Looking for ways to manage risk but still target mammoth long-term returns? Here are three investment trusts from the FTSE 250 I think deserve a closer look.

Handy Murray

As its name implies, the Murray Income Trust (LSE:MUT) is a true hero for investors seeking a large and growing passive income. And today it can be picked up at very low cost.

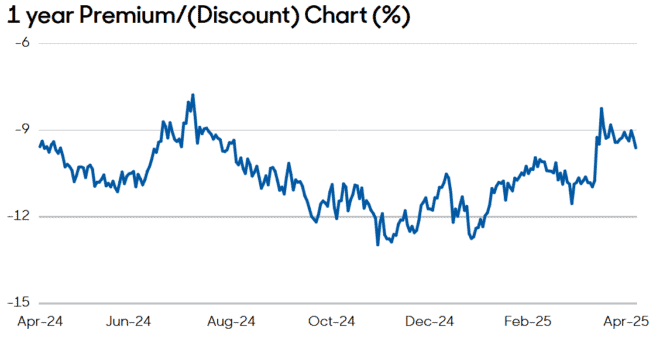

At 854p per share, it trades at a 9.6% discount to its net asset value (NAV) per share:

Dividends at Murray Income have grown for 51 consecutive years. But unlike some of the UK’s dividend growth trusts, the yields here are far from disappointing. For this year it sits at 4.8%, far ahead of the FTSE 100‘s 3.4% average.

It’s able to do this thanks to a focus on a range of income-paying UK blue chip shares. Prominent holdings include Unilever, RELX, AstraZeneca and National Grid.

This cross-sector exposure provides added strength, though remember that its focus on British stocks creates regional risk. Murray Income’s delivered an average annual return of 4.9% since 2015.

Take it to the bank

At 116.4p per share, the Bankers Investment Trust (LSE:BNKR) trades at a 9.5% discount to its estimated NAV per share. For investors seeking to effectively diversify their holdings, I think it’s worth serious consideration.

In total, this investment trust has holdings in 101 different companies spanning the globe. As you can see below, it’s pretty well diversified by sector and geography, although a large weighting of US tech stocks provides it with enormous growth potential as the digital economy booms:

According to its website, Bankers Investment Trust is set up “to achieve capital growth in excess of the FTSE World Index and dividend growth greater than… the UK Consumer Prices Index.” It’s done a pretty good job of this, with dividends rising for 58 years on the spin.

Total annual returns here have averaged 7.9% since 2015. While an economic slowdown could impact its tech holdings, I think it’s still a great trust to consider, and especially at today’s prices.

Rock solid

Investing in the BlackRock World Mining Trust (LSE:BRWM) carries more risk today. As the name implies, 100% of its holdings operate in the cyclical world of commodities production.

Not only this, but the industry it’s focused on is prone to significant unpredictability. Disappointments can be common at the exploration, mine construction and production phases, meaning sales and cost projections can fluctuate wildly.

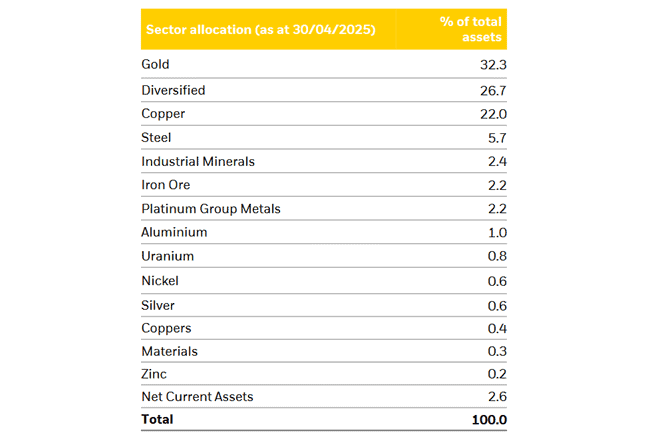

But with holdings in more than 60 different mining companies — including diversified heayweights Rio Tinto, BHP and Glencore — it effectively spreads this risk out. Its wide wingspan also provides protection from localised issues in specific commodity markets and countries (almost 60% of its holdings operate across the world):

At 517p per share, the BlackRock World Mining Trust trades at a 6.5% discount to its NAV per share. Delivering an average annual return of 9.8% since 2015, I think it’s worth a serious look today.