Whatever you think about Tesla (NASDAQ: TSLA), this is a stock about which there seems to be no shortage of opinions.

Just looking at the share price chart already gives an indication of the wild swings in sentiment we have seen about Tesla in the stock market at different points.

It is down 36% since the start of the year. That is a big fall for any company, let alone one that – even after the fall – commands a market capitalisation of over $800bn.

Despite that, the share is still up by over 50% in the past year alone. Over five years, things look even better: shareholders over that period are now sitting on a 437% gain.

Tesla seems to confuse many investors

So, what is going on here?

Some of the movement reflects Tesla’s almost meme-like qualities for a company of its size, with lots of investors taking a strong view based on factors like their opinion of its chief executive.

But most meme stocks have a market capitalisation of a few billion dollars at most. I think there is something very different going on when it comes to Tesla stock: even many sophisticated investors are genuinely confused about how to value it.

Is it a car maker with attractive profit margins in recent years, now seeing sales volumes level out?

In that case, even adding in some extra value for its fast-growing power generation business, the current market capitalisation looks loopy to me. It is 20 times the market cap of Ford, for example.

Or, is Tesla really an investment case about a proven ability to innovate and disrupt massive industries, as it has already done with cars and may yet do with taxis and robotics? In that case, I see an argument for Tesla potentially being a long-term bargain at the current price.

Investing on facts, not hope

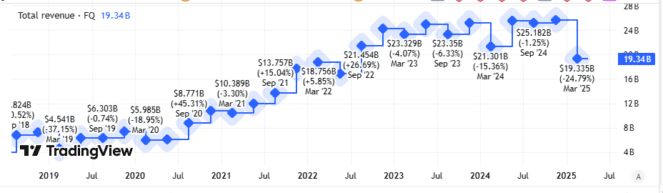

Tesla has done a very impressive job when it comes to business growth. Revenue has soared in recent years. Broken down into a quarterly revenue number, though, and as the chart below shows, there is clear cause for concern for Tesla investors right now.

Created using TradingView

This week, the company announced a woeful first quarter as the company fights fires on multiple fronts. Not only has it seen falling sales, but profits slumped too. The first quarter saw revenues fall by a fifth compared to the same period last year.

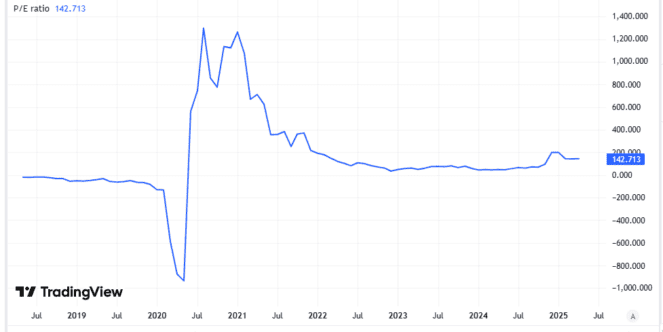

Meanwhile, earnings per share (on a Generally Accepted Accounting Principles basis) fell 71% compared to the same quarter last year. Already, Tesla’s price-to-earnings (P/E) ratio of 143 looks far too high for me to consider investing. But if earnings fall, the valuation will look even less attractive.

Created using TradingView

I do see hope for the non-automotive business. Energy generation and storage revenue surged 67% year on year in the first quarter. But it still represents only around 15% of total revenue.

For now, at least, power generation and pipeline projects like automated taxis look too unproven to justify the current Tesla valuation. With rising competition, the vehicle business also looks overvalued to me.

Taken together, based on current facts not future hopes, I see Tesla stock as overvalued and will not be investing.