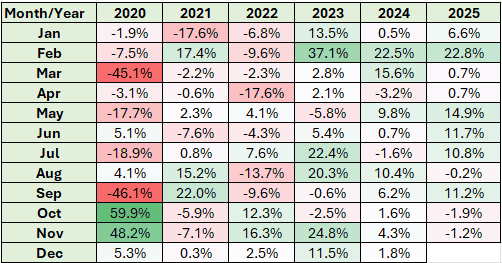

If November continues as it’s started then the Rolls-Royce Holdings (LSE:RR.) share price will have fallen during three of the past four months. Although the drops have been relatively small, it could be a sign that the stock’s stellar post-pandemic rally could be stalling. But as the chart below shows, since the start of 2020, a swift recovery has often followed a poor run.

The bear case

I’m sure that pessimists will point out that given the stock’s relatively high valuation — the group’s currently valued at 40.2 times its forecast 2025 earnings — there’s little margin for error. If the company reports an earnings miss, or there’s any other kind of bad news, it’s highly likely that there will be a sharp correction in the share price. This will be tested tomorrow (13 November) when the group publishes its latest trading update.

And the pandemic reminded us how reliant the group is on the aerospace sector. It generates cash when its engines are used. Any slowing in air travel and the profit from its civil aviation division is likely to fall short of analysts’ expectations.

Last week (7 November), investors reacted badly to the third-quarter results of International Consolidated Airlines after the British Airways owner reported softer demand on its North Atlantic routes. The demand for air travel reflects wider economic conditions. If global GDP growth were to slow then Rolls-Royce is likely to see a reduction in its large engine flying hours.

There’s also a risk that investors have already priced in the expected benefits from its small modular reactor (SMR) programme. In August, one broker placed a value of 40p a share on these factory-built mini nuclear power stations. And yet there’s not a single SMR that’s commercially viable at the moment.

There are also dozens of different designs currently being tested. At this stage, it’s impossible to know whether the group’s version will prove to be a winner. Also, critics argue that the electricity generated by this technology will be extremely expensive.

The bull case

On the other hand, the demand for electricity is expected to grow exponentially over the coming decades. And SMRs are likely to be one way in which the additional capacity required can be built quickly. Rolls-Royce has established a reputation for engineering excellence and has been developing nuclear technology solutions for decades. On this basis, I see no reason why it cannot emerge as a market leader.

The group’s also planning to enter the narrowbody aircraft market. This makes perfect sense to me given its expertise in manufacturing engines for larger planes.

Rolls-Royce also operates a diversified business model. Its three divisions – civil aviation, defence and power – are all exposed to markets that are currently growing. But the three are sufficiently different to offer some protection should one of them experience a downturn.

My verdict

On balance, I’m more persuaded by the bull case and plan to hold on to my shares. But that’s because I’m taking a long-term view. For the same reason, patient investors could consider adding the stock to their own portfolios.

However, even though I remain positive about the group’s prospects, I’m not expecting rapid share price growth over the next couple of years or so. That’s why I also have my eye on other exciting opportunities.