After the latest rally, a lot of investors are looking at the stock market and working out what to do if prices start falling again. But I think there’s another possibility they need to make plans for.

Valuations might be relatively high, but that doesn’t mean a crash is on the way. So I’m still looking for buying opportunities even as stocks keep moving higher.

Valuation

There’s no question that valuations are high at the moment. Both the FTSE 100 (17) and the S&P 500 (27) trade at unusually high price-to-earnings (P/E) multiples.

| DATE | FTSE 100 P/E RATIO | S&P 500 P/E RATIO |

|---|---|---|

| 30 Jun 2025 | 12.91 | 29.06 |

| 31 Dec 2024 | 12.85 | 28.16 |

| 30 Jun 2024 | 14.46 | 28.08 |

| 31 Dec 2023 | 10.51 | 25.01 |

| 30 Jun 2023 | 10.85 | 24.76 |

| 31 Dec 2022 | 13.88 | 22.82 |

| 30 Jun 2022 | 15.34 | 20.53 |

| 31 Dec 2021 | 17.10 | 23.11 |

By itself however, this isn’t a sign that the stock market’s going to crash immediately, or even soon. There’s no rule saying stocks can’t trade at elevated multiples – they’re doing it right now.

It does mean investors have to be a little careful about what to buy. Share prices are reflecting some optimistic assumptions about future growth and these need to materialise.

At times like this, I think it’s worth taking a more detailed look at individual stocks. While shares collectively have been doing well, some companies still trade at attractive-looking valuations.

The S&P 500

While the S&P 500’s up 27% from its April lows, the rally’s mostly been led by some of its biggest names, especially in the tech sector. These have pulled the index as a whole higher.

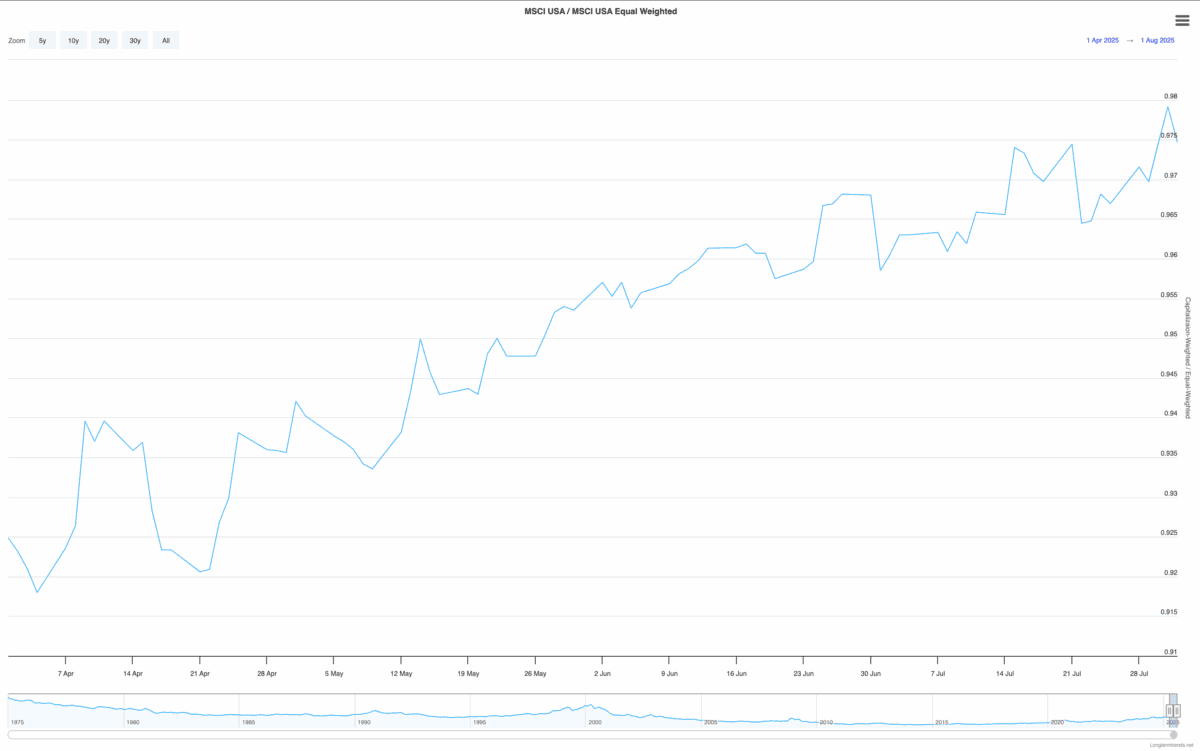

One way of illustrating this is by comparing the market-cap-weighted version of the index with an equal-weighted version. The ratio between the two has expanded significantly since April.

Source: Longtermtrends

As a result, I think the place to look right now in terms of US stocks is among the smaller companies. These are the shares that seem to have the most to gain if the stock market rally continues.

Underperforming sectors recently have included energy and consumer staples. But it’s a stock in the healthcare space that has been catching my attention recently.

Growth stocks

Danaher‘s (NYSE:DHR) a stock I’ve got my eye on. Demand for bioprocessing supplies have faltered since the pandemic and sales have also faltered, leading the stock to decline 27% in the last year.

The current US administration is openly sceptical about the pharmaceutical industry and this is an ongoing risk for the company. But there are clear signs a recovery might be on the horizon.

Danaher’s guiding for revenues to start growing again in 2025. And while this is modest at around 3%, the firm’s looking for margin expansion to push earnings up at a higher rate.

The falling share price means the stock currently trades at unusually low multiples of sales and earnings. And this means I think there’s room for these to expand, giving it an extra boost.

Stock market outlook

I think if the stock market’s going to continue its recent run, it’s going to be driven by some of the shares that have been underperforming lately. And Danaher’s one example.

The company has been facing some temporary difficulties, but these might be coming to an end and its long-term prospects have put it on my buying radar.