For years, I was a little bit narked that I didn’t hold Fundsmith Equity in my Stocks and Shares ISA. The quality-focused fund managed by Terry Smith regularly trounced the market, leaving me tempted to invest in it just to get rid of the self-guilt. Yet I never did.

In recent years though, Fundsmith has been underperforming the market. Consequently, investors have been pulling money out of it over the past 12 months.

Should I go against the crowd and invest today? Here’s my view.

Keeping it simple

Fundsmith’s three-step investing philosophy is famously very simple: “Buy good companies, don’t overpay, do nothing.”

In theory, there’s no reason why this formula shouldn’t beat the market long term, assuming the stock selection is sound. Looking at the top of the portfolio, I see names like Meta Platforms, Microsoft, Visa, and IDEXX Laboratories. Those look very sound to me.

Meanwhile, some of the fund’s founding principles — such as avoiding market timing and short-term trading — chime with my own long-term investing approach. On this basis, I would feel comfortable investing in Fundsmith.

Worrying trend

Last year, it gained 8.9% versus 20.8% for the MSCI World Index. While beating the market every single year is not realistic — and not holding Nvidia certainly didn’t help — I still found 2024’s relative underperformance disappointing.

As we can see below, Fundsmith hasn’t beaten the index since 2020, and it lost 1.9% over the six months to 30 June this year.

The long-term outperformance since inception in 2010 is still intact, but it’s a worrying trend.

Nauseating Nordisk

Smith blamed the recent half-year result on Novo Nordisk (NYSE: NVO) and a weak dollar: “Novo Nordisk alone accounted for almost all the underperformance during the period. Its ability to snatch defeat from the jaws of victory in respect of its leadership in weight loss drugs continues to be remarkable.”

As a fellow Novo Nordisk shareholder, I share his exasperation. Shares of the Danish pharma giant are down 51% over the past year.

Novo makes Wegovy, the blockbuster weight-loss drug. It recently launched in India, where it’s reportedly selling like crazy.

In theory (that dangerous phrase again), this should be a golden age for the stock.

Instead, investors are focused on the competitive threat from rival Eli Lilly, which makes Mounjaro. Trials show that it strips more weight than Wegovy, meaning Novo risks losing share in this lucrative global market. The firm has already fired its CEO.

Stepping back, Novo stock looks great value at 16.7 times forward earnings. So investors might want to consider it as a cheap way to invest in the weight-loss drug market (which I doubt will be dominated solely by Eli Lilly).

Will I buy Fundsmith?

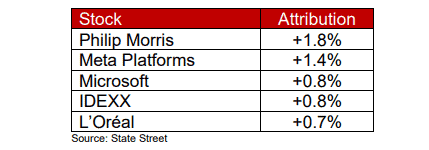

Referencing the fund’s five biggest positive contributors in the first half, Smith quipped: “We continue to make money with old friends.” Though it should be noted that Novo is — or perhaps was — an old friend too.

Fundsmith aims to “produce a high likelihood of a satisfactory return rather than the chance of a spectacular return which could be spectacularly good or spectacularly bad.”

Picking stocks for my ISA portfolio is delivering a very satisfactory for me. Weighing things up, I will continue with this strategy rather than outsource it to Fundsmith.