Whichever way you look at it, Legal & General‘s (LSE:LGEN) share price is a stunning bargain. Well, that’s my view, at least. It’s why the FTSE 100 company is currently the largest single holding in my portfolio.

Legal & General shares have risen a mediocre 4% in value in 2025. The broader Footsie, meanwhile, has increased an impressive 18%. Yet this underperformance doesn’t trouble me — as a long-term investor, I’m confident it will provide far superior returns looking ahead.

And right now represents a good time to consider opening a position or boosting an existing one.

Low earnings multiple

One reason is the blue chip’s attractive value based on expected earnings. For 2025, it trades on a price-to-earnings (P/E) ratio of 11.4 times, below that of the broader European financial services sector and the FTSE 100 (12.2 to 12.5 times).

Legal & General’s multiple falls sharply to 9.8 times for next year, too.

Furthermore, predictions of robust profit increases over the period leave the company with rock-bottom price-to-earnings growth (PEG) readings.

These come in at below 0.1 for this year, and 0.6 for 2026. Any reading below one implies that a share is undervalued.

Highest FTSE yields

Legal & General’s shares also offer tremendous value from an income perspective. In fact, it offers the highest dividend yields on the FTSE 100 today.

Reflecting its poor share price performance lately, yields on Legal & General shares are 9.1% and 9.3% for 2025 and 2026, respectively.

Both figures blow the broader index’s long-term average of 3% to 4% out the water.

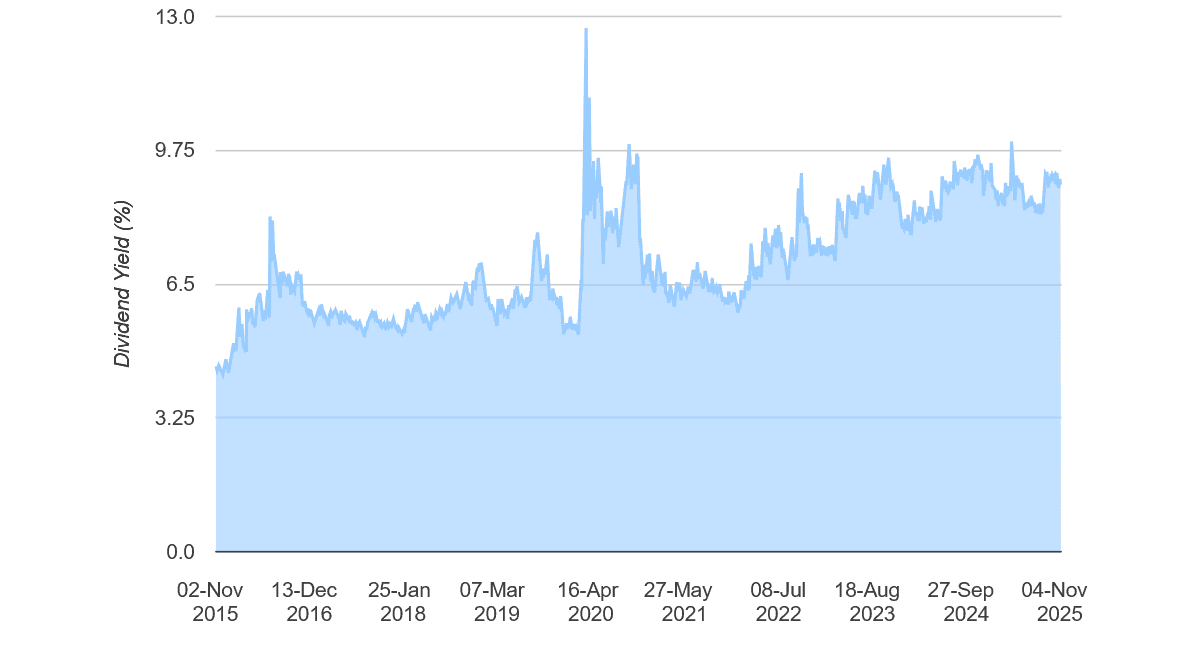

As a rule, sky-high dividend yields like this merit investor caution. However, Legal & General has made a habit of offering market-bashing dividend yields, as the chart below shows:

A strong balance sheet suggest this impressive record is set to continue. The firm’s Solvency II capital ratio remained well above 200% as of June.

Reflecting its robust financial base, the business has targeted steady dividend growth of 2% through to 2027. It’s also planning significant share buybacks over the period, staring with a £500m repurchase in 2025, up from £200m last year.

Huge rewards

So why is Legal & General’s share price so cheap? Worries about the economic landscape and rising inflation have caused its shares to backpedal in recent months.

With the company facing severe competitive pressures, too — and particularly in the pension risk transfer (PRT) market — concerns over sales and margins have grown.

Still, it’s my opinion that these threats are baked into Legal & General’s shares at current prices. And what’s more, I’m confident the business has what it takes to overcome these tough conditions. It’s on course to grow 2025 core operating earnings per share “at the higher end of our 6-9% range“, it said last month despite ongoing challenges.

Over the long term, I’m expecting the FTSE company’s profits to soar, as demographic changes drive demand for its retirement, protection, and wealth products. I think investors today could enjoy robust returns during the next decade.