After years of barnstorming growth, the S&P 500 has hit one of its occasional sticky patches. Uncertainty around a potential global trade war and the direction of the US economy has led to a 7.3% decline in the index in just over a month.

For long-term investors though, this might simply mean cheaper prices for high-quality stocks. Here are two that could prove to have been bargains a few years down the road.

Uber

Speaking of roads, I think ridesharing giant Uber Technologies (NYSE: UBER) stock is worth considering. It’s down 13.3% since mid-October.

While Uber is no spring chicken these days, the company continues to grow very strongly. In 2024, revenue jumped 18% year on year to $44bn, and the firm ended December with 171m monthly active platform customers.

More importantly, Uber is now very profitable, which de-risks the investment case. It reported $2.8bn in operating profit last year, a vast improvement from the cash-incinerating days of yore.

Current projections indicate that Uber’s operating profit will surpass $10bn by the end of 2027!

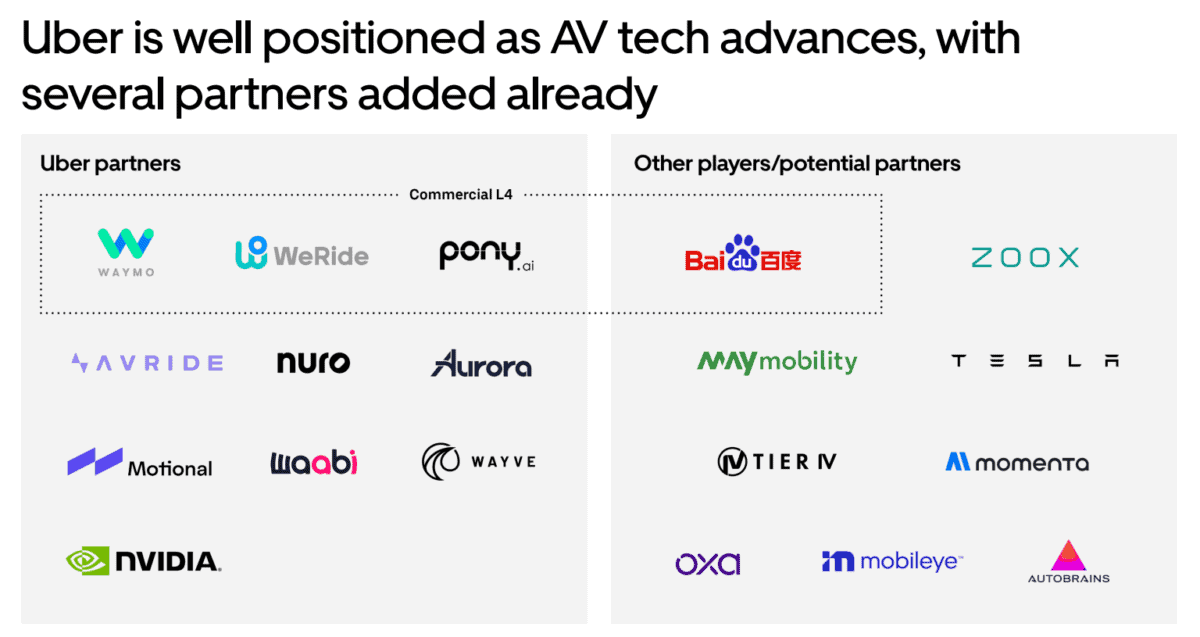

One risk here though is the rise of robotaxis. If Alphabet‘s Waymo or Tesla manage to scale their own consumer apps, that could hurt Uber’s growth trajectory and could even disrupt its business.

That said, there are lots of firms working on autonomy now. I find it unlikely that consumers will want multiple robotaxi apps downloaded. For companies then, it’ll be much easier to tap into the network effects of the Uber platform than to go it alone.

I think Uber will ultimately become the partner of choice for most, if not all. It already works with many, including Waymo, whose autonomous vehicles are booked exclusively through the Uber app in Austin, Texas (and soon Atlanta, Georgia).

If robotaxis start replacing human drivers, then Uber’s labour costs would start falling dramatically. Margins could expand meaningfully.

This potential makes the stock look cheap at around 18 times forecast adjusted EBITDA for 2025.

Cheap tech giant

After being uncertain about Nvidia (NASDAQ: NVDA) for over a year, I think the stock has reached a price ($111) where it’s also worth considering.

Down 24% in two months, it’s now trading at just 24 times this financial year’s forecast earnings. That multiple quickly falls below 20 next year, based on current forecasts.

For a fast-growing company whose chips remain integral to advances in artificial intelligence (AI), that looks like a potential bargain to me.

So what’s the catch? Well, one issue is that Nvidia currently gets 13% of its revenue (around $17bn) from China. But the US is tightening restrictions on chips entering the world’s second largest economy.

China is also actively encouraging domestic technology firms to reduce reliance on Nvidia’s AI chips and instead adopt local alternatives. Nvidia is piggy in the middle and this could impact sales growth.

Despite this risk, I was encouraged by the company’s long-term vision set out at its recent technology conference. AI is moving from the training stage to inference (being deployed and able to deliver more data), which could need exponentially more computing power. Nvidia’s chips have more competition in this space, but its offerings remain cutting-edge.

Meanwhile, the company is systemically positioning itself to be at the centre of multiple megatrends, from self-driving cars and humanoid robots to AI-driven healthcare and the metaverse.