The past decade has been one of extreme lows and stunning highs for Rolls-Royce (LSE:RR.) shares.

Chronic operational issues dogged the engineer during the first five years of the period. Then profits dived as the Covid-19 crisis grounded the world’s airline fleet, driving Rolls’ share price as low as 34.59p.

But significant fundraising, a widescale restructuring programme, and a stronger-than-expected travel sector recovery have since blasted Rolls shares from those troughs.

All this means that, at 717.2p as I write, the shares are 114.6% more expensive than they were 10 years ago. So £10,000 worth of the FTSE 100 company’s shares bought back then are now worth £21,455.

That’s a pretty tasty profit, I’m sure you’d agree. And if you factor in dividends during the time, someone who invested £10k a decade ago would have £23,554 to show for it.

That amounts to a decent 135.5% total shareholder return, and an 8.93% annual average one. By comparison, the broader Footsie’s delivered an average yearly return of 6.4% over that time.

But what’s next for Rolls-Royce shares? And should investors consider buying the engineering giant today?

Back through 800p?

The outlook’s become murkier for cyclical shares like engineers amid the threat of a widescale trade war. Since hitting peaks of 818p in mid-March, Rolls-Royce shares have fallen on concerns over weakening end markets and supply problems.

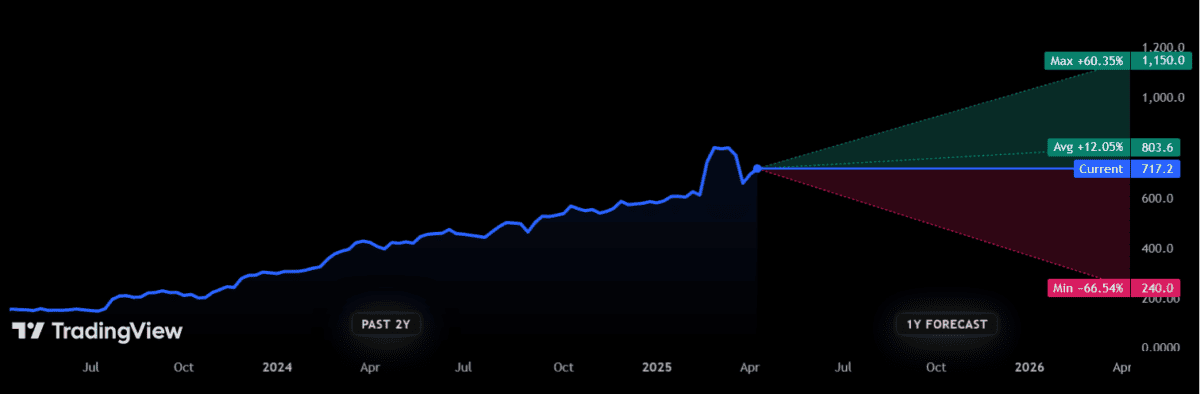

Yet broadly speaking, City analysts believe the shares will rebound close to those record highs in the next 12 months. The 16 analysts with ratings on Rolls believe its share price will rise to 803.6p, up around 12.1% from today’s levels.

As you can see from the chart above, however, there are some significant variations among forecasts. Indeed, the difference between the most bullish and the least optimistic estimates is a whopping 910p with maximum expectations of it being above 1,100p and minimum plunging to below 250p.

That’s a pretty huge gulf considering Rolls’ current share price is closer to 700p.

So what next?

On the plus side, chief executive Tufan Erginbilgiç’s plan to “transform Rolls-Royce into a high-performing, competitive, resilient, and growing business” has plenty left in the tank. Performance has improved across the group, and in February the firm upgraded its medium-term profit, margin and free cash flow targets.

Earnings goals are helped by a strong outlook for the global defence market. Around a quarter of sales come from military customers, and I’m expecting them to continue rising as NATO nations embark on rapid rearmament.

But there’s also big risks to Rolls’ profits and its shares. Signs of cooling have emerged in the civil aviation market more recently, which may threaten demand for the company’s aftermarket services. Things could get especially difficult if, as many have tipped, fresh rounds of trade tariffs sap economic growth.

The engineer also faces gigantic cost rises and potential supply chain disruptions if a full-blown trade war happens.

Given these challenges, I’m not convinced that Rolls shares will rise as sharply as brokers currently suggest. And given the company’s high price-to-earnings (P/E) ratio of 30.3 times, I’m not tempted to open a position in the company. I think this lofty valuation could cause a share price to slump if current challenges worsen.