For well over a decade, Legal & General (LSE:LGEN) shares have proven a solid stock to buy for investors seeking a passive income.

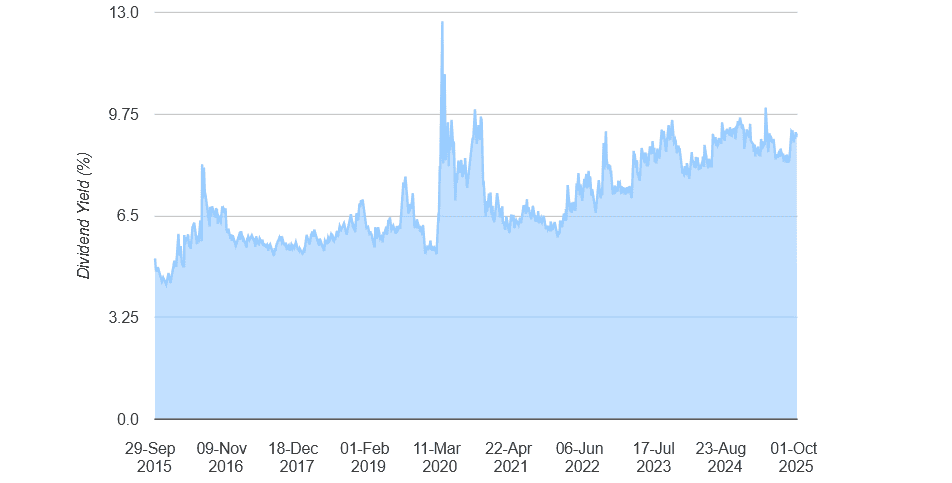

Since 2015, dividends have grown at an average compound annual growth of 6.2%. And as the graphic below shows, dividend yields at the financial services giant have also been enormous over the period. To give them context, the long-term Footsie average yield sits back at 3%-4%.

Legal & General’s impressive dividend record is supported by its rich cash flows and strong dividend culture. But amid an uncertain economic landscape, can the company keep its generous payout policy alive?

Slower growth, large yields

While broker projections aren’t set in stone, it’s of course a good idea to see what the City’s forecasting. Here, things are looking promising:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 21.79p | 2% | 9.2% |

| 2026 | 22.23p | 2% | 9.4% |

| 2027 | 22.71p | 2.2% | 9.6% |

The first thing you’ll see is dividends are tipped to keep growing over the medium term, albeit at a slower pace than in previous years.

This is in line with the company’s current capital distribution policy. Under plans introduced in 2024, future dividend growth will be pegged at a lower rate of 2%, but with share buybacks helping to supplement cash returns.

As a consequence, dividend growth may trail the rate of inflation, meaning the real-world value of payouts could fall. Yet with yields still above 9% and growing over the period, the stock may still remain a compelling one for dividend investors.

Cash machine

As I say, dividends are never guaranteed though. So let’s see how robust these forecasts are.

On our first measure — dividend cover — these estimates are looking a little flaky. This metric gauges how well predicted rewards are covered by expected earnings, for which a reading of 2 times and above is desirable.

With Legal & General shares, this year’s expected dividend per share is actually higher than predicted earnings per share (20.78p). Things improve thereafter, but dividend cover’s modest at 1.1 and 1.2 for 2026 and 2027 respectively.

That’s clearly not great. But it’s certainly not a reason to panic, in my view. Sub-par coverage has long been a feature of this particular FTSE 100 stock, yet — thanks to its rock-solid balance sheet — this hasn’t prevented the delivery of large and growing dividends over the past 10 years.

Legal & General’s remains cash rich today too. So I’m optimistic it can at least meet those dividends City brokers are expecting. The firm’s Solvency II capital ratio was 217% as of June.

Is Legal & General a buy?

Legal & General, in my view, remains one of the hottest passive income shares to consider today. There’s a good reason it’s currently the largest single holding in my own portfolio.

Yet investors need to consider the risks of owning the share. Despite still paying large dividends, Legal & General’s share price continues to struggle. It’s up just 2% in the year to date, meaning investors could have still got better total returns elsewhere.

This could remain so if economic conditions are tough. But over the long term, I’m confident it will deliver impressive capital gains alongside further market-beating dividends, supported by strong growth in its retirement, insurance and asset management markets.