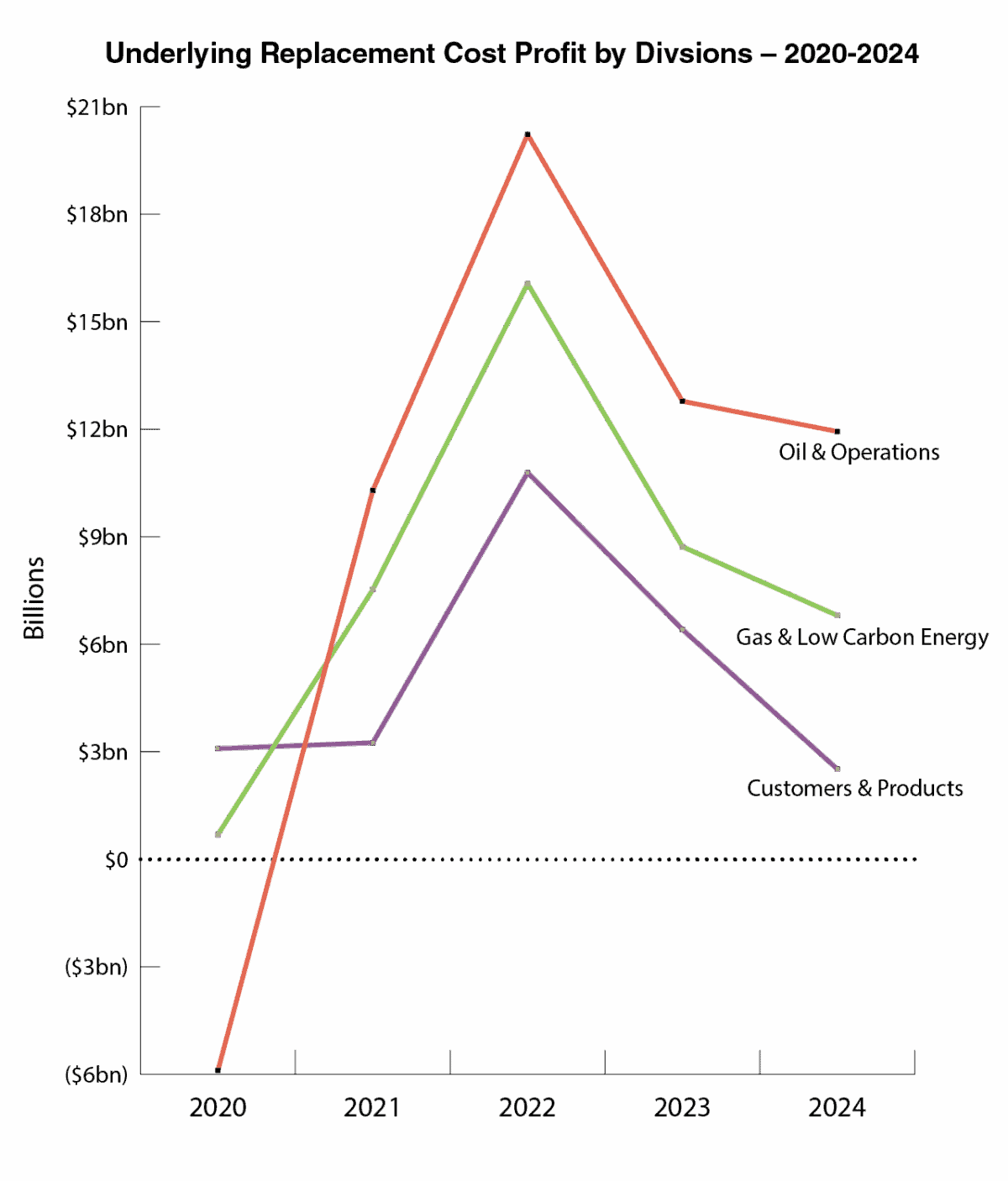

First, BP is a very strong cash and profit generator. The chart below shows its underlying replacement cost (RC) profit across three divisions. This metric reflects the profit made from running the business, stripping out one-off costs, write-downs, and other accounting noise.

Chart generated by author

The chart clearly shows the impact of negative oil prices in 2020, the post-Covid surge in energy prices, and the effects of the Ukraine war on the oil major’s profitability.

While the RC profit chart shows strong overall results, the real story lies in Gas and Low Carbon Energy.

Adjusting items

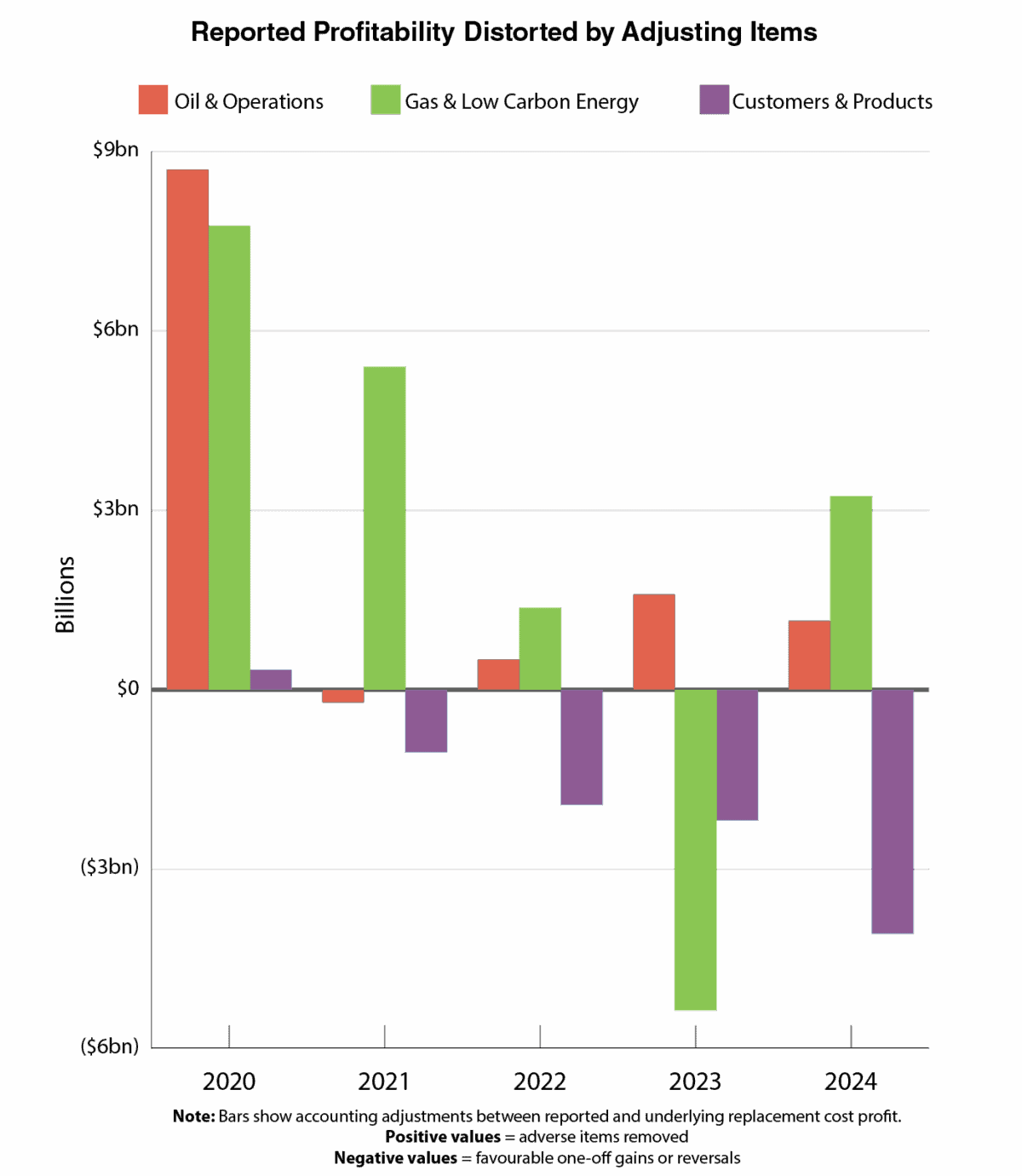

Adjusting items bridge underlying RC profit and the accounting profit reported in the income statement. In the chart below, focus on the green bars for Gas & Low Carbon Energy. Bigger bars don’t mean better performance – they show larger gaps between reported profit and the business’s operational reality.

These adjustments include impairments, write-downs, restructuring charges, and failed projects. Their size and frequency aren’t explained by gas prices alone – they reflect repeated re-evaluation of assets in the company’s renewables portfolio.

Chart generated by author

Strategy reset

The large adverse adjustments in 2021 and 2022, the reversal in 2023, and another big adjustment in 2024 reflect a strategy focused on growth optionality rather than earnings stability.

In other words, BP’s huge gas profits in 2021-22 masked unresolved strategic risks.

The chart tells the story clearly: it explains why BP scaled back its renewables portfolio. Hydrogen projects were cut from 30 to just 5-7; offshore wind shifted to capital-light partnerships, including a tie-up with Japanese energy company Jera; and the US onshore wind business was sold.

A new dawn?

BP’s share price in 2026 is now tightly linked to whether its strategy reset delivers. The ambitions are bold – and far from guaranteed.

Management is targeting adjusted free cash flow growth of more than 20% a year to 2027, alongside a return on average capital employed above 16%, up from 14% last year.

So far, the signs are encouraging. BP has started up six major oil and gas projects this year, and its exploration pipeline looks healthy. That includes two recent discoveries, one of them its largest in 25 years, at Bumerangue in Brazil.

But there’s a catch. These targets assume an oil price of around $74 a barrel, well above current levels. If prices don’t recover – and it misses its financial goals – the market is unlikely to be forgiving.

Bottom line

I’ve owned BP shares for many years, and the underlying RC profit chart shows why. This is a highly profitable, cash-generative business. Its 5.5% dividend yield stands out among major oil stocks and rewards patient investors.

For me, the stock earns a place in my Stocks and Shares ISA built for passive income. The dividend compounds tax-free, while strong cash generation supports long-term payouts.

I also remain bullish on oil prices long term. With inflation persistent and government deficits rising, I want exposure to hard assets – things that can’t be created out of thin air like fiat money.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.