How large would a Stocks and Shares ISA need to be to generate a £3,000 second income each month? If invested in 6%-yielding assets (like dividend shares, bonds and investment trusts), the figure comes out at £600,000.

The calculation’s simple: a second income of £3,000 a month works out at £36,000 a year which, when divided by a 6% yield, gives a figure of £600,000. Thanks to the ISA’s tax benefits, an investor doesn’t have to pay a single penny from their portfolio to the taxman.

That £600k may look like a substantial sum of money. And to be fair, it is. But thanks to two key forces — the power of compound returns, and the enormous growth potential of the global stock market — hitting this magic number is more than achievable over time.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building a £600k ISA

According to Shepherds Friendly, the average Briton invests £514 a month. At this level, someone who uses this to invest in an ISA over a couple of decades could realistically target a £3k second income.

Let’s say we have an investor who achieves an impressive average annual return of 11.2%. That rate of return matches the performance of the MSCI World Index — which tracks the performance of 1,325 global shares — over the past decade.

Excluding trading fees, stamp duty and other costs, our investor would have turned a £514 monthly investment into £602,842 in just over 22 years. That would comprise total deposits of £137,238, and more than £465,604 in compound returns, with dividends reinvested.

Trust exercise

Investing in the stock market can be unpredictable. But over the long term, it’s consistently (and often handsomely) rewarded patient investors.

Investors can also smooth out temporary volatility and manage risk by purchasing investment trusts and/or exchange-traded funds (ETFs). These diversified instruments can hold a wide range of assets, allowing a smooth return across the economic cycle.

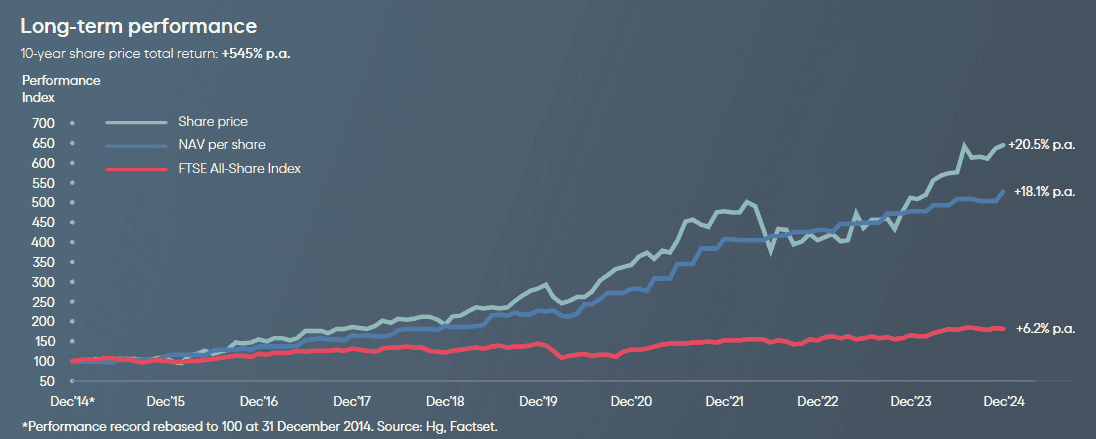

Take the HgCapital Trust (LSE:HGT) as an example. Delivering an average annual return of 20.5% between 2014 and last year, this product could be a great trust for our investor targeting that £3k passive income to consider. But remember, past performance isn’t always a reliable guide to future returns.

With net assets of £2.4bn, the trust’s focused on fast-growing software and services businesses that aren’t listed on stock exchanges. These include the likes of Visma, whose software is used for functions like payroll, procurement and accounting, and Howden, which is the largest insurance intermediary outside of the US.

In total, HgCapital has holdings in more than 50 companies. Though it’s still vulnerable to economic downturns, its diversification by end market and geography helps spread risk and deliver impressive results. On a trailing 12-month basis, its portfolio has delivered sales and EBITDA growth of 20% and 21% respectively.

Building a passive income of £3k a month with an ISA isn’t simple. But with proper research, regular investing and patience, it’s totally achievable.