In the middle of a cost-of-living crisis, building passive income streams has never felt more important. My favoured method is to use a Stocks and Shares ISA to buy stakes in high-quality FTSE 100 companies with proven business models and dependable dividends. The best part? You don’t need a large pot of savings to begin. So how much passive income could an investor realistically unlock by putting just £35 a week to work?

Tiered contribution

Let’s assume an investor has a 20-year time horizon. They begin by contributing £1,820 a year (£35 a week) to their Stocks and Shares ISA. As their earning power grows, so too do their contributions. A realistic tiered approach might look like this:

| Tiered years | Yearly ISA contribution |

| 1-5 | £1,820 |

| 6-10 | £3,000 |

| 11-15 | £5,000 |

| 16-20 | £10,000 |

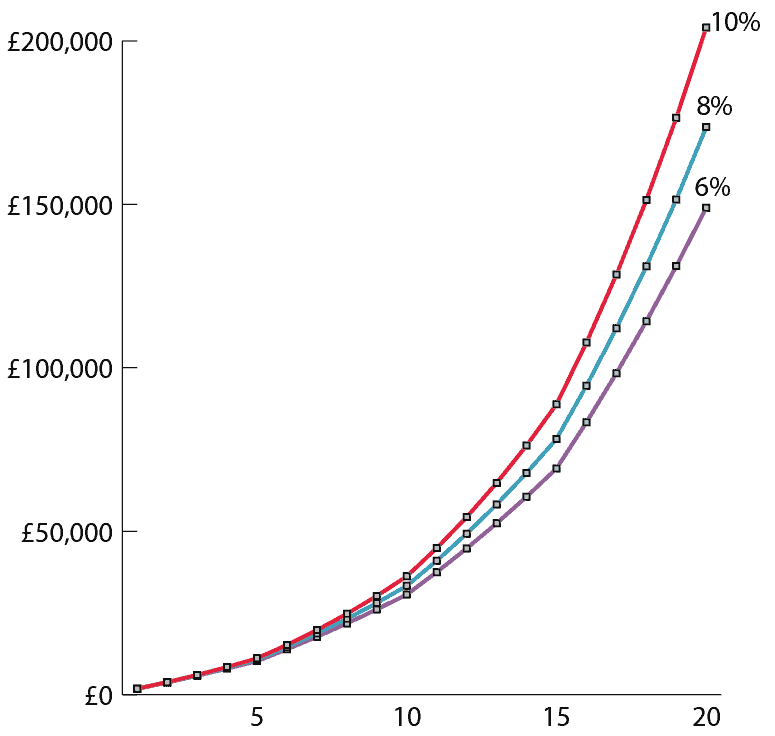

As the chart below shows, the final amount accumulated can vary dramatically even when yearly return assumptions differ by only a couple of percentage points. Small changes in compounding rates can lead to meaningfully different outcomes over a 20-year horizon.

Chart generated by author

Nevertheless, the overall message is consistent: reinvesting dividends and letting compounding do the heavy lifting makes a huge difference. In fact, across all return scenarios, a significant share of the final pot is generated in the last five years, underscoring the power of staying invested for the long term.

Constructing a portfolio

Two stocks that could be worth considering as a good fit for a passive-income strategy are BP (LSE: BP.) and Phoenix Group (LSE: PHNX). Both offer market-beating yields while operating in sectors with long-term relevance.

BP’s 5.3% yield is underpinned by a business still generating strong cash flows from global oil and gas demand.

Despite the energy transition, consumption continues to rise in emerging markets, aviation, and heavy industry. And with the rapid build-out of AI data centres – many of which rely on natural gas for stable, round-the-clock power – the company is positioned to benefit from both legacy and new energy needs.

Phoenix Group, meanwhile, offers a substantial 7.75% yield backed by strong, recurring cash generation from its pensions and retirement operations. Managing millions of policies, the insurer benefits from steady workplace pension contributions that provide predictable, long-term cash flows. And with structural trends such as an ageing population and the ongoing shift toward defined-contribution pensions, its dividend looks well supported for many years to come.

Risks

No investment comes without risk. For the oil major, cash flow and dividends are closely tied to oil and gas prices. These can change quickly due to economic forecasts or geopolitical events. The company is also writing down a large portion of its renewables assets, which have not delivered the expected cash flows.

For the insurer, future dividend payments rely on strong cash generation from its pensions and retirement businesses. Rising unemployment could result in such flows going into reverse. The company is also exposed to interest rate changes, regulatory updates, and long-term actuarial assumptions. These factors could impact profitability and its ability to maintain high dividend payouts.

Bottom line

Consistently investing in dividend-paying shares through a Stocks and Shares ISA can help grow passive income over time. Even modest weekly contributions, combined with reinvested dividends and long-term compounding, can turn small investments into a steadily increasing income stream, showing how disciplined investing can work for everyday savers.