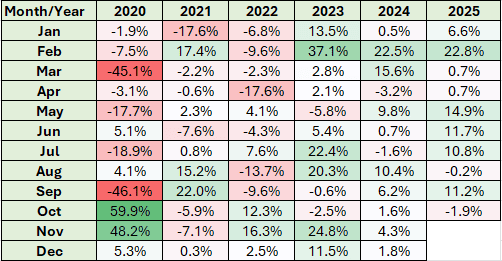

In October, the Rolls-Royce Holdings (LSE:RR.) share price fell 1.9%. At first glance, this seems pretty unremarkable. But when you consider this was only the seventh month-on-month fall since October 2022, it appears to have more significance.

During 30 of the past 37 months, the aerospace and defence group’s share price has gone up. At the end of September 2022, its shares were changing hands for 69.59p. Today (4 November), one would cost around £11.40. That’s an astonishing increase of 1,538%.

However, it’s now fallen during two of the past three months. Admittedly, not by very much. But this is the first time this has happened since October 2023. Could this be a sign that investor enthusiasm is starting to wane? Maybe an increasing number think there’s very little value left in the stock.

Let’s see.

A bit of number crunching

The most common method for valuing shares is to use the price-to-earnings (P/E) ratio. Based on its reported underlying earnings per share (EPS) for 2024 of 20.3p, Rolls-Royce has a P/E ratio of 56.2. This is expensive. For context, it’s over three times that of the FTSE 100.

But many investors look to the future when assessing value for money. Analysts reckon that the group will achieve EPS of 42.6p in 2028. If they’re right, the stock’s currently trading on 26.8 times future forecast profit, which is much more reasonable.

However, this is based on a forecast that’s looking way into the future. For 2025, the consensus is for EPS of 28.7p. This implies a multiple of just under 40.

Not cheap

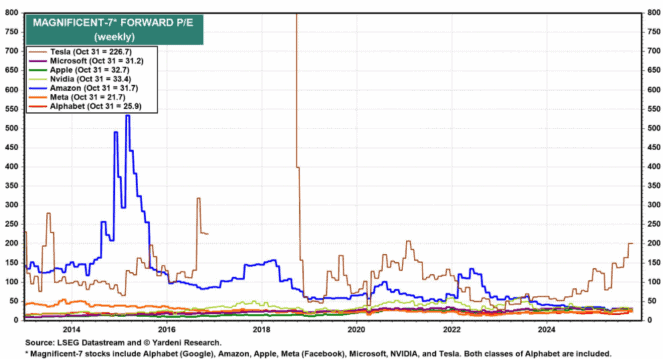

Leaving aside Tesla — which appears to write its own rules when it comes to stock market valuations — this is higher than those achieved by the Magnificent 7.

Whether Rolls-Royce deserves comparison with these tech giants is debateable. After all, I don’t think it’s a pure technology company. Also, the group looks even more expensive given that, generally speaking, US stocks command higher valuations.

And when a company’s stock trades at a generous multiple, there could be trouble if there’s evidence of a slowdown. An earnings miss is likely to be punished by investors.

Of concern, if Rolls-Royce was to produce a disappointing set of numbers, there’s no generous dividend to soften the blow. Based on amounts paid over the past 12 months, the stock’s presently yielding 0.9%. Although analysts are expecting the payout to rise to 14.7p by 2028, based on the current share price, it would imply a yield of just 1.3%.

Reasons to be positive

However, the group upgraded its earnings guidance in July. Large engine flying hours are now exceeding pre-pandemic levels, its defence division’s benefiting from a more uncertain world and its power systems business is growing on the back of more data centres being built.

And looking further ahead, the group’s prospects also appear healthy. It’s leading the UK’s move towards small modular reactors and it’s looking to return to the narrowbody aircraft engine market. Although the full impact of these will not be seen until the 2030s, I see no reason why they couldn’t become additional highly lucrative income streams for the group.

For these reasons, I shall continue to keep my Rolls-Royce shares and why other long-term investors could consider adding some to their own portfolios.