On Thursday (4 December) last week, FTSE stock Trustpilot (LSE: TRST) fell 32%. It rebounded a little on Friday, but still ended the week down 23% from its Wednesday close.

Could there be an opportunity here after such a sharp fall?

Short seller report

It fell after short seller research firm Grizzly Research published a scathing report on the company. It accused Trustpilot of creating fake profiles that gave negative reviews and then pressuring companies to pay for subscriptions, removing genuine negative reviews of its subscribers, allowing paid-for fake positive reviews to thrive, and more.

“We believe that the public will increasingly wake up to the fact that Trustpilot has traded the integrity of reviews for revenues. We see this resulting in a rapid depreciation of the Trustpilot brand and its fundamental value proposition.”

Grizzly Research

Grizzly believes that once the depth of these issues is understood the Trustpilot website is likely to see less visibility on Google. This will be the “nail in coffin” for the company, it believes.

Trustpilot’s reply

On Friday, Trustpilot put out a statement categorically rejecting the allegations made by Grizzly Research. “Their report contains factual inaccuracies and false claims, which were intended to adversely impact the company’s share price,” it said in the statement.

It went on to say that Grizzly Research’s report is built on a “basic misunderstanding” of the company’s business model and ignores publicly available information about its scale, policies, data, and enforcement. It added that it’s considering all appropriate options in response to “demonstrably false statements”.

My view

Short sellers like Grizzly Research get a bad rap, but I think they have a place in the market.

They tend to do their research. And they can help regular investors identify risky stocks, whether the risk is related to a high valuation, a sketchy management team, or a flawed business model.

Grizzly Research has a pretty good track record when it comes to identifying risky stocks. In the past, it has produced reports on lots of stocks that have gone on to fall 80%+.

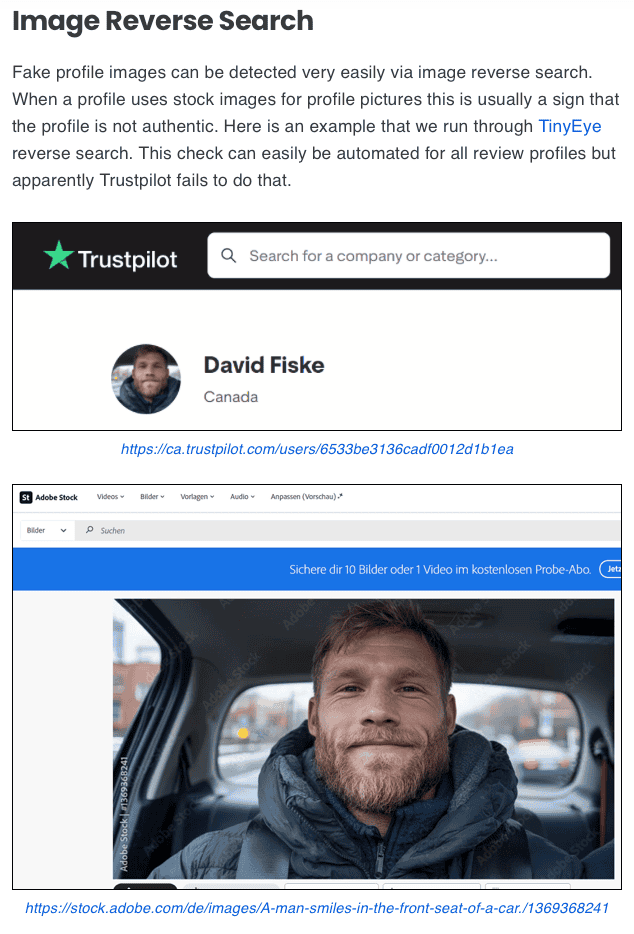

In terms of its Trustpilot report, I went through this over the weekend and it’s pretty alarming. It highlights fake profiles on Trustpilot using stock image photos and leaving good reviews (see below).

It also highlights how some companies that have really bad reviews on Reddit have unusually high ratings. An example here is freecash.com, which has a 4.8/5 review, despite shocking reviews on Reddit.

Overall, the report left me with a less positive view of Trustpilot.

“Trustpilot seems to be most appreciated by companies who run sketchy business models. Many companies that are already shut down due to fraud are somehow still extremely highly rated on Trustpilot.”

Grizzly Research

Better investment opportunities?

Short seller research firms don’t always get it right. Sometimes, their negative views can be off the mark and Grizzly could be wrong here.

Of course, Grizzly has an active short position, so the report should be taken with a healthy dose of scepticism, until anything might be proved.

Yet I I think investors should consider avoiding Trustpilot shares until we know more.

If someone is looking for growth, there are better opportunities in the market today, in my view.