Driven by the fast-paced tech revolution, Scottish Mortgage Investment Trust (LSE:SMT) shares have delivered a FTSE 100-beating return over the past decade.

There’s been bumps along the way, but the technology trust’s shares have risen from 267.5p per share in early May 2015 to 943p today. This means someone who bought £10,000 of Scottish Mortgage shares back then would have seen the value of their investment balloon to £35,248.

Dividend income hasn’t been formidable in that time, as you’d maybe expect from a trust focused on growth stocks.

However, adding in total dividends of 33.91p per Scottish Mortgage share, the total return on a £10k investment improves by more than £1,000, to £36,515 (or 265%).

To put that into context, the broader FTSE 100 has delivered an annual return closer to 85% in that time. But can Scottish Mortgage shares continue to outperform, and should I buy the trust for my portfolio?

The bull case

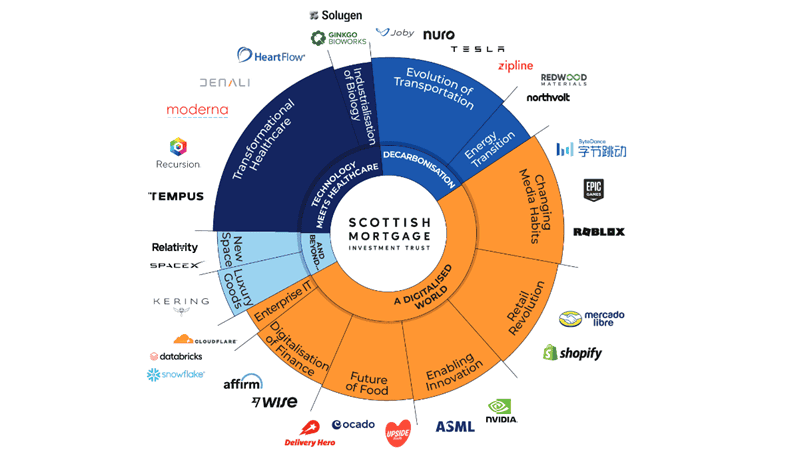

With a focus on US tech shares, the trust’s been able to harness a multitude of major tech trends of the last decade. The explosion of social media, e-commerce, cloud computing, smartphones and electric vehicles are just a few such phenomena that have driven returns.

Many of these trends have further scope to grow over the next 10 years too. Additionally, other early-stage technologies like quantum computing, autonomous cars, augmented reality and generative artificial intelligence (AI) are also tipped for take-off.

Scottish Mortgage invests in innovative market leaders like Nvidia, Amazon, Tesla and Meta for both targeted and diversified ways to capitalise on these. But this is only half the story, as the trust also holds a high proportion of smaller private businesses which have particularly substantial growth potential.

Around 27% of the trust is tied up in private tech companies that investors may not otherwise be able to gain exposure to. These include SpaceX, ByteDance, Databricks, Stripe and Epic Games, which form 10 of the world’s most valuable ‘unicorns’ (private start-ups valued at $1bn or more).

With more than 96 holdings, Scottish Mortgage has excellent growth potential while simultaneously allowing investors to diversify to spread risks.

Should investors consider the shares?

That said, investing in the trust isn’t without its dangers. In the short term, returns could disappoint if economic conditions worsen, prompting investors to dump tech-based shares and trusts.

Longer term threats include rising competition for US tech shares from Chinese disruptors, and punishing global trade tariffs that damage sales and inflate costs. But in my view, the potential benefits of owning Scottish Mortgage shares outweighs these hazards.

What’s more, at current prices, it trades at a discount of roughly 8% to its net asset value (NAV) per share. All things considered, I think this FTSE 100 growth share is worth serious consideration in May.