It’s hard to believe but an investment of just £10,000 into Rolls-Royce (LSE:RR.) shares two years ago would be worth a massive £57,000 today!

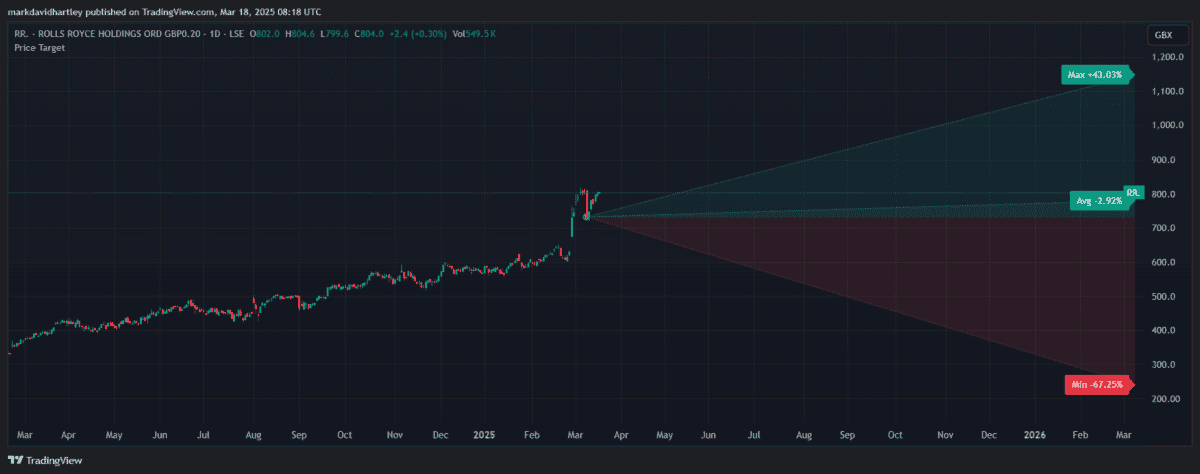

The parabolic growth has left some analysts confused, feeling the price action’s irrational. Subsequently, 12-month price forecasts vary widely. Some predict it’ll reach £11.50 by next March, others expect a fall to £2.40.

The huge discrepancy averages out to an expectation of a 2.4% drop in the next 12 months. But if history’s anything to go by, that gives us very little direction. Many, including myself, have been expecting a correction for months — all have been proven wrong.

So is it a bubble, or can it keep going? Let’s weigh up its chances.

Powerful management

An over-arching theme in the news lately has been the exceptional leadership of CEO Tufan Erginbilgiç. Since taking up the reins in 2023, his unique management style has transformed the company. It went from a struggling stock down 80% to the FTSE 100‘s biggest success story.

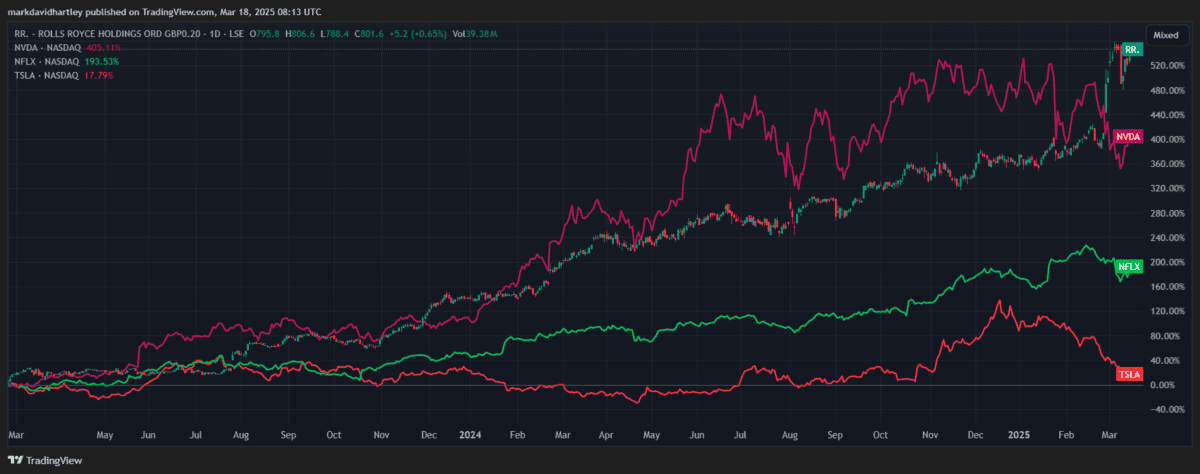

Over the past two years, it’s outperformed Nvidia, Tesla and Netflix.

Naturally, it’s the top performer on the FTSE 100 by a long margin — the second is 3i Group, up by only 142%.

Erginbilgiç feels he has what it takes to keep this rally going, noting in a recent update: “We have made good progress but we are not done yet.”

While I admire his optimism, I can’t help but wonder just how far the stock can climb. After breaking the 800p mark earlier this month, it experienced a sharp pullback. Yet already it looks like a new all-time high is imminent.

Waning momentum

The operational changes and cost-cutting exercises put forward by Erginbilgiç have worked spectacularly. By streamlining operations and optimising processes, he boosted 2024 revenue by 16% and profit by 57%.

Debt has all but been wiped out and the company finally has enough spare cash to reintroduce dividends. But there is only so much streamlining and cost-cutting to be done. With the price-to-earnings (P/E) ratio now up to 26.8, the stock’s looking increasingly overvalued.

The price is also now 3.5 times revenue per share — a metric that should ideally remain below 1. Neither ratio suggests more room to grow.

A steady keel

If the economic fallout of the US trade war seeps into the UK, Rolls could take a hit. There’s already a risk of supply chain disruption and potential losses if Europe reduces defence spending.

What might keep it growing is small modular reactors (SMR). These tiny nuclear power stations have been tipped as the future of energy. There’s already significant interest in the UK and the boost for the company could be huge.

Right now, it feels unrealistic to expect the stock to keep climbing. But as recent history’s proven, there’s a good chance that is exactly what will happen.

As famous economist John Maynard Keynes would say: “Markets can remain irrational longer than you can remain solvent“.

Those who like taking chances may want to risk it — but it’s not a stock I’m considering at this point in the cycle.