Passive income is typically defined as money earned with minimal ongoing effort. And the concept has plenty of high-profile backers. For example, Warren Buffett once said: “If you don’t find a way to make money while you sleep, you will work until you die”.

This sounds great in theory. But what’s the best way of making this happen?

My preferred approach

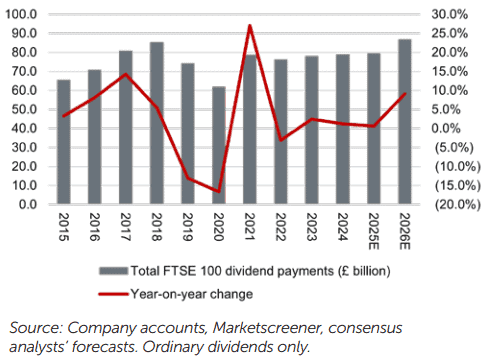

Personally, I like to invest in UK stocks and shares. Generally speaking, they have a reputation for paying the most generous dividends in the world. According to AJ Bell, members of the FTSE 100 are likely to return £79.4bn to shareholders in 2025.

Admittedly, there’s a bit of up front work required to identify the most appropriate income shares but then, other than keeping an eye on earnings releases and other stock exchange announcements, very little effort is needed.

To give some idea as to the level of return that’s currently on offer, I’ve identified five high-yielding stocks of companies that are operating in different industries. I believe spreading risk through diversification is essential for successful investing.

Based on amounts paid over the past 12 months, the five presently (31 October) offer a yield of 8.1%.

I would have to do further research to understand more about the pros and cons of investing in all of them. But the purpose of the list is to give some idea as to the potential level of return that might be on offer from domestic equities.

| Stock | Sector | Yield (%) |

|---|---|---|

| Legal & General | Financial services | 9.0 |

| Harbour Energy | Oil and gas | 9.0 |

| Taylor Wimpey | Construction | 8.8 |

| Mondi | Industrial products | 7.3 |

| Land Securities Group | Commercial property | 6.4 |

Solid prospects

When it comes to income, I like the look of Taylor Wimpey (LSE:TW.). The housebuilder has a policy of paying around 7.5% of net assets — subject to a minimum of £250m — in dividends each year. Based on the current number of shares in issue, this should lead to a payout of at least 7.06p in 2025, which is equivalent to a 6.7% yield.

However, the company is currently offering a better return. Although the industry has been in the doldrums since the pandemic, there are some signs that we are in the early stages of a recovery. The group hopes to build 4.3%-8.3% more homes (excluding joint ventures) in 2025 compared to 2024.

But there are some challenges. The UK’s finances are not in great shape and it’s widely expected that the Chancellor will increase taxes in this month’s Budget. This could squeeze incomes, dent consumer confidence, and damage the housing market. Also, persistent construction cost inflation remains an issue for the sector.

However, there remains a shortage of housing in the country and the government is trying to get legislation through Parliament which will streamline the planning process. Mortgage approvals are slowly increasing and if, as expected, interest rates start to fall over the coming months, borrowing should increase further. In addition, the group has very little debt on its books.

All this gives me confidence that Taylor Wimpey’s generous dividend can be supported. On this basis, I think the stock could be one to consider.

Wise words

Of course, all of the yields quoted cannot be guaranteed.

Earnings can be volatile, which means returns to shareholders can also fluctuate from one period to another. However, by choosing the stocks of companies with strong balance sheets and healthy potential earnings growth, I think it’s possible to mitigate — to some extent — against erratic payouts.