Can you imagine earning £60,000 a year — or £5,000 each month — for doing absolutely nothing? It might seem like a pipe dream. But as I’ll explain, with the right passive income strategy, it might be closer than you think.

For me, the best way to chase a life-changing second income is with dividend shares. The bounties can be even greater when held inside a tax-efficient Stocks and Shares ISA.

Protection from capital gains and dividend tax gives investors more financial heft to grow their wealth. And with no income tax on withdrawals, investors can keep more of the cash their portfolios generate.

But how much would an ISA investor need to have for a regular £5k monthly income?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building an ISA

I think a figure in this region is sensible, given the soaring cost of living and social care. In two to three decades, a £60k annual income (plus the State Pension) may be needed for a comfortable lifestyle.

This clearly is no small chunk of change. But the excellent long-term returns of the stock market make it a very achievable target, as past performance shows.

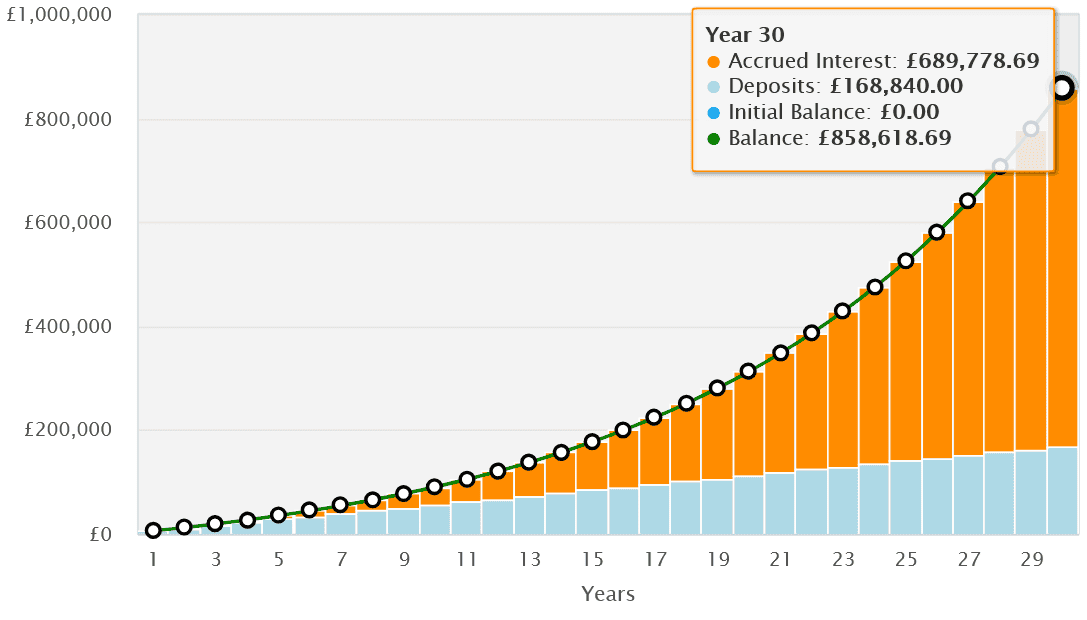

To achieve a £5,000 income a month, someone would need a Stocks and Shares ISA worth just over £857,000. This figure assumes our investor buys 7%-yielding dividend shares once they hit retirement.

Based on the 9% average annual return that share investing typically delivers, someone investing just £469 in their ISA over 30 years could reach that £857k target.

FTSE 100 dividends

The UK stock market’s packed with excellent dividend shares to turn that into a reliable long-term income. The FTSE 100 alone has dozens of quality stocks with strong records of delivering large and growing cash rewards.

Aviva‘s (LSE:AV.) one such dividend stock I own today in my portfolio. Extensive restructuring and balance sheet repairs have made it one of the Footsie‘s hottest income shares in my book.

Annual dividends have risen by an average 11.2% over the last five years. Supported by a huge cash buffer, City analysts tip payouts to keep growing to 2027 at least.

As a result, the dividend yield for next year is a brilliant 5.8%.

Aviva’s drive towards capital-light businesses is an important step towards boosting cash generation and supporting future dividends. With a broad range of insurance, wealth, and retirement products, the firm can also harness demographic trends to support payout growth.

Given its cyclical operations, Aviva’s profits could come under pressure if economic conditions worsen. Yet I wouldn’t expect this to impact the company’s ability to keep raising dividends. Its Solvency II capital ratio remains comfortably above 200%.

The final word

I believe Aviva’s dividend prospects make it a great share to consider for an income portfolio. A diversified ISA of 15 or more stocks like this could deliver a growing and reliable passive income over time.