I think investing in UK dividend stocks is the best way for me to source a passive income. Here are three key principles I’ve personally adopted to make the most of this opportunity.

1. Eliminate taxes

The first task on my investing journey was to open a Stocks and Shares ISA. After this, I also opened a Self-Invested Personal Pension (SIPP) to hold my share investments.

Both of these products protect individuals from both capital gains tax and dividend income. These products provide me with a total annual allowance of £20,000 (the ISA) and a sum equivalent to my annual pay, up to £60,000 (the SIPP).

Given the steady rise in dividend tax, these tax-efficient products offer significant advantages. Today, investors can receive just £500 in dividends outside one of these products before they pay tax. That’s down from £2,000 just two years ago.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

2. Diversify for strength

With my accounts set up, I set about building a portfolio spanning a wide variety of regions, industries, and sub-sectors. It took time, but today my ISA and SIPP collectively hold around 25 different shares, trusts, and funds.

Some of my key holdings are Aviva, Coca-Cola HBC, Taylor Wimpey, HSBC, and Primary Health Properties. As you can see, these companies operate in very different sectors, helping my portfolio weather specific shocks and still deliver a solid passive income across the economic cycle.

3. Don’t just focus on yield

It’s tempting to focus on dividend yield when searching for passive income stocks. This can be a massive mistake, as high yields today can be unsustainable over time.

For this reason, I choose companies with strong payout records and ideally a rising dividend over time. I’m searching for businesses with respectable payout ratios, strong balance sheets, diverse revenues streams, and market-leading positions. Ultimately, it’s about seeking quality companies that can deliver reliable dividends through thick and thin.

Legal & General (LSE:LGEN) is one such share that ticks each of these boxes. I wasn’t just pulled in by its large yield, although it’s forward reading of 8.5% is clearly a major attraction!

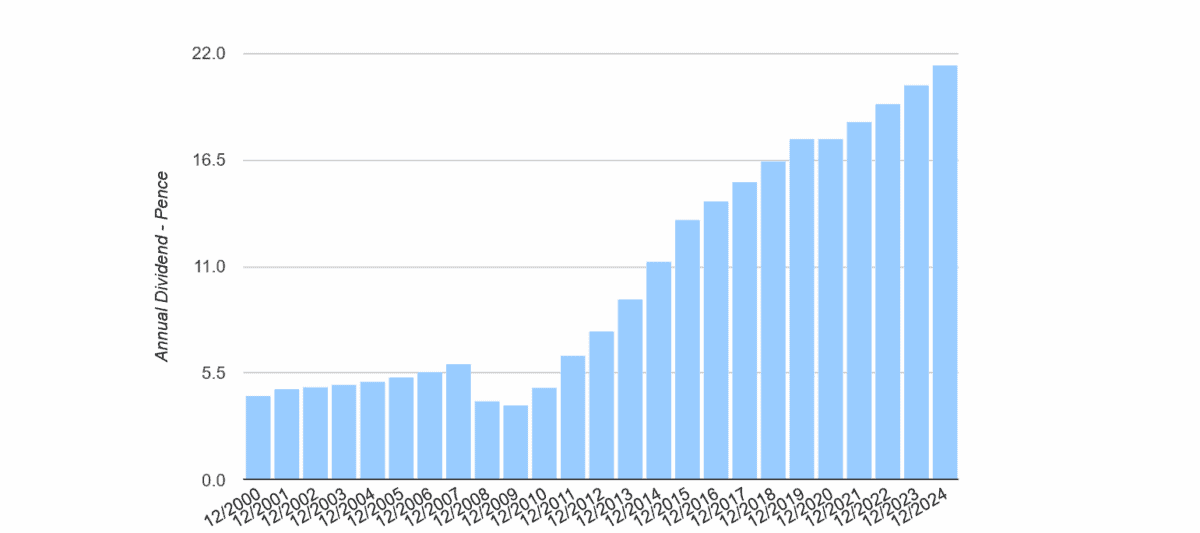

The FTSE 100 company has raised dividends every year since 2010. The only exception came in 2020, when pandemic uncertainty caused it to freeze the full-year payout.

Legal & General has plenty of weapons in its locker that makes it a true dividend hero. One of these is its formidable cash generation — today it’s Solvency II capital ratio is 232%, a sector high.

The firm’s awesome cash flows are supported by its wide geographic footprint and broad range of financial services — it’s a big player in protection, savings, asset management, and retirement solutions. This diversity leaves it well placed to weather weakness in specific regions or product lines, and to keep paying a large and growing dividend.

Of course, its operations are cyclical so profits are exposed to a global slowdowns. This could have impact on its share price, though I’m confident it shouldn’t affect the firm’s progressive dividend policy.

City analysts share my optimism. And so the dividend yield on Legal & General shares rises to an incredible 8.7% for next year, and 9% for 2027.