The Self-Invested Personal Pension (SIPP) is an excellent vehicle for building wealth. But many Britons don’t realise they can open a SIPP at any age. In other words, you can start a pension for your children as soon as they’re born. This gives the money a huge amount of time to compound into something much larger.

Now what I’m talking about today is similar to what’s been recently touted as ‘Trump Accounts’ in the US, although this was proposed as a ‘baby bond’ in 2020 by Senator Cory Booker.

The idea is that when a child is born, they’d receive $1,000 to be placed in a stock market tracker on their behalf. Over the years, this would grow into a nest egg, maybe helping them buy a house or maybe aiding a safer path to retirement.

What we did

Back to the topic. When our daughter was born, we opened a SIPP for her and started contributing the maximum £3,600 a year — including the tax allowance. We hope to do this for as long as we can.

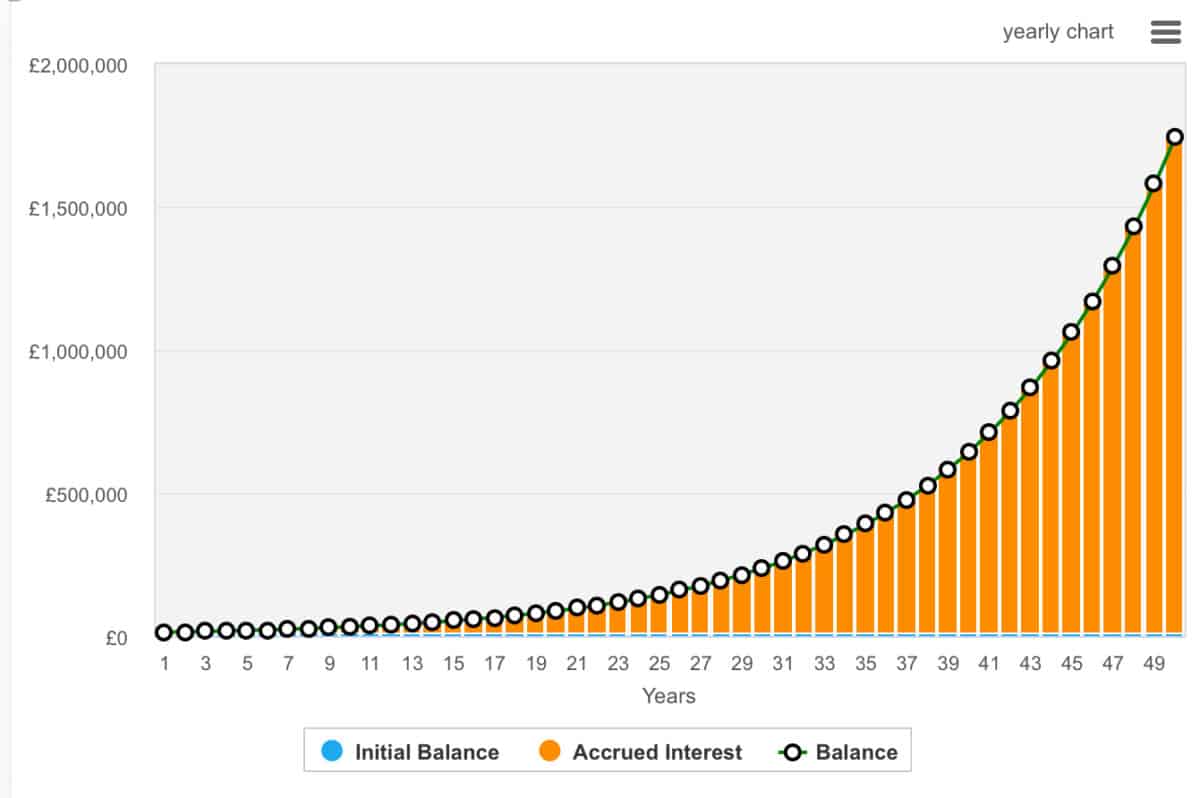

However, I appreciate not everyone will be able to do this. But what they may consider doing is contributing for just the first three years. Assuming there’s some growth over the first few years, that portfolio could be worth around £12,000 when the child turns three.

From here, that £12,000 could balloon during their lifetime. In fact, assuming an annualised return of 10%, which is below the S&P 500 long-term average but may prove challenging to achieve for some novice investors, this SIPP could hit £1.74m by the time they turn 53. A lower return percentage will generate less money but should still be a healthy nest egg.

This is a huge figure when we remember that this doesn’t include any contributions they will make during their working life. For context, this is roughly the same amount of money someone would have in a SIPP if they contributed £300 a month from the age of 20 through to 60 with a 10% annualised return.

Long story short, compounding can change lives.

Where to invest?

My daughter’s SIPP is more focused on funds and investment trusts. Meanwhile, our ISA typically contain around 20-30 stocks, with a small holding of trusts and funds.

One stock that’s present in her SIPP is Berkshire Hathaway (NYSE:BRK.B). Under billionaire investor Warren Buffett’s guidance, it has consistently delivered long-term value by acquiring high-quality businesses and maintaining a diverse portfolio. This diversity spans insurance, transportation, and well-known brands such as GEICO and Dairy Queen.

Its vast cash reserves provide resilience and flexibility in volatile markets, enabling opportunistic acquisitions. The company’s strategy emphasises reinvestment of earnings and a conservative approach to debt, fostering sustained growth and stability.

However, one risk lies in succession. The near-eventual retirement of Buffett and potential management changes could impact Berkshire’s unique culture and investment performance. Despite this, I still believe it’s worthy of consideration for long run investors.