This exchange-traded fund (ETF) has delivered substantially higher returns than the FTSE 100 and the S&P 500 over the past year. And I think it can continue outperforming major global share indexes.

Here’s why.

Race for gold

Up 43% over the last year, the L&G Gold Mining ETF (LSE:AUCP) has been swept higher by the surging precious metal price. While down from April’s record high above $3,500 per ounce, I’m confident gold will stride to new peaks as geopolitical and macroeconomic tensions grow.

It should also receive support from a falling US dollar, which endured its worst six month period since 1973 between January and June.

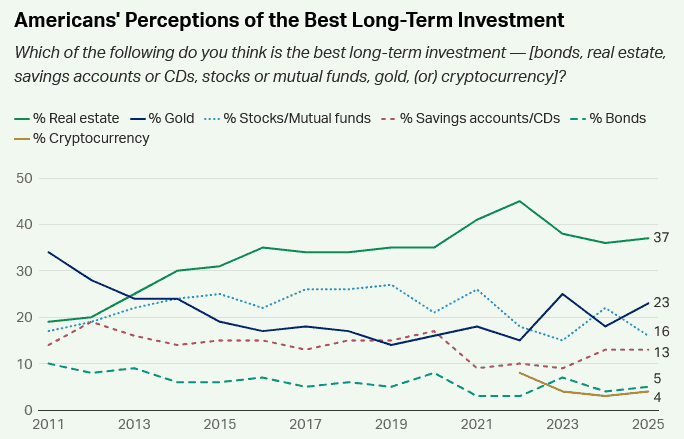

Retail and institutional demand for gold has exploded as investors have sought safe-haven assets. As the following Gallup poll shows, gold is now considered a better long-term investment than shares among US investors, for instance. Personally, I’m still buying shares, but a gold stock feels like it might be the best of both worlds!

At the same time, bullion demand from the world’s central banks is also steadily increasing. These institutions bought a further 20 tonnes of yellow metal in May, according to the World Gold Council (WGC).

Leveraged play

Getting back to that L&G fund, it provides a way to capitalise on rising prices by holding shares in 38 gold mining companies. These include industry heavyweights like Agnico Eagle and Newmont Mining, alongside smaller operators in the exploration or early production stages.

In theory, such companies have significantly more long-term growth potential, although they also carry greater risk of failure.

The advantage of owning a gold miner ETF like this is that investors can turbocharge their returns when metal prices rise. This is because they offer leveraged exposure — a miner’s earnings may increase more rapidly than the gold price, as their costs stay relatively fixed while their revenue rises. Consequently, their share prices can rocket.

Another perk is that the fund receives dividends from a number of of the companies it owns. It then reinvests this to achieve further growth. Conversely, gold bars, coins, or price-tracking funds don’t provide income to their holders.

A top fund

The disadvantage of funds like this, however, is that the leveraged aspect can backfire when gold prices drop.

This isn’t the only potential problem either. Indirectly holding mining shares exposes investors to production risks, unlike physical metal or gold price ETFs. Operational issues can reduce company profits, causing the fund to underperform even when gold appreciates.

But on the plus side, the fund’s diversification across dozens of miners may substantially the impact of such problems on overall returns.

Furthermore, almost 70% of the fund is invested in its top 10 holdings, which are predominantly large-cap miners. Companies like this are in a strong position to absorb operational setbacks, providing the fund with added stability.

While not without risks, I think this gold fund is worth serious consideration in the current climate.