The UK stock market is packed with income stocks that have long records of unbroken dividend growth. As of today, there are 30 stocks on the FTSE 100 and FTSE 250 that have raised annual payouts for 20 years or more.

The London Stock Exchange is packed with companies that some consider ‘perfect’ dividend shares. We’re talking about businesses whose market-leading positions, strong balance sheets, and diverse revenue streams lead to ultra-stable dividends.

The UK also features a large number of companies in mature or defensive industries, where dividends are considered a better use for surplus cash than investing for growth.

I’ve done some research to find the best dividend growth shares to consider right now. Want to see what I’ve found?

Five of the best

During my search, I’ve looked for companies with solid dividend yields along with scope for further long-term growth. They are:

| Dividend share | Years of dividend growth | Forward dividend yield |

|---|---|---|

| Clarkson | 22 | 3.1% |

| Alliance Witan | 58 | 2.3% |

| BAE Systems | 21 | 2.3% |

| Sage Group | 33 | 2.4% |

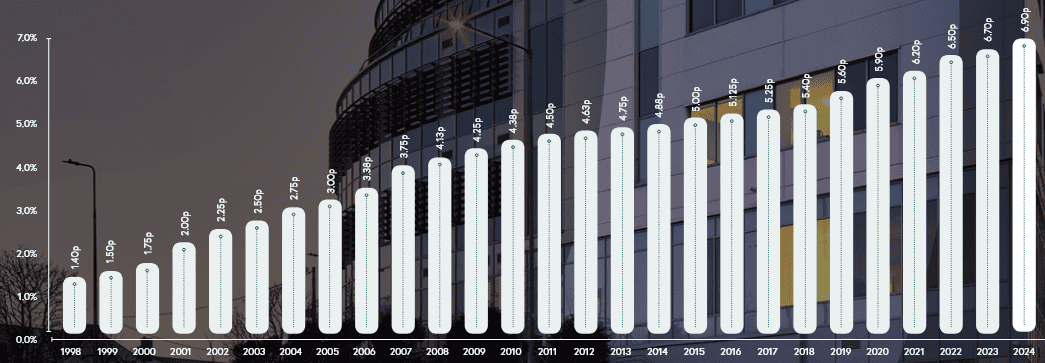

| Primary Health Properties (LSE:PHP) | 28 | 7.5% |

Each of the companies enjoys most (if not all) of the qualities described above. But I think one — Primary Health Properties — is a standout income share from this list.

And it’s not just because, at 7.5%, its forward dividend is more than double the FTSE 100 average of 3.1%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Healthy dividends

Primary Health’s proud dividend record reflects several key strenths.

Firstly, it operates in one of the most defensive industries out there. The majority of its properties are GP surgeries, though dental surgeries, pharmacies, and diagnostics centres also sit in its portfolio.

These sorts of properties remain in heavy use across the economic cycle, unlike those in other sectors like retail, office, and logistics. In fact, demand for them is booming as the UK’s ageing population drives healthcare needs, resulting in high occpuancy levels.

What’s more, with rents that are backed by government bodies, the chances of rent defaults are slim-to-none.

Finally, with roughly a third of its portfolio subject to either inflation-linked or fixed uplift rent reviews, it has built-in mechanisms to help it steadily raise dividends over time.

These qualities alone don’t guarantee consistent dividend growth, of course. Companies can typically choose the size of the shareholder payout. They can decide not to pay any dividends at all.

However, Primary Health shareholders have more security on this front than most. This is because — under real estate investment trust (REIT) rules — it must pay at least 90% of annual rental profits out in dividends.

The bottom line

As with any stock, there are risks for this FTSE 250 trust. One significant one is a change in NHS policy that impacts rent levels and occupancy. However, with primary healthcare being a government priority, an event like this is unlikely in my view.

When all’s said and done, I think Primary Health is one of the best income growth stocks to consider today.