The FTSE 100 leading index of shares has risen an impressive 12% since 1 January. But such healthy gains have not been universal, and some top-quality UK shares have dropped sharply for a variety of factors.

I think these unloved FTSE 100 stocks could now prove great dip buys for long-term investors to consider. Here’s why.

Glencore

Glencore‘s (LSE:GLEN) share price has recovered ground in recent months, but remains down 6% since the start of 2025. Commodities prices (like copper) have picked up but risks remain as China’s manufacturing sector splutters.

Indeed, latest purchasing managers index (PMI) data showed factory activity still shrinking in September. It marks the most protracted slump since 2019.

Especially worrying for Glencore are the troubles in China’s steel industry. Strong steelmaking coal prices are essential to the miner‘s bottom line. Adjusted EBITDA slumped 14% in the first half as weakness endured.

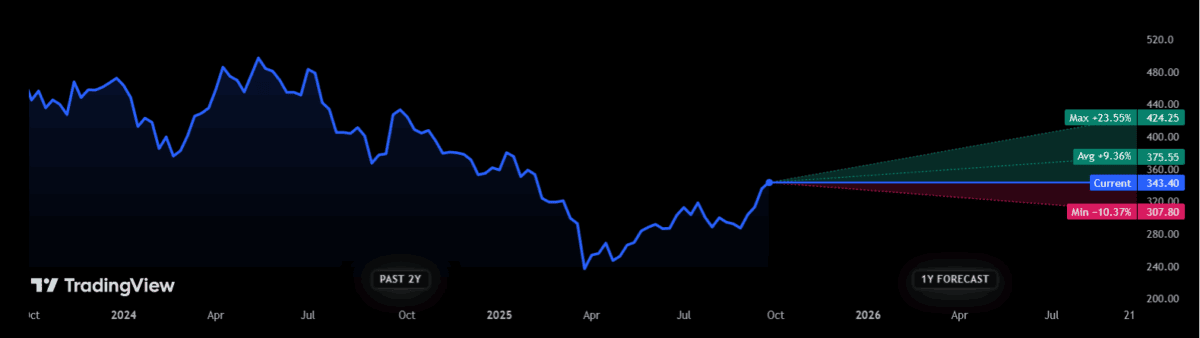

However, City analysts are confident Glencore’s shares will rebound over the next 12 months. Worsening supply shortages in key markets are helping offset weak demand and driving industrial metals higher.

With these troubles becoming more widespread, broker consensus suggests Glencore will rise 9% in value between now and next October, to 375.6p per share. Analysts are also hopeful further interest rate cuts from global central banks will revive commodities consumption.

Over the long term, Glencore has significant opportunities to grow profits thanks to the growing green and digital economies. Metals like copper, nickel, aluminium and cobalt play critical roles in industries like electric vehicles (EVs), renewable energy, consumer electronics and data centres.

The FTSE 100 company also has a sprawling marketing division to help it capitalise on these trends. Pleasingly, this unit also reduces Glencore’s reliance on its mining operations to drive earnings.

Barratt Redrow

Barratt Redrow (LSE:BTRW) shares have retraced 11% since the start of 2025 amid rising worries over the housing sector.

Returning inflationary pressures, and the impact on Bank of England interest rate policy, has seen the industry recovery moderating in recent months. So has enduring weakness in the domestic economy and a downturn in the jobs market.

Speculation that a new property tax may replace Stamp Duty is also hampering home sales. Latest HMRC data showed residential property transactions dipped 2% month on month in August.

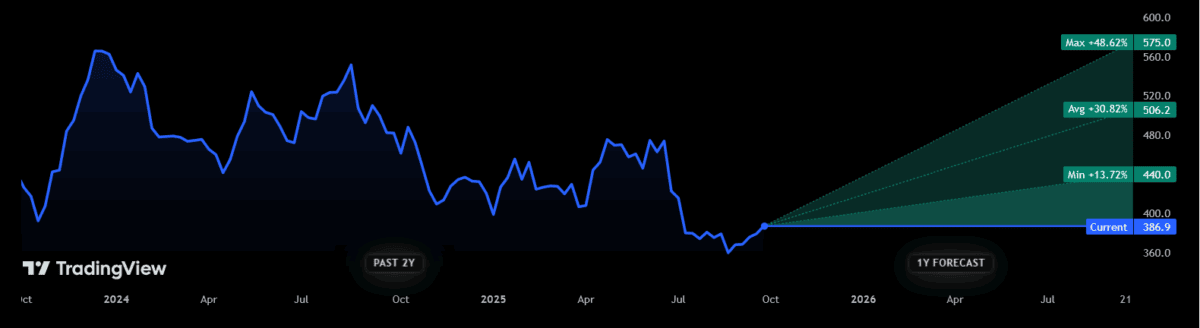

Yet City analysts are unanimous in their belief Barratt Redrow’s shares will stage a spectacular recovery. The average price target among them is 506.2p, representing a 31% premium from today’s levels.

Despite the current gloom among investors, there are reasons to be optimistic for Britain’s largest housebuilder. Private reservations rates are improving nicely — up 16.4% in the first half, at 0.64 per week. It is also benefitting from accelerating cost benefits following last year’s mega-merger, helping the enlarged business better weather current tough conditions.

I think Barratt shares could recover as optimism builds over its long-term earnings picture. Demand for homes looks set to grow strongly as the domestic population booms. Government plans to ease planning restrictions should make it easier for housebuilders like this to capitalise on this favourable backdrop.

For patient investors, I think picking up quality FTSE 100 shares Glencore and Barratt is worth serious thought.