Tesco (LSE:TSCO) shares have delivered a far stronger return over the past year than many investors expected. A £20,000 investment 12 months ago would now be worth about £25,600.

So, what’s behind this outperformance and can it continue?

The share price growth has broadly been driven by strong trading, steadier inflation, and a share buyback programme that has tightened the company’s capital structure.

The company has also looked disciplined, confident, and operationally sharp.

A big part of the story has been margins. Cost inflation has eased, but Tesco has continued to innovate and push efficiency, from distribution to in-store labour planning, and the benefits are starting to show.

Clubcards remain central to Tesco’s strategy. By funnelling more customers into its data ecosystem, Tesco has been able to sharpen pricing without sacrificing profitability. All while protecting its leading market share.

The ongoing buybacks have reduced the share count, which in turn lifts earnings per share and supports the valuation. Combined with a dependable dividend, the total-return profile has looked unusually strong for a supermarket stock.

Sustainable momentum?

The question is whether the momentum continues. Management has already hinted that profit growth could soften as cost pressures re-emerge and competition intensifies.

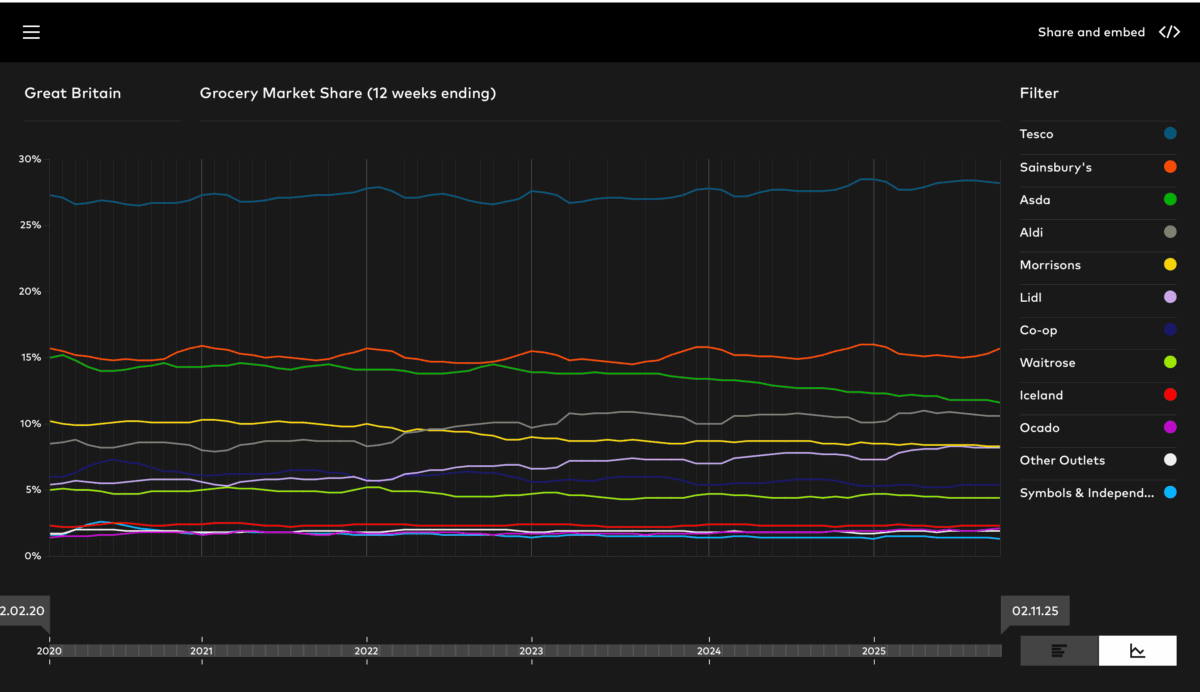

Asda, among others, has signalled its willingness to cut prices to take market share. Tesco’s market share proved incredibly resilient when Aldi and Lidl came on the scene, but it looks like there’s another fight on the cards.

However, Tesco’s scale, cash generation, and tighter operational discipline still provide a credible foundation for long-term investors, even if the next 12 months prove less dramatic.

In short, investors may not see such strong gains in the near term.

Valuation is key

Tesco’s scale and resilience in recent years means investors are typically happy to see it trading at a premium to its peers.

However, the stock is now trading at 15.7 times forward earnings. That’s a lot higher than we’ve seen in recent years. While earnings have risen and shares have been bought back, this loftier valuation is more reflective of a re-rating rather than anything else.

A re-rating occurs when the market’s perception of a stock shifts and doesn’t typically reflect a growth in earnings or other financial factors.

Adjusting for growth, the stock still looks a little expensive. The price-to-earnings-to-growth ratio of 2.2 isn’t vastly offset by the dividend yield at 3.1%.

The bottom line

Investors will always be happy to pay a premium for a quality business. It’s the case across all sectors. The best companies trade with premiums to their peers.

However, Tesco stock appears to be trading very close to fair value. The margin of safety from an investment perspective isn’t there anymore.

As such, it’s a stock I’m monitoring from a distance. It’s still worth considering, because it’s a great operator. But it’s worth recognising that the valuation is the most important factor when investing.